Crypto Needs Kamala To Win

Here's what will happen to crypto if Kamala Harris wins the election... It's a bitter pill to swallow.

I want you out of your seat yelling FREEDOOOM like Mel Gibson in Braveheart by the end of this one.

No need to poetically alter your brain through story telling analogies before back-dooring alpha into your brain today.

There will be no market update here... For that, tune into The Trading Pit hosted by Marconi Wight of xChanging_Good Tuesday at 9:15a / 13:15utc on X. I'll write up a summary of the show and some other thoughts later this week.

Instead, let's tighten up that kilt and get to it.

My stance, Donald Trump wins the U.S. Presidential election.

His message of restoring freedom, adding Kennedy to his circle, and even trying to act like Elon is going to straighten up government efficiency seems to be resonating with voters.

The odds of him winning are even beginning to tick higher of late. So while my timeline, news feed, and what I digest daily is likely more aligned to Trump, it seems that my feelings are somewhat legitimate based on what the data is saying.

Which is great... What my gut and data say are one of the same.

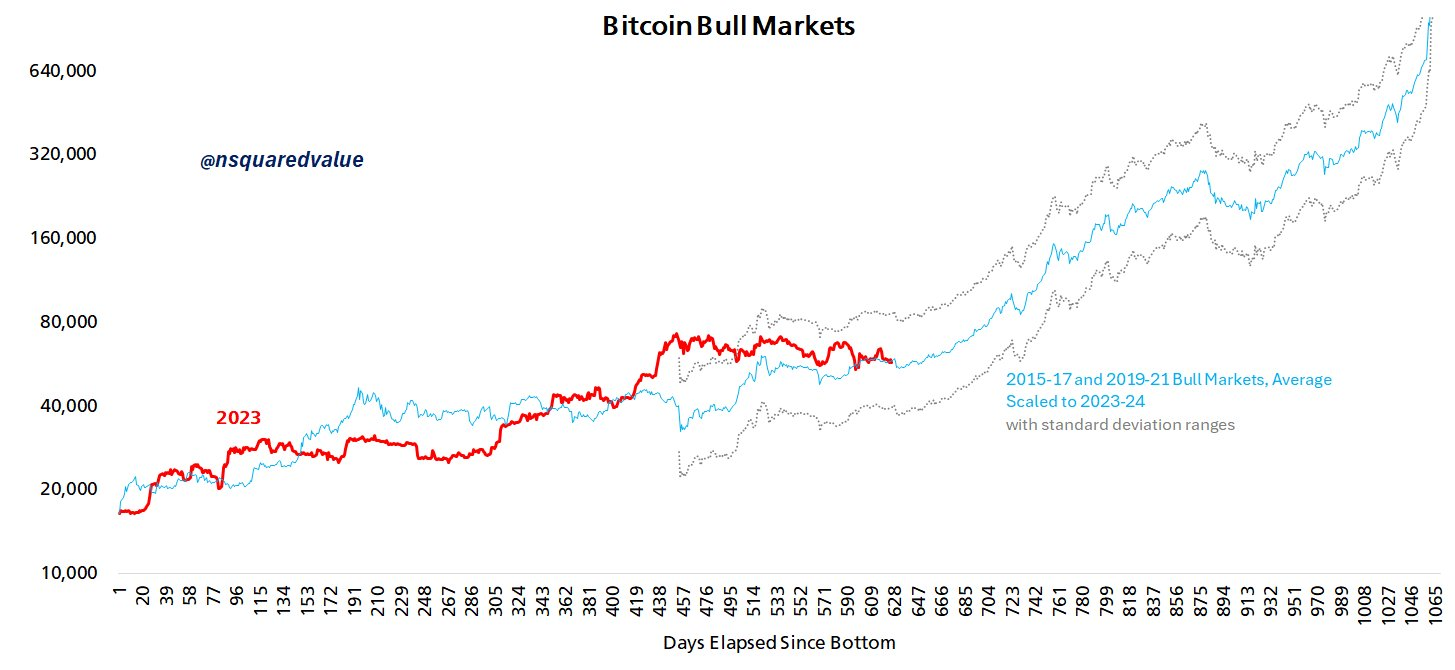

This stance is in part why a message I received this weekend about this excellent chart from Timothy Peterson got me thinking in parabolic terms - up and to the right.

The chart is great. Yea, we can definitely nit pick on some things as it tries to average together (with a standard deviation in gray) price action relative to market bottoms, but this is cycle analysis. It's more art than science. And the key finding here is really twofold.

First, the ETF essentially pulled forward a lot of demand for this cycle. That's shown with the red line rising above the standard deviation line in March of this year. This pulling forward is why we've had six months of Bitcoin moving sideways.

It's why things feel a bit unbearable today.

