Crypto's Requiem

Market Update: 30 Jan 2024

The ETF approval of Bitcoin is acting like an opioid on the crypto market.

It came onto the scene, flooded our brains with endorphins…

And now many are realizing the unsettling nature or the “yang” of the ETF approval’s “ying” moment. The ying and yang effect… Every day has darkness… Or the hangover to every high.

It’s an after effect I think I’ve seen all too many times. Especially when it comes to newer crypto entrants. They come into the space eager to learn anything and everything about crypto. The knowledge gap is immense, so they are able to crank the endorphins to max for excessive periods of time.

Newcomers tend to enter when price action is incredibly positive. Which only supercharges such chemical flows in the body…

Then once price gives a sudden knee jerk, the flows pause. Worry kicks in, and withdrawal like symptoms begin to appear. This tends to look like a lack of energy and low enthusiasm among your coworkers. Or reduced posts on the social media timeline.

When you see this happening, it’s a sign that crypto needs to take a respite.

A recharge to get the body back into balance.

The word I find most fitting is “requiem”. In Latin it means rest… But that’s not why I find it fitting. It’s mote about how crypto’s intensity can flood the body like a drug at times. And with such intensities, the pull backs can yield parallels to the movie Requiem For A Dream - too far?

Luckily, this pullback is not extreme enough to warrant cascading bankruptcies and historic ponzi schemes to be uncovered.

But the aftereffects of the ETF approval are clear. Social media posts are down, views on social media are down, search terms have fallen, and even I’ve told myself I need to take a few days off.

So if you’re feeling a bit down and lethargic, this introductory note is for you. It’s all normal. Just take a few days to let your body be. Energy levels will come back and you’ll be excited once again to read the latest forum posts of your favorite crypto project.

With all that said, let’s do a quick snapshot of some important levels in the market. I originally wrote a bit of a longer piece on macro commentary… But I decided to wait until some U.S. Treasury comments come out today before drawing some conclusions. So I tabled that piece until hopefully later this week.

So for now, let’s do a quick crypto update as we (I included myself here) get those batteries recharged.

Crypto

The main stat I’ve been keeping my eye on during this post-ETF Bitcoin world is the spread between Coinbase and Binance. This has been negative for the most part since the approval, and tends to be correlated with negative price action.

Reason being is an uptick in demand, and a higher price realized on Coinbase is associated with fresh dollars coming into the asset class. While a discount represents money or fiat leaving the asset class. It is also a focus of late since many ETFs list Coinbase as an entity helping facilitate flows of coinage - making this all the more interesting.

In the chart below, I went ahead and gave the price difference between Coinbase and Binance an eight day moving average. You can see it in blue. When it dips below the white line, it reflects BTC on Coinbase being below the price of Binance. When it’s above the white line, it represents a premium. Right now it’s at a discount.

I added some red and green vertical lines to help visualize this move from premium to discount territory.

The daily measure of this premium/discount is pretty noisy, which is why I smoothed it out here. You can see the price of Bitcoin tends not to do well when Coinbase is at a discount.

I’d like to see this blue line improve before I’d get excited about piercing any new trading ranges to the upside. But it’s not one to look at in isolation…

