Changing of the Guard

Whale games vs institutions

There’s an interesting contrast happening in the market.

It’s the old vs new breed of whales.

The old being bitcoin whales that were birthed in previous cycles. While the new are whales being birthed in this cycle.

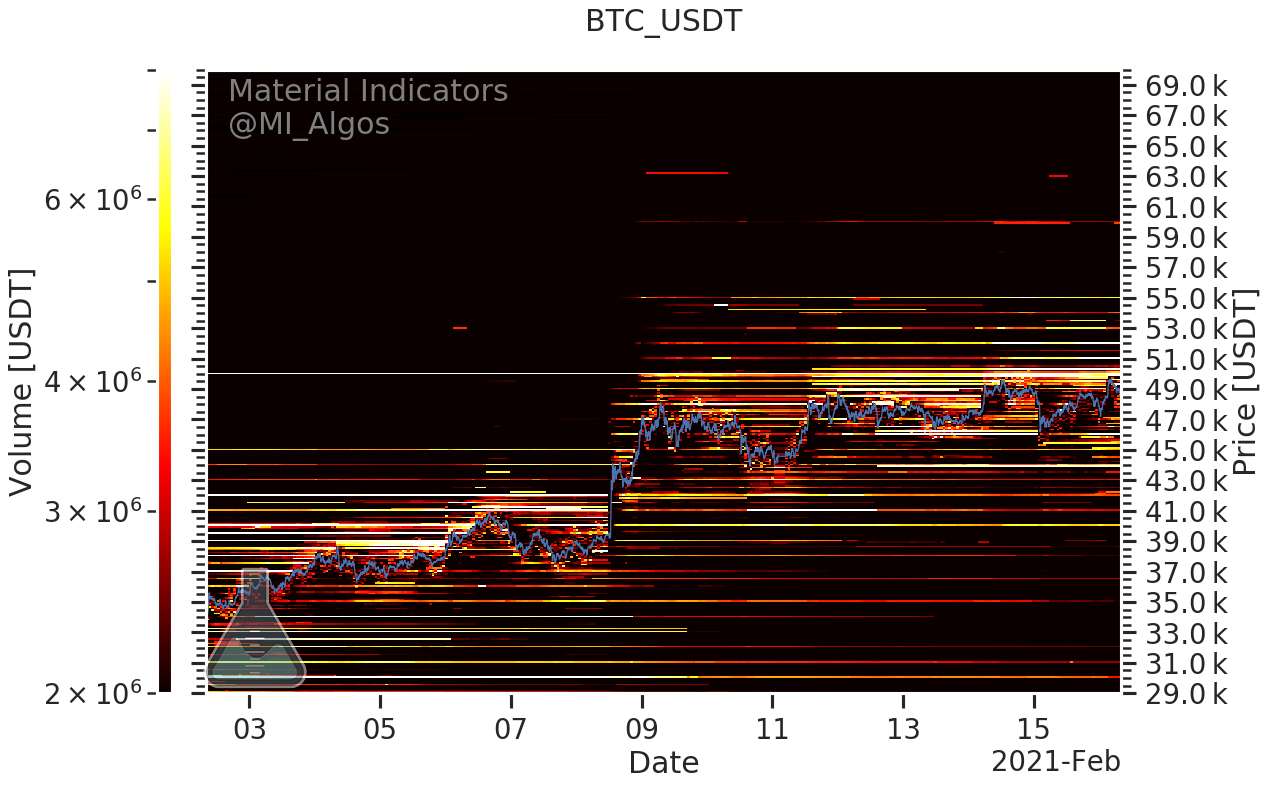

The main difference can be seen in the chart below. It’s a Firechart from Material Indicators. It shows order book volume in crypto, and serves as a general guide for where resistances and supports are.

In the chart below you can see that $50k, $51k, $52k, and $53k price points are bleached white. This is the highest reading for this chart meaning we don’t necessarily know just how large those order blocks are.

What’s interesting is sell walls like this are the whale games of old.

Whale games of new are not played out in the order books. The new whales being born happen through a series of marching orders. The order comes in for $50 million worth of BTC. There’s no time to waste, the order gets routed, the algo fires up, and the BTC are bought.

This is the new breed of whales in town. It’s one that wants exposure now, not tomorrow, but now. And it hands out the order via a contract and money wire.

This sell wall is the first a several changing of the guard battle grounds unfolding in this cycle. It’s an interesting area to watch for this reason alone.

