Broken Record

Market Update

My inclination is many of you opened up today’s edition of Espresso thinking the chaps over at Jarvis Labs likely have some clarity.

And it would be something along the lines of up, up, and away we go.

Back the truck up and unload it.

Market buy with voracity.

After all, we decided to test a algo live that’s been in the research and design stage for over a month now. I personally call it the Knife Catcher as it looks to call bottoms and tops… And with it getting within $300 of the absolute bottom, you would think it requires pristine clarity.

But to operate on small time scales like the algo does, it uses short-term memory. It doesn’t need clarity in the mid to long-term.

Which isn’t helpful for us because we are trying to realize when the market will flip from bear back to bull.

And instead of giving some nice guidance on this, I fear my writing sounds like a broken record as we mention once again we haven’t gained much clarity.

The reality is I’m not sure we will gain a better understanding of the state of the market until next week. Until then, we continue to meander in an ocean of chop without wind in our sail.

And we track short-term opportunities as they come with the hope it they evolve into widespread market momentum.

Now, to explain why we continue to sound like a broken record, here’s what we mean…

Yesterday offered the greatest price action we’ve seen all week.

Price first dipped, and found support near at the $30k-35k area we highlighted with our onchain support and resistance chart on Monday. This area represented the proverbial last line of defense.

Then as price reversed and tracked higher, we got a tiny short squeeze.

