Blockchain Games Are About to Catch Up to the 21st Century

Plus: Ethereum Shares Something in Common With Treasury Yields; More Smoke Signals From Crypto Regulators

Hear that? That silence you’re hearing is actually the sound of boredom.

I know the markets are still rather dull. And the market frenzy is not here, nor are the 2x gains in an afternoon.

But big things are happening.

Gary “Shades” Gensler is looking more and more like a fool by the day.

Wall Street is finally done playing games and ready to bring it on like Donkey Kong on steroid-riddled bananas.

And market activity around the TrueUSD (TUSD) stablecoin lets us all gossip throughout the day. Not to mention the occasional nerd fight breaking out on Crypto Twitter. And even, in the case of Gabriel Haines, a real fight.

We are clearly our own entertainment. And that’s good.

Because later on, when things get overwhelming with WAGMI pop songs and various new meme token frenzies, we can all remember we saw what was coming way back in June 2023…

And when you’re way older in crypto years… I’m referring to your future self in 2026 in the next apocalyptic crypto crash… you can tell the newest entrants of crypto that you remember when bridging meant signing contracts leaving and coming.

As you do, you’ll feel like your grandpa telling you he walked uphill to his job – before going to school – in the snow, without shoes, and without eating for three days. While doing so, he’ll also lament on how simpler those times were when a stick of gum was a penny.

I say that for all of us to lighten up a bit. Let’s enjoy these days while they last.

“These are the days we will never regret…”

Alright, let’s get into today’s Blend. We got some smoke signals from global regulators taking place regarding crypto, thoughts on playing Ethereum’s (ETH) yield curve, and a fun one about crypto games.

Let’s go…

The Most Boring Podcast in Crypto Is the Most Important One

We all know about the BlackRock, Fidelity, Citadel, and JPMorgan news of late. These guys are coming.

What I find fascinating is they’re taking action as the Bank of International Settlements (BIS) is dedicating months of podcast content to discussing blockchain.

Now, this might have flown under your radar, since the BIS podcast is…not very fun to listen to.

The content tends to be very dry. It’s the Bank of International Settlements after all. It’s not like they need to hire a group of copywriters to hook you in.

Marconi Wight from the XC podcast even pokes fun at me for listening to it, along with World Economic Forum podcasts… But somebody needs to do it, right?

Well, I finally have a bit of a takeaway today from all those boring hours. Luckily for us, I don’t even need to talk about the contents of the podcast itself.

The last four or five episodes have tackled tokenization, smart contracts, and the BIS unified ledger.

It’s a pretty major signal that us JPEG-wearing, crypto-native degens tend to miss because we are more focused on the latest AMM tweaks happening among Uniswap, Ambient, Balancer, SushiSwap, Curve, Maverick, etc. etc. etc.

But this shift is happening out in the open. Not behind closed doors anymore. Here’s a snippet of some news out of Europe from a set of banker meetings taking place discussing Basel III – a set of risk guidelines for banks to follow:

The European Union reached a tentative deal Tuesday on toughening up capital rules for banks to help prevent a repeat of the taxpayer-funded bailouts that followed the 2008 financial crisis.

EU member states agreed with the European Parliament on how to implement long-awaited global standards known as Basel III as part of a wider package of reforms that also touch on cryptoassets and sustainability risks.

What many tend to look at first is that the BIS is trying to promote its private unified ledger. It’s an unpalatable solution for us natives. But what we need to realize is this isn’t for you or me. It’s for CBDCs and higher-level institutions.

That’s why we should note that we’re seeing institutional experimentation on systems like Polygon and Ethereum today.

The way tokenization hits retail will be through these public blockchain solutions. It’s in part why the International Monetary Fund (IMF) just changed its tune toward crypto earlier this month.

Which is all to say…

I’m about as bullish on this space as I’ve ever been. Sure, many of these things will be permissioned, closed-source, and centralized. But that’s OK. They’re still pushing this space toward mass adoption.

Public blockchains are not ready for global adoption. Exploits are all too regular. But that will change over time. Their decentralized nature will allow builders to work more efficiently to make them safer and suitable for retail.

If anything, let the world discover the inherent flaws of centralized solutions on their own. When a hack or issue arises due to centralized solutions creating a giant honeypot for exploiters to attack, the innovative tsunami wave happening in our decentralized and open source world will shine.

The BIS cannot iterate, develop, and move with the speed nor nimbleness of tens of thousands of startups. Giving the nod to crypto to continue building will create the environment for this meritocracy-like solution to rise up.

Build on.

Treasury Yields Are Hard to Predict These Days – And So Are Ethereum’s

When looking at the U.S. yield curve, we see things are messed up.

The 30-year Treasury yield at 3.8% is currently yielding well below the 1-year Treasury rate of 5.3%. Which doesn’t make sense. If you lock up your capital for 30 years, you expect to receive a higher yield.