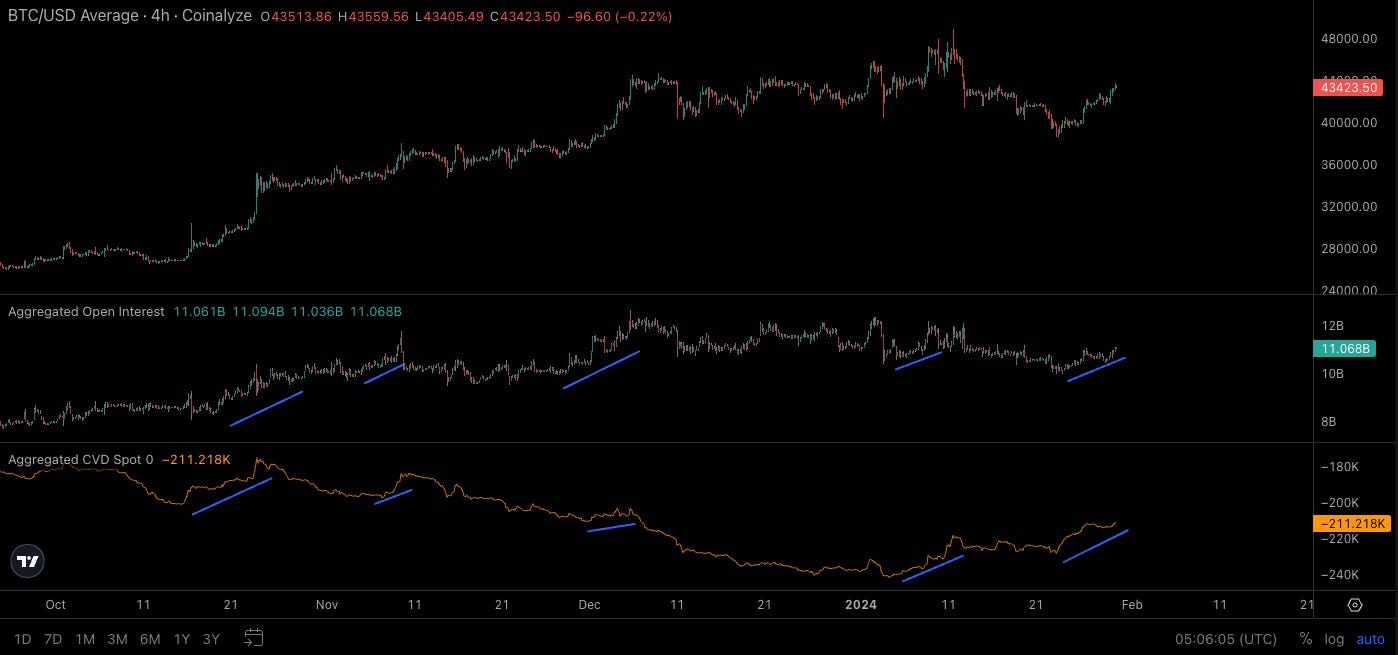

If we go ahead and pull up another metric that’s helpful when zooming out - Cumulative Volume Delta for spot - we get another glimpse at current demand pressures.

It’s been trending up of late. Given a lot of action since the ETF flows, we do need to take this with a grain of salt. However, it is increasing alongside aggregate open interest in the market. This tends to be a good sign for the last year whenever the two move up in tandem.

I’ve added an upward sloping blue line to the areas where the two are trending higher in tandem. The chart shows BTC/USD, open interest, and CVD spot from top, down.

Now, if we look at the chart with a more discerning eye, we can see that this upward move might not have much more room. It’s been going on quite a while when compared to prior instances. And with prices floating around $43.4k as I write, we should ask ourselves how high can this upward trend take us.