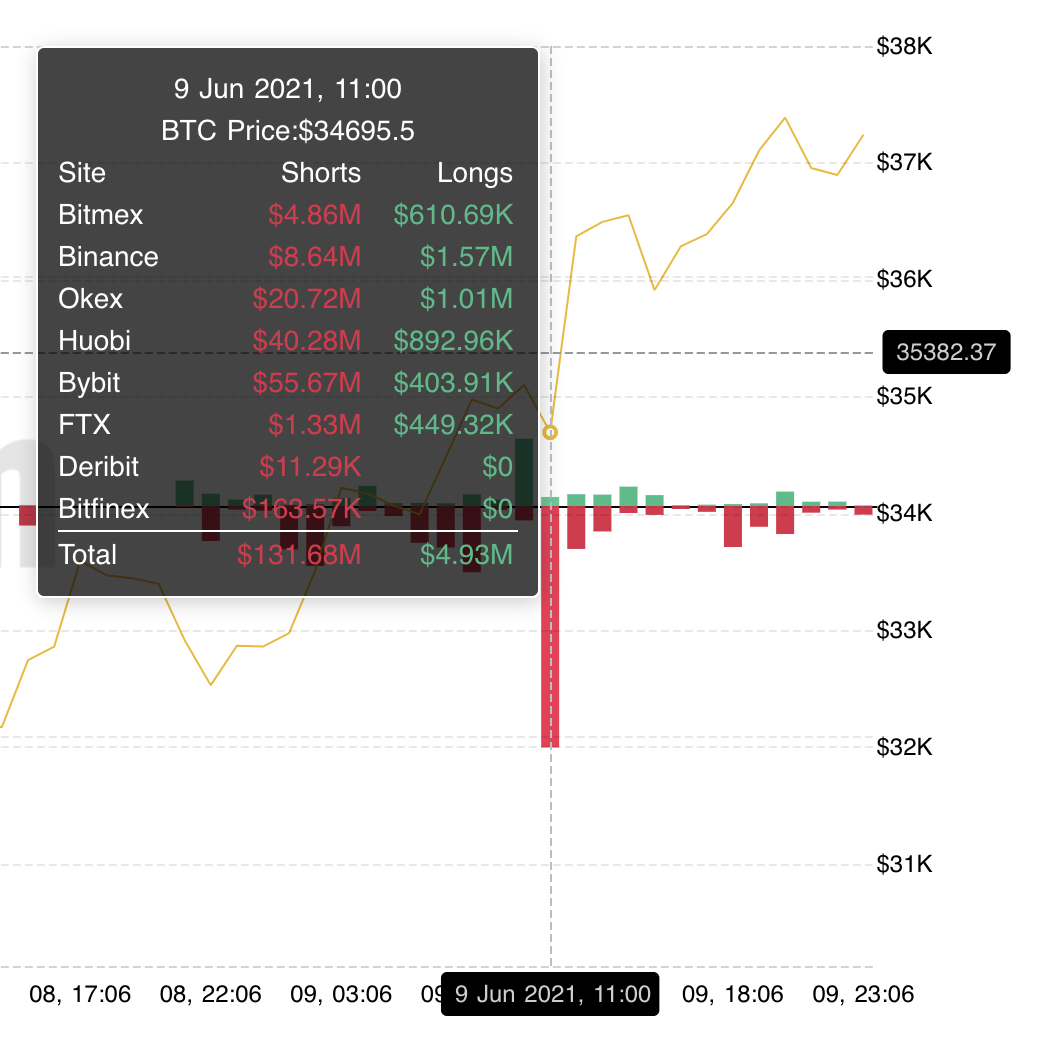

Here’s a hour by hour liquidation chart. In the hour where the most liquidations took place we saw price jumped about $2k. And breaking this down on a regular chart, we can see it took place in less than 30 minutes.

Hopefully none of you got caught up in it.

This helped tally up over a half billion dollars worth of liquidations in the last 24 hours according to Bybt. And even after these events we’re witnessing major positions being opened up on Bitfinex.