Your pulse on crypto,

B

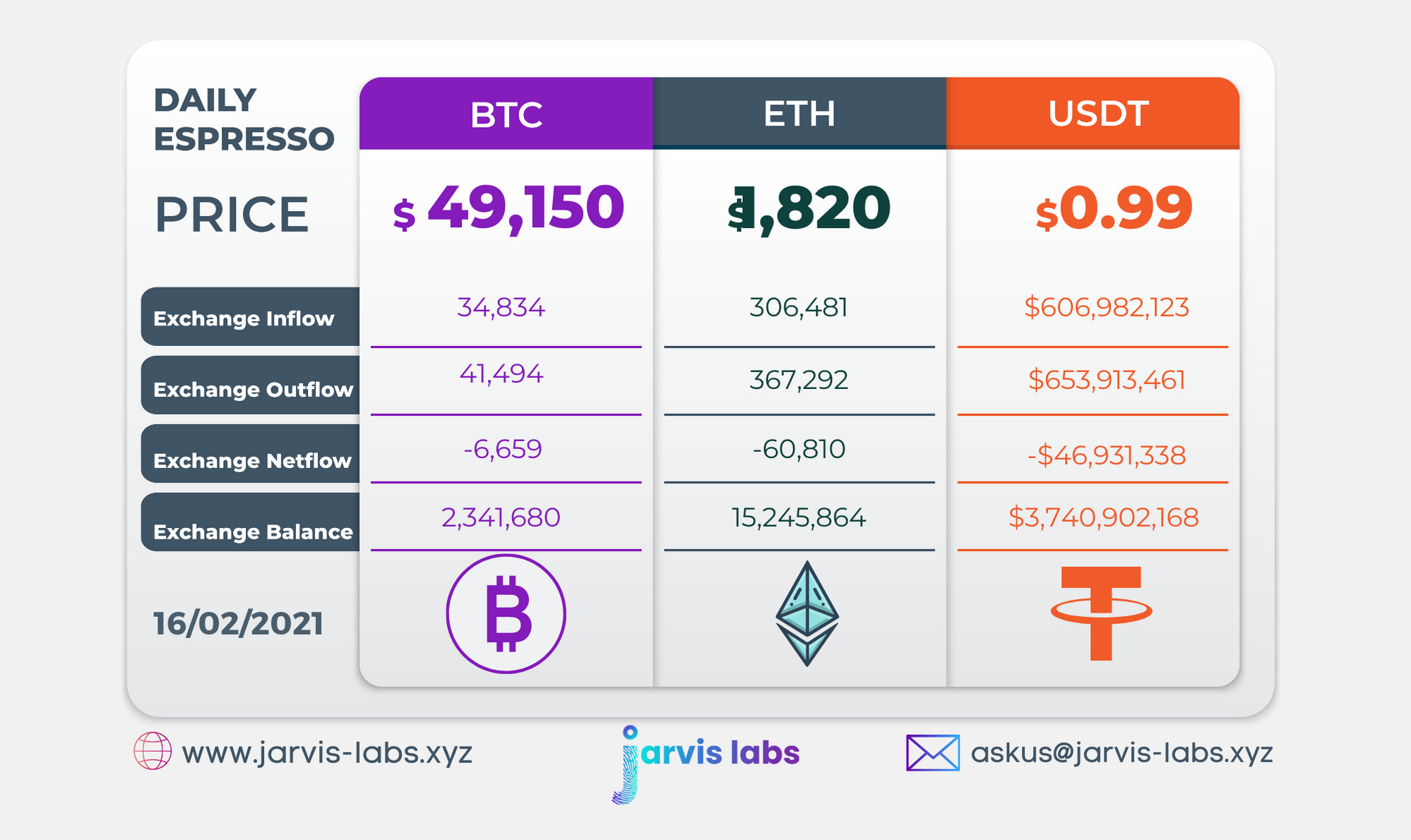

Below is our daily exchange flow data. This is a great gauge for understanding if BTC, ETH and USDT are flowing into exchange or leaving. If BTC and ETH are entering exchanges it can generally be viewed as bearish. The opposite scenario is bullish.

When USDT is flowing into exchanges it’s typically viewed as bullish. The opposite scenario is bearish.

This should only be used as a general gauge. Tagging the exact wallets these flows move into or out of helps improve the reliability of this data, which is what we do at Jarvis Labs. To date we have over 800 market mover wallets and 16 million wallets tagged all together. Consider us your on-chain trackers.