Blockchain's Biggest Enemy Could Become Its Biggest User

Macro Update: Why CBDCs May Be Coming to a Bank Near You, Part 1

Listerine and bubble wrap…

At first glance, it may not seem like they have anything in common.

But in fact, they do. Their inventors intended them to be used for a different purpose than the one they’re used for today.

Bubble wrap was originally invented to be used as wallpaper. That obviously did not go too well. Fortunately, it found a new lease on life when people discovered that bubble wrap makes great wrapping material.

Listerine, on the other hand, was invented by Joseph Lister (hence the name), a surgeon who promoted it as a powerful antiseptic for surgery. Later, it was marketed as a floor cleaner and a cure for gonorrhea.

It wasn’t until the 1920s when people started using Listerine as a solution for bad breath that it pole-vaulted to its current success.

The list of modern-day inventions that were intended to be used for a different purpose is quite long, and now, we can add blockchain to that list.

Blockchain was originally intended to enable people to transact value freely without requiring centralized middlemen, thereby offering an alternative to a monetary system controlled by governments.

Proponents of Bitcoin and certain altcoins often cite this as their raison d’etre and as the solution to the centralization and blind regulations which often impede the free market.

But at some point, governments began to realize that blockchain could be a better ally than enemy, and this could be the reason why we’re seeing a race to push out central bank digital currencies (CBDCs).

In a nutshell, a CBDC is a programmable, centralized digital fiat currency on a blockchain that’s issued by a government or central bank. By using blockchain, governments can create a CBDC and tighten their control over their population’s monetary freedom.

As a follow-up to last week’s article about capital controls, the next two updates will cover CBDCs at a macro level. This update will explore how CBDCs are used at the sovereign/wholesale level.

Next week, we will dissect the impact they could have at the retail level, along with their implications as a capital control strategy.

Let’s get to it.

If It Ain’t Broke, Why Fix It?

Imagine a world where the dollar bills in your wallet and the supermarket cash register all but disappear.

No one uses cash anymore. All the transactions are cashless.

Taxes are collected electronically via deduction from bank accounts as well.

Welcome to the world of the CBDC.

CBDCs are not backed by an asset. They’re similar to the current fiat system, in which the currency is backed only by the government guaranteeing its value.

So why would a country bother switching to a CBDC when the existing fiat system is working like a well-oiled machine?

There are quite a few good reasons for a CBDC at the sovereign/wholesale level. Let’s examine the strongest reasons.