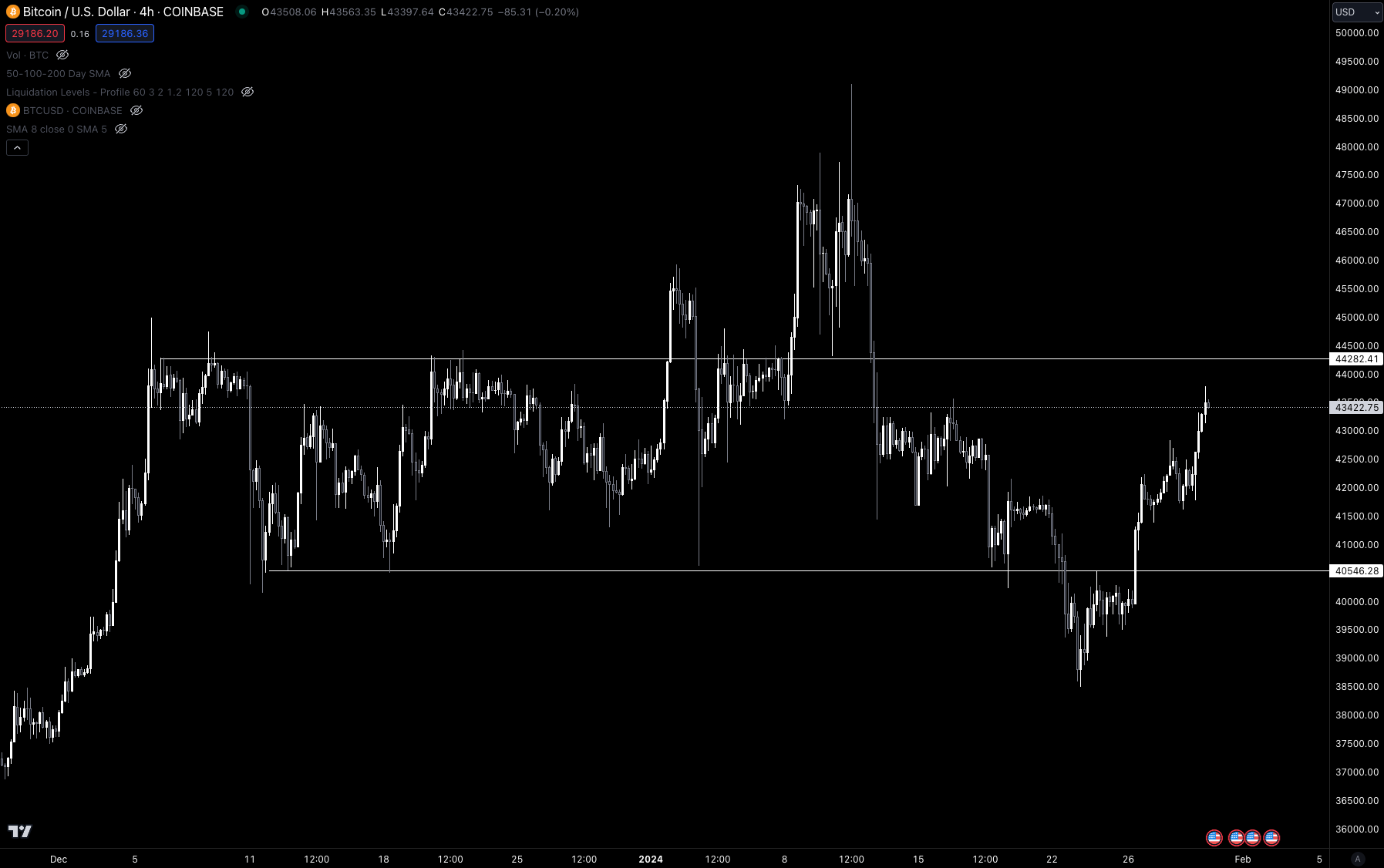

To get an idea, here is a liquidation pool chart. This highlights where price might go as it is attracted to liquidity. There’s a nice batch sitting at $44.4k. Based on the chart prior, I would expect to see price attempt to grab that liquidity in the ours surrounding the New York open on January 31.

I’m not much for drawing lines on a chart anymore, but here the trading range is pretty apparent. We see the $44.4k area show itself again as where a price wick might present itself if the mid-range holds true.

With this view of the market, we can say that if price shows weakness once it sweeps liquidity in this region, then the headwinds mentioned in prior issues (ie - DXY Risk index, FOMC meeting underwhelming price cut hopefuls, volatility suppression regime in options) will be hard to overcome… And likely present themselves with greater force.

Which means this price area becomes an area of interest in the days to come.