Second, we are currently right where we need to be. The market is not too high, not too low, it's in a goldilocks range. I know that sounds odd as the fear and greed index is screaming fear, but cyclically speaking, we are right at the average.

This "goldilocks" region begs the question of what, outside of time, will be the upcoming catalyst for Bitcoin to spark a multi-month run higher, and to new all-time highs.

Analysts have been quick to form an opinion using two potential catalysts. The first is a rate cut from the Federal Reserve. The easing of financial conditions would mean Bitcoin, Ethereum, and the rest of crypto act as the landing zone for a flaming hot ball of money.

I'm not sold on this.

In fact, if we go back to March, April, May 2020 when the world felt like it was coming to an end, it took the rest of the year - many months after the Fed acted - before the market really woke up. And that was an extreme move in rates plus money printing. This time, we're talking 25bps as of now. Nothing crazy.

The second potential catalyst to launch us from this goldilocks zone - Trump.

Yea, he wants to mine and mint the greatest Bitcoins the world has ever seen... Have the military carry each byte of each Bitcoin into the vaults of Fort Bragg... And equip each and every utility company with a hard hat and pick ax to pull them from computers.

That's all fun to think about, but that's not what really excites me.

The rally cry of excitement was in the roar of the crowd in Nashville, Tennessee at the Bitcoin conference when he said he would fire Gary Gensler on day one.

FREEDOOOMMM is what that yelling felt like to every dev, founder, and token designer of the world.

The thought that for once we might get a sandbox regulatory environment to experiment on token utility solutions caused me a mental lapse in MEWing. The thought that tokens might earn yield from a protocol would be the biggest moment for cryptocurrencies since Compound bootstrapped liquidity by minting COMP - the spark of DeFi Summer 2020.

If such regulatory regime existed, all of crypto would hold hands, sing kumbaya, and admit governance tokens were just an excuse to buy time until this new paradigm. And we would all be willing to move forward, together.

Which would then spark a race for the best token utility and value accrual designs in the industry. Wave after wave of economic revamp papers would overwhelm our browser tabs, forcing us to group them into various themes thinking we'll have time again to catch up on them.

A Trump presidency can make one truly dream of the industry getting excited and ultra competitive once again. The result of this innovation boom would likely be more of a catalyst for ETH than BTC.

Yes, Trump wants to chisel "Made in America" on each new Bitcoin and potentially buy it for the country's reserves, but would he? I'm not sure. He tends to make a lot of promises and not fulfill. What I do know is innovation will surge if he's elected as the anti-crypto army gets the boot.

There's only one massive problem to my logic. Remember the start where I said Donald Trump will win the Presidential election?

Well...

The Problem

I'm not a political analyst.

Not even an armchair pundit.

I'm no better than your Uncle after a Thanksgiving meal for giving you words of wisdom.

Because of this severe lack of Nate Silver-ism talents... When the tweet below came through my timeline...

Harris will defeat Trump in November 2024, says American University historian Allan Lichtman, who has correctly predicted 9 out of the last 10 US presidential elections.

— Readean (@readeancom) September 8, 2024

Lichtman has been virtually error-free in picking the winners of U.S. presidential races since 1984, using a… pic.twitter.com/P0xBf72sTs

I had to consider the possibilities.

This little exercise quickly led me down to some extreme results. Things like the 4th Turning, debts reaching escape velocity, recessions, more war, and other terrible outcomes proliferated the mind.

All of which seemed rather low odds once I took a few breaths.

To give myself some credit, and Marconi Wight who helped me think through today's issue... It's sort of in the data.