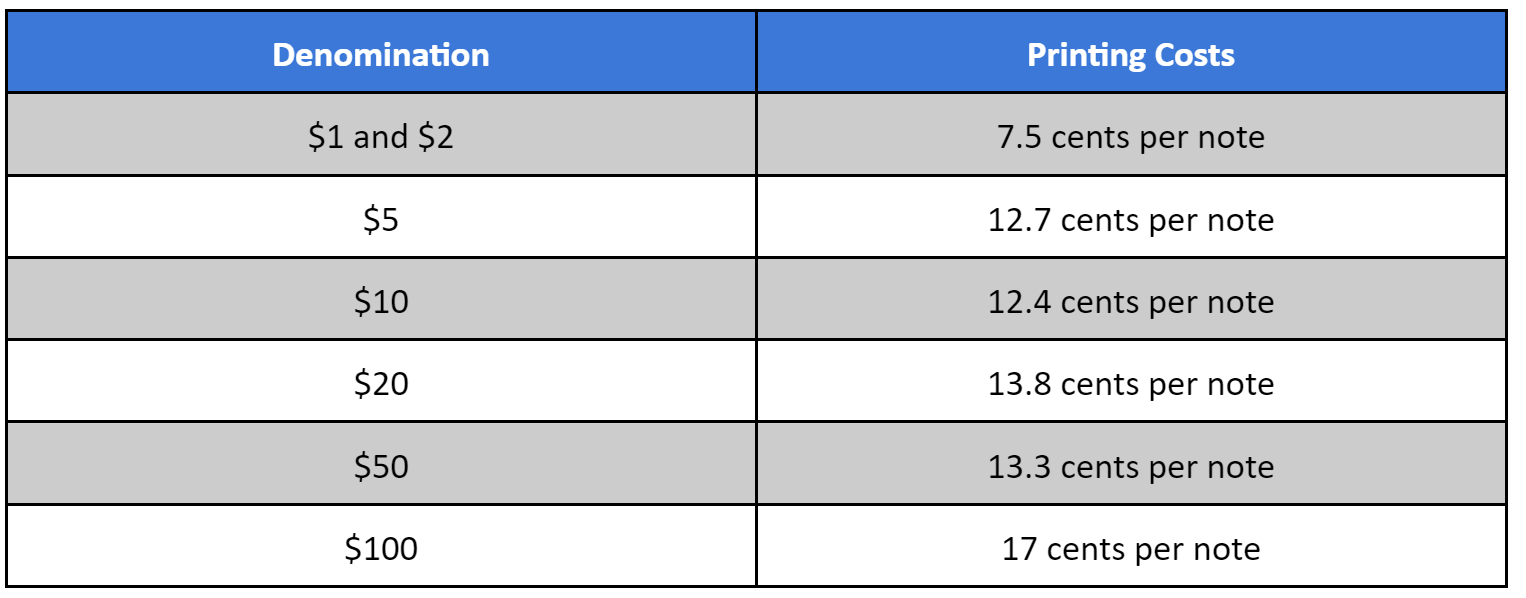

First, CBDCs take away the seigniorage problem for central banks. Seigniorage in simple terms is the cost of producing a physical currency. The chart below shows how much it costs to make the different denominations of U.S. dollar bills.

For every $1 note that the Federal Reserve produces, the seigniorage is $0.925 cents because it costs $0.075 cents to produce per note. The $0.075 is the profit that the government makes to issue new notes.

But for coins, because of the rise of prices in metals, there were occasions when it cost more to produce the coins than the denominated value on the coin itself. In 2021, it cost the U.S. Mint $0.021 cents to make a penny.

A CBDC would eliminate this problem.

CBDCs would also enable more people to gain access to banking, especially in emerging market countries, thanks to mobile phones.

Mobile phones already provide telecommunications access to rural populations in developing nations like India, where brick-and-mortar shops and hard infrastructure do not exist. A digital wallet app for a CBDC, and all the banking features it comes with, could be installed on a user’s phone, allowing them to make transactions directly through the digital wallet.

Meaning, they could open a bank account or perform other operations on their phone rather than requiring a bank branch office, ATM, or teller.