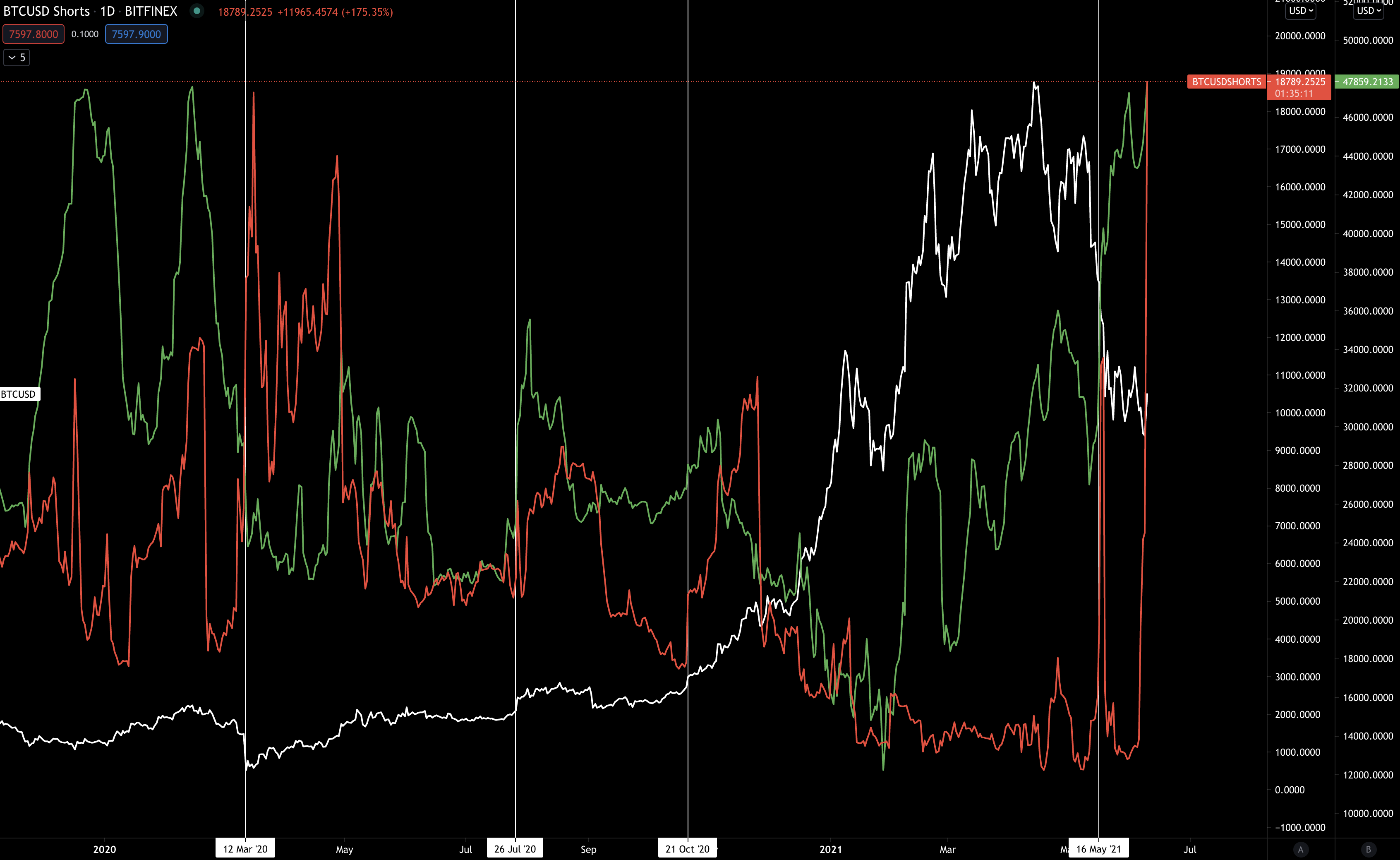

These positions are on the long and short side. You may have seen this chart float around in various forms yesterday. Here it is below with the red line indicating the amount of bitcoin short while green is the amount of bitcoin long.

The white vertical lines pair up with big changes in shorting interest.

So what can we draw from this chart is really centered on those vertical white lines.

These big changes in shorting open interest (OI) tend to coincide with big price movements.

Unfortunately, there is no conclusive evidence in predicting price direction. Instead what we can deduce is the growing interest in terms of OI means there is interest in the market once again.

If we want price to do something, this is what we need.

Now the main concern for bearish continuation is the onchain activity. We keep witnessing Pablo transactions here and there. And also see some bearish alerts being triggered.

In fact my brother in arms, Benjamin, was up for nearly 24 hours straight working to uncover some transactions here and there. And after such a stretch the both of us are content saying we are at a crossroads in the market.

Price had a great pump which formed a strong “V” reversal type of move. With such a move traders tend to pile in to confirm the reversal. This does not look like the case at the moment.

Pablo doesn’t look to be quite done. He has been making moves periodically since Monday, and still has another round sitting in the chamber.

Additionally stablecoins have not piled in on this V reversal. Meaning the lack of dry powder signals low demand for the time being.

Lastly, whales haven’t stepped up yet.