The way it is now, just lock it in a short-duration Treasury and receive a higher return. Then later, when yields are normal again, you can lock up the higher rate for a longer duration.

Simple enough, right?

Well, who knows if rates will be 10% or 0% in a year. This is a real question mark right now: If inflation shows up again, what happens to rates? They are likely to go even higher, closer to that 10% figure.

But if something in the economy “breaks,” then rates might go down to zero… And you’re left wishing you bought that 30-year bond when you had the chance.

All this uncertainty is what creates a market. And in one way, it’s why the U.S. yield curve is so jacked up.

But let’s just make things even more complicated, shall we?

If you lock up Ethereum via Lido’s staking solution, the 7-day yield is around 3.9%. Not the worst.

Well, what do you think will happen if economic activity picks up in the land of Ethereum? Will those rates go higher?

Likely. But what if 100,000 more validators come online to stake their ETH? With rewards from the Ethereum network getting spread across even more validators, will the increase in activity really result in more yield per staked ETH?

Then there’s a question of the timing between how much activity rises and the amount of validators coming online. If activity rises on day 360, but several thousand validators have been added, will you really benefit in terms of yield earned for the year? Not really.

All of these questions give us what will become one of the more exciting niches of the Ethereum market for macro economists like myself…

The Ethereum yield curve and how best to play it.

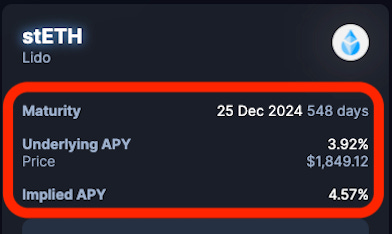

Let’s try an example. Pendle Finance is one team looking to deliver on the yield curve market. Right now, the market is pricing in a 4.57% yield for ETH token staked from now and until the end of 2024. That’s what the implied APY is saying below.

The question then is whether this is a high or low expectation. Well, don’t you worry… I have the mid-curve take below as my mind races back and forth between these two opinions.

On the one hand, there are about 633,000 validators, with more than 90,000 waiting to get activated. Meaning over time as those 90,000 validators come online, there will be fewer rewards to go around. So perhaps this yield is too high.

On the other hand, transaction activity is sure to rise at some point if you’re like me and think the Bitcoin halving next April will feed into a very bullish second half of 2024. Which means the yield is likely too low.

Weighing these two things, maybe the 4.57% yield is a decent expectation.

But those are only two factors I mentioned. You still need to ask yourself questions like…

Will users move to L2s as fees rise in a bull run? Will ETH as collateral become scarce, making locked ETH a premium? Will EigenLayer create a whole new set of dynamics on stETH? Or how about certain use cases for ETH that we haven’t even considered yet?

Welcome to the beginning of what will be a fun market that I look forward to spending more time diving into in the future.

If you have a few moments, share your thoughts in the comments below on what you think a good rate would be as I think we would all benefit from hearing various points of view.

Web3 Games Are Getting an Upgrade

Take a look at this image from a game called Wolf Game. Depending on your age, you might think it’s one of those Game Boy games from the 1990s.

You’d be wrong, though. Wolf Game came out in 2021. It was one of the first iterations of a blockchain-based game.

And as you can probably guess from this screenshot, if there was no blockchain or internet connection involved, this could exist on technology that is three decades old.

But that sort of assessment of Wolf Game is very shortsighted.

The game itself was about sheep. These sheep produce a commodity, Wool. Wolves can steal sheep and thus, steal Wool. And so players need to decide how to protect their sheep and also grow their flock of sheep to maximize Wool production.

There are some intricacies I’m skipping over as I really want to get to the part that matters…

This is all being recorded on the blockchain. These assets can be bought and sold in various markets onchain.

That’s what made it fun for crypto natives. For an outsider, this would be less fun than filling out little bubbles on grade school multiple-choice exams. If anything, it would be an anger management test for users as they learn to grapple with keys, connecting wallets, sending necessary gas, signing transactions, and more.

Sometimes I yearn for having time on my hands like that… But I digress…

The reason I bring up gaming is we are about to get a major upgrade across the board.

I recently stumbled upon MetalCore. Here’s a quick snippet of some gameplay taken from their website.

It’s built using Unreal Engine. The graphics are much better than the Game Boy-inspired graphics of Wolf Game.

And it’s onchain. The team went with ImmutableX, which is known for its easy onboarding experience via its “Passport” solution.

The game is mostly a first-person shooter, a shooter that you own as a NFT. Gamers also get various vehicles to either fly or drive around in. These are also NFTs.

Now I really wish I had more time for stuff like this.

But what to expect here…

There are some solid names backing this one. The one name I find most interesting here is