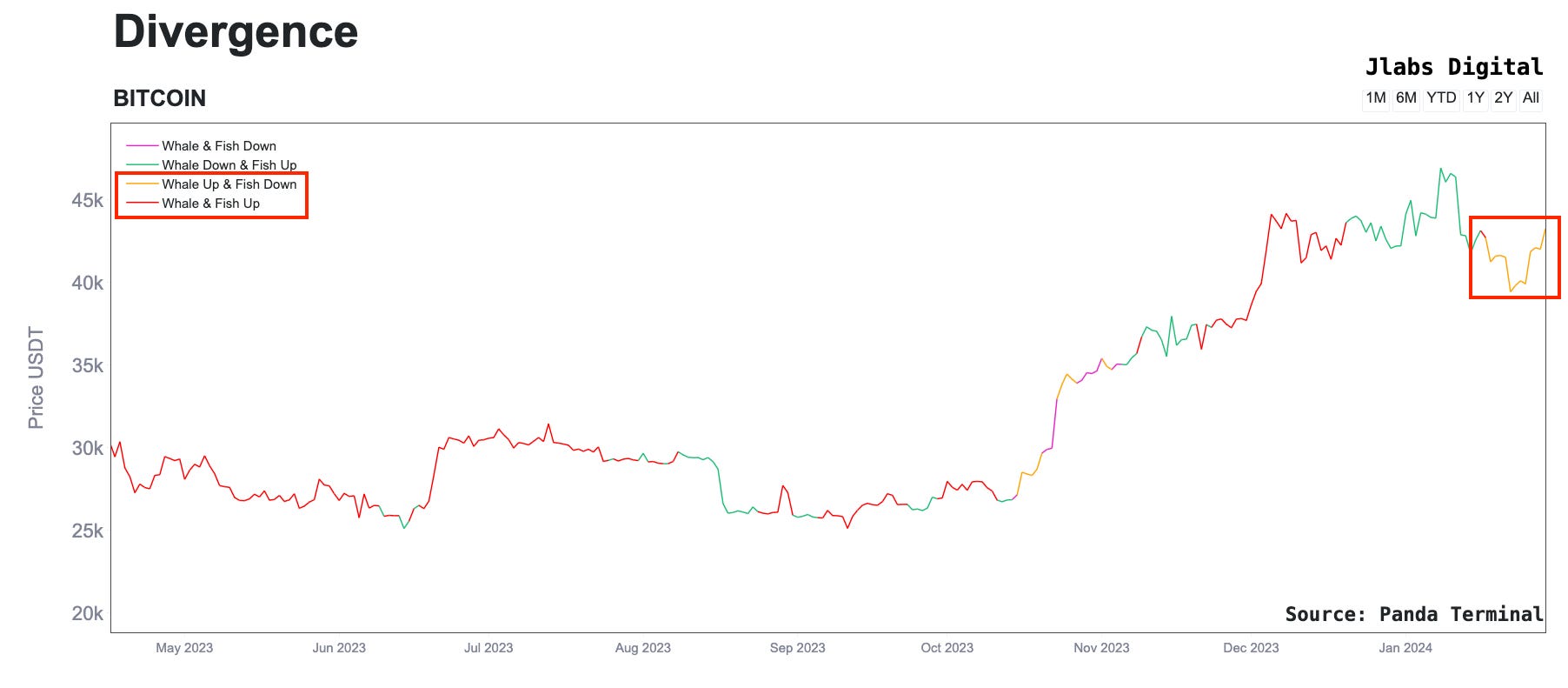

Now, before I leave you for the day, I do want to bring up one metric that does give me hope that any headwinds might not hit crypto too hard… Or that perhaps some momentum can be had here if price can accelerate above $44.4k…

It’s this metric in the chart below. It shows larger wallets were buying the recent dip.

Was it Larry’s plunge protection team stepping in? Only time will tell.

But for now, I’ll leave you with a few price levels to watch in the days to come. Next time, expect to get a macro update that might prepare us for one of the greatest opportunities to buy crypto in 2024.

Until next time…

Your Pulse on Crypto,

Ben Lilly

P.S. - Tune in later today to the xChanging Good show. It’ll be during the New York open. You can find it on the YouTube channel below… For those that missed the last episode, JJ and I went ahead and touch on a few of the headwinds we see forming in the weeks to months ahead. Click below to listen in.