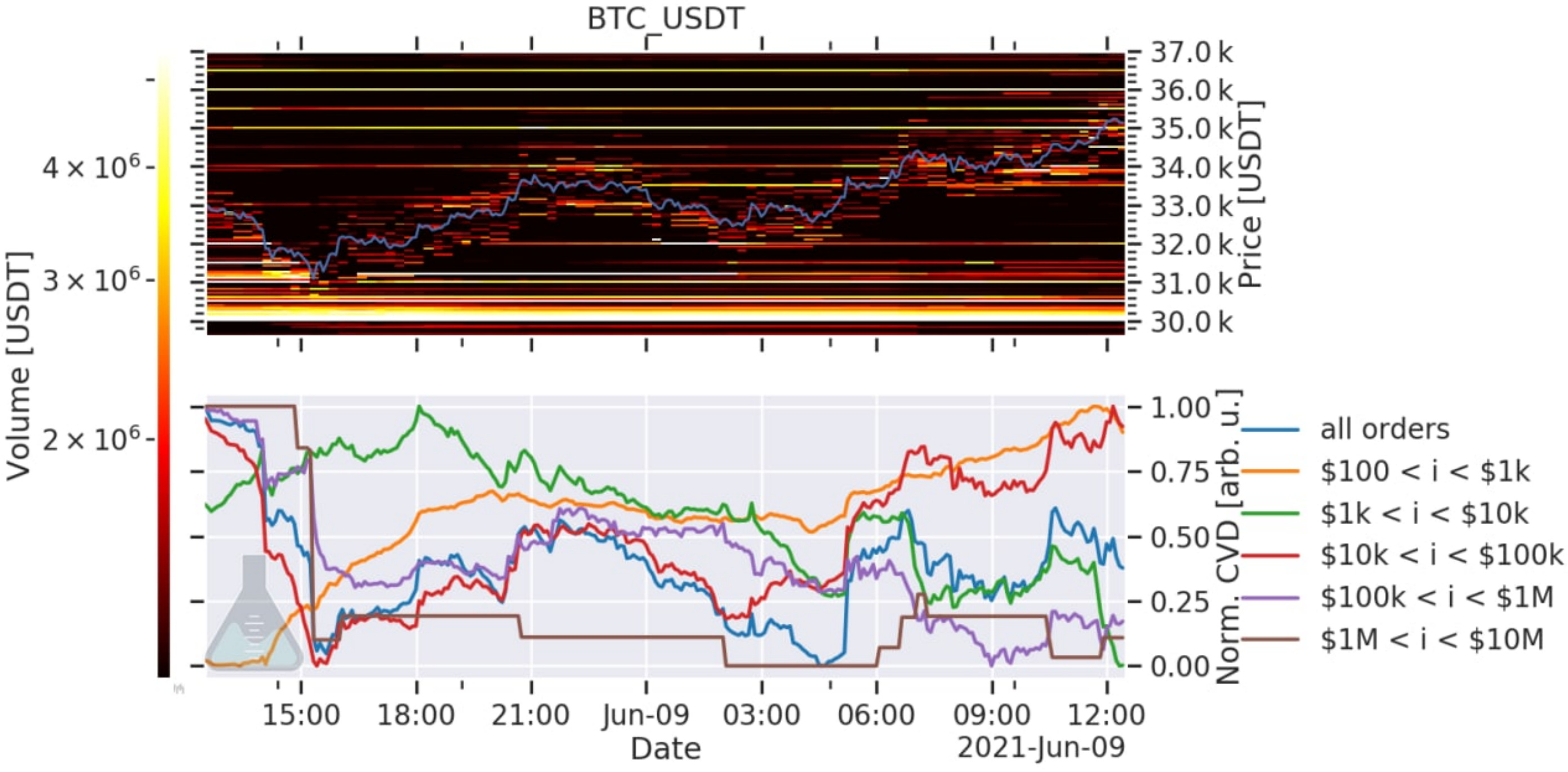

The CVD indicator on the bottom half of this chart showcases this (h/t: Material Indicators). The brown and purple lines are the two to make note of. The fact they are hanging out in the bottom right-hand corner is not something we like to see.

This implies orders in the $100k to $10mn range are market selling versus lines in the upper right corner that are market buying.

Meaning market movers are not behind this upward move in price. They are letting price move about unencumbered. Wherever it lands, it lands.

In terms of when they will likely get up off the bench and take part in this speculative madness is next week.

On Wednesday next week the Fed will attempt to squash any fears that quantitative easing is slowing down… While at the same time allude to future tightening.

It should be choke full of double talk. And with J Pow becoming a finely groomed spokesperson for the Fed and the powers that be, he’ll probably be somewhat successful in squashing fears of future tightening.

It’ll be interesting to watch the market react around the event. If crypto does make another dive lower, my hunch says this might be one of the last major buying opportunities left.

And with Pablo still moving, a lack of whales in the market, and worries about the Fed approaching, it’s best to be on your toes.

Your Pulse on Crypto,

Ben Lilly