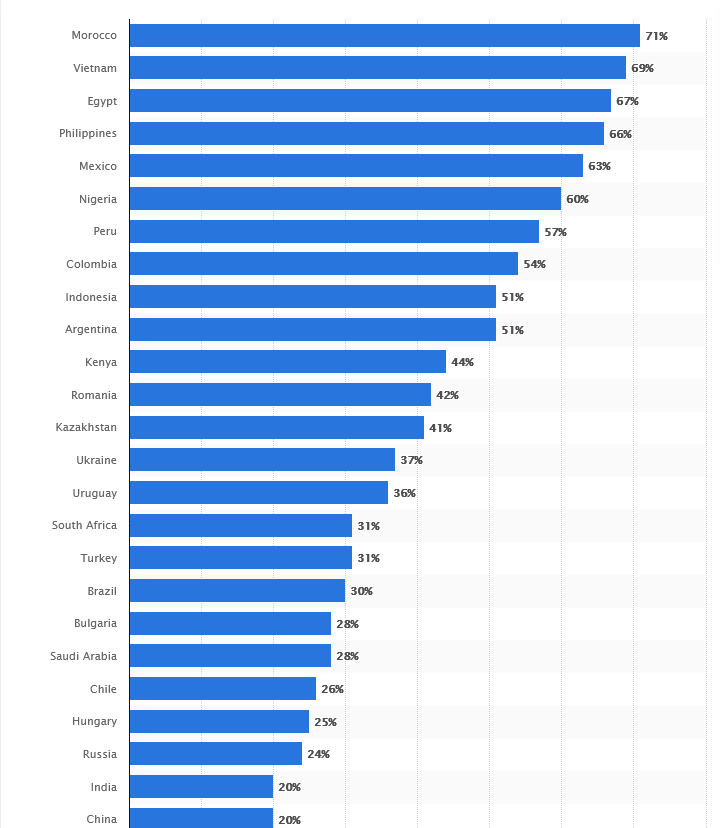

Listed below are the countries with the highest percentage of unbanked populations, as of 2021.

CBDCs would provide an efficient and effective avenue to deliver banking solutions to underserved populations in countries such as Morocco and Vietnam.

Another area where a CBDC can provide frictionless transactions, increased efficiency, and reduced transaction costs is cross-border foreign exchange transactions.

Currently, cross-border payments are quite time-consuming and very costly because of the number of intermediaries it takes to push the transaction through. Plus, there are multiple processes that add friction, like conducting compliance checks, mitigating different operating systems, and dealing with corrupted data.

All of this means a cross-border fund transfer usually takes two to three days, sometimes more, to complete.

The Bank for International Settlements has proposed three models to set up wholesale CBDC and cross-border payments that would lessen or remove these friction points. All three are being tested by several countries and their central banks at the moment.

The cost savings of a CBDC don’t stop at the cross-border payment system. It also reduces operational costs for banks.

The days of Brinks trucks with armed personnel delivering paper money to bank branches will be a forgotten memory. Plus, no more hardware maintenance and software upgrades for ATM machines. And the number of employees needed to staff a branch office will be drastically reduced because there will be no reason to have tellers and customer counters.

These are all cost savings for banks and financial institutions.

A more notable reason for adopting CBDCs is to reduce fraudulent and illegal transactions.

Money laundering, drug trafficking, tax evasion, and illegal firearm sales will be drastically cut down because the central authority has the ability to control and monitor the entire money flow.

CBDCs can also be programmed so an authority has the ability to target specific accounts and make the digital currency in them unusable, further restricting criminal activity.

The Flipside

While there are many benefits to CBDCs, they are not without criticism and concern.

At the wholesale CBDC level, one of the main concerns is data security. A CBDC will most likely require storing the sensitive and private information of individuals or the transaction itself.

Another concern is the possibility of governments implementing fiscal and monetary policies that are risky, unproven, and unsound.

Under the current system, there are limitations that curb the government from implementing such measures, but with a CBDC, the handcuffs are off.

For example, a negative interest rate policy, in which lenders pay borrowers instead of the other way around, is nothing new. Japan, the European Central Bank, and a few others have done it.

Within the current fiat system, there are limitations on how long a government can implement policies like this. Negative interest rates could lead to banks charging retail customers when they deposit money. However, customers can choose to cash out the account and store the paper notes at home.

This defeats the purpose of the policy. Instead of making consumers spend the money in hopes of stimulating the growth of the economy, they just sit on the cash.

But with a CBDC in place, consumers will have no choice but to spend their money.

As discussed earlier, CBDCs are programmable, meaning the central authority can program them to expire at a certain date. For consumers, it means you have to spend the money or lose it. Holding on to it wouldn’t be an option.

And then, a government can lower the negative interest rate and drag out the policy for a much longer period.

The New Kid in Town

CBDCs have definitely been the talk of the town for the past couple of years, and they have plenty of proponents and an equal number of opponents.

As with any new change that departs from the traditional way of doing things, there is bound to be criticism. After all, humans are creatures of habit and resistant to change.

Next week, in the second part of this CBDC update, we’ll discuss the retail level of CBDCs and dig in a little deeper on their functions as a tool for governments to carry out their monetary policies.

Yours Truly,

TD