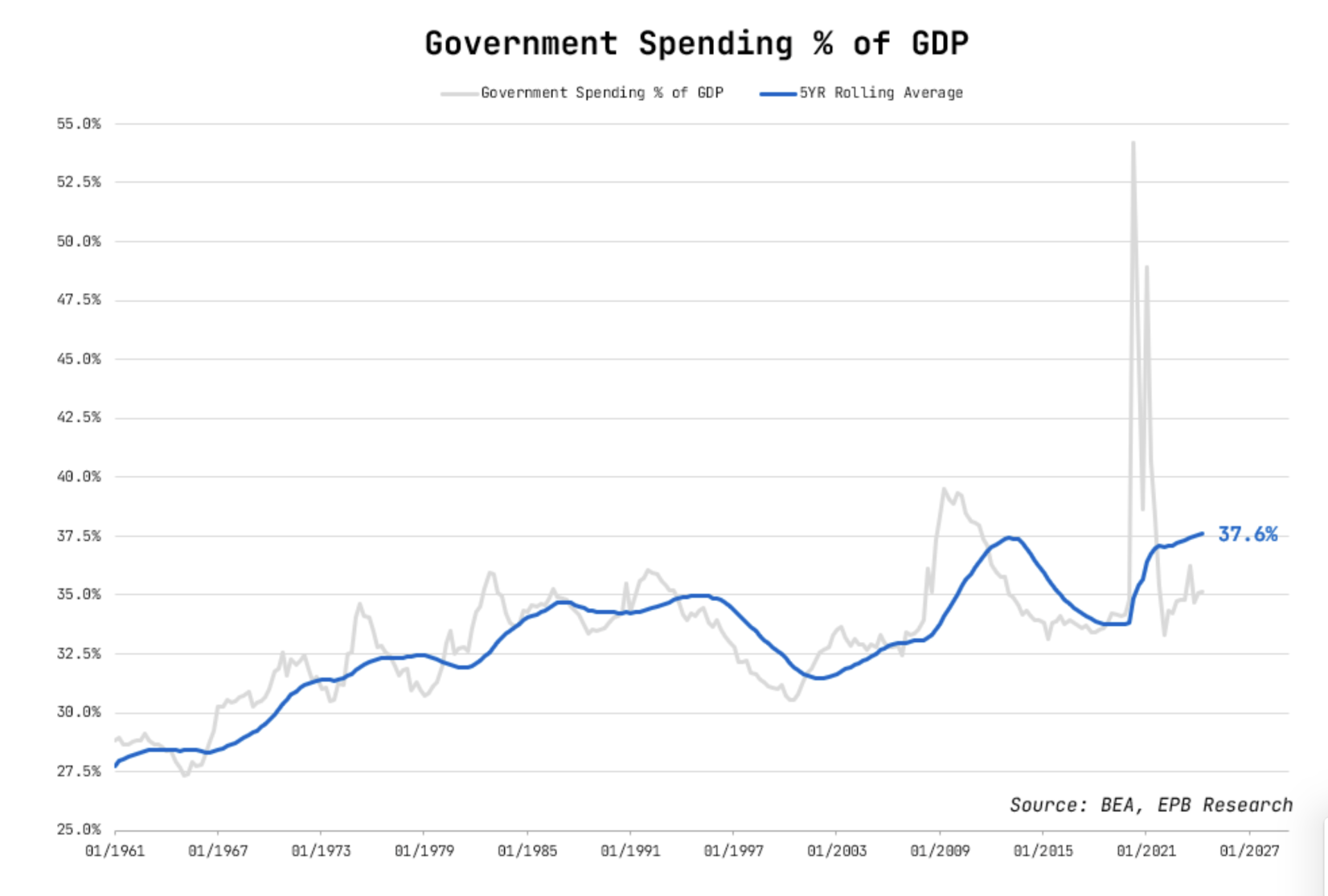

The amount of government spending is trending higher.

Much of the positive job stats are in part due to the uptick in government hiring. And while the government is spending more, corporate profit margins remain elevated from post-2008 levels.

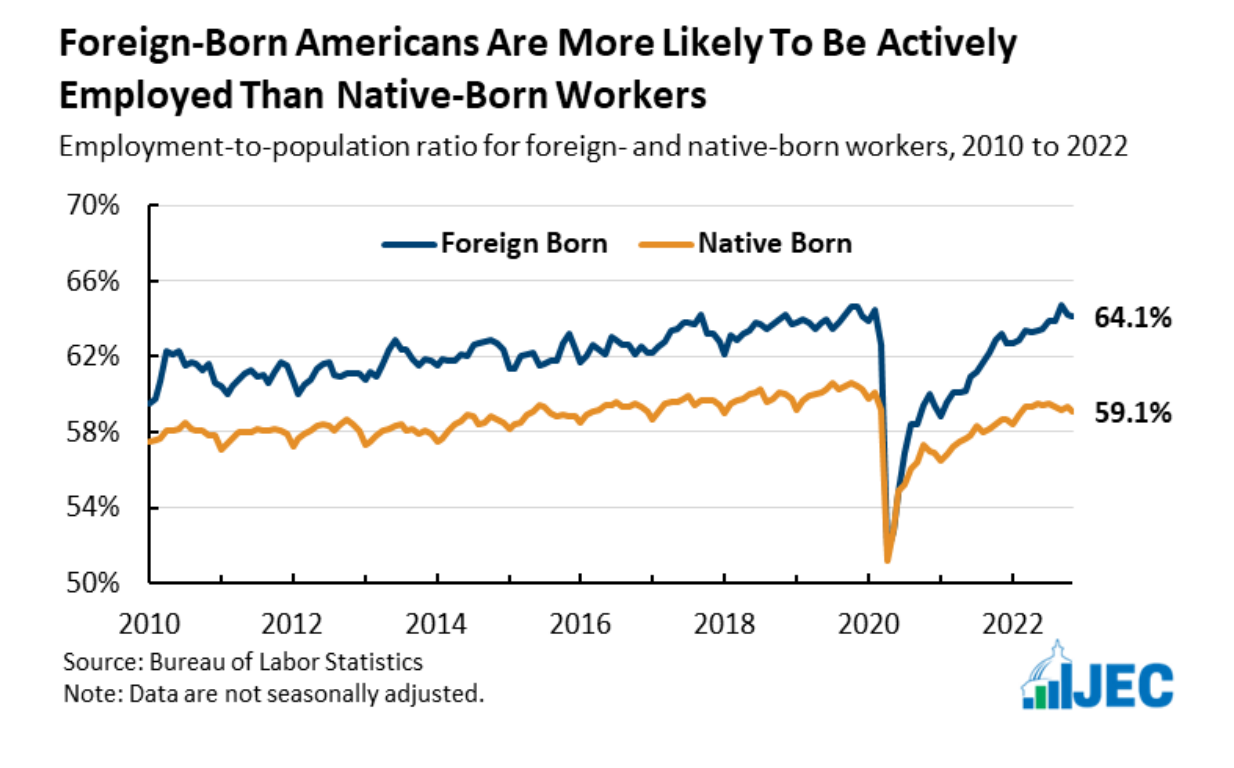

Not to mention native born workers, who tend to have higher costs to a company, show sagging employment stats as well.

It's a combination of factors that showcase a country not able to address a key issue, one I laid out over two years ago in Part Three of Macro Cycles.

There is a need for the government to spend more to hire more... labor costs need to stay low via foreign born workers to keep margins up and GDP looking strong... And we're about to be scraping the bottom of the barrel for finding ideas on how to kick the can of "productivity" down the road one more time.

Sure, it's an Ouroboros. But does it all come crashing down tomorrow? Those are the low odds portion in all of this.

I mean... The consequences of the world not just seeing or believing, as that's likely already common thought, is big... But why now? Why does the world all of a sudden decide to price in these major warning signs that have been around for many many years.

To that, I tell myself not to waste time in that thought exercise.

Instead, I try to envision what crypto narrative would succeed if crypto and Kamala Harris had to walk hand-in-hand for four years.

The Buyer

Stablecoins are crypto's killer use case... How many times have you heard that recently?

For those that have read The New Financial System from March 2023, you know that the central bank digital currency that doomsday prep'ers fear, it's already here. Its just in private form.

In an anti-crypto world, this just gets more KYC/AML layers added. Banks can now reduce settlement costs while also earning yields on the Treasury collateral. And most importantly...

Kamala can unload her debt bags to retail, globally. Crypto is a global industry, and US stablecoins represent almost 9% of crypto. That's pretty sizable for a $2 trillion market.

And in reality, this likely happens with or without Kamala. Exporting treasuries via stablecoins globally is manifest destiny at this point.

The can is now kicked further down the road.

BUT here's the other side of this four year term...

We already hear the impending Twitter 2.0 type of government <> social media game getting ready to happen once again. Combine this with the fact Google is in hot water as it might get strike three in anti-trust court cases here... Funny thing is many don't even know that. Likely because Google is hiding it.

And I'm sure they'll likely play ball with Kamala if that means they get a slap on the wrist.

Yes, yes, I know this feels like it's going off the deep end here, but bear with me as this represents a future you'll be war crying within...

The world will truly need censorship resistant tooling if we get four years of Harris.

Privacy tooling. And all the ideals that many of us still believe in, even if Travis Kling says we are knowingly buying vaporware in the hopes of getting rich, will get renewed.

In a world where permissionless app development leads to a SEC letter or arbitrary threat, KYC/AML apps will be the primary way to build. Maple Finance type of apps will grow 10x in such environments as private equity companies try to package up debt to resell onchain. RWA narrative.

This isn't what crypto natives want.

A Harris Presidency, however, might just be what the industry needs. A wake up call to build in an ethos from a bygone era. Re-instill the vigor to build without permission. A day in, day out desire to innovate like the persistent force of a stream that erodes away societal inequities. A soul centering life mission to carve out a tomorrow that you can be proud to one day tell your children that you were in the heat of the day laying down the bricks to build.

It's all enough to make me consider this uneasy fact...

Crypto needs four years of Kamala to re-invigorate its vendetta to separate money and state. That's how killer apps get born.

Your Pulse on Crypto,

Ben Lilly

P.S. - Jlabs Digital is a leader in crypto market research. In our more than six years of operation, we've built a host of autonomous execution software for funds, market makers, and even retail. Our flagship product is J-AI and we just completed its v3.0 upgrade. We're celebrating this milestone by offering a no cost opportunity to onboard (just click here to see if you qualify). Give it a try and let "J" take care of the trading while you go touch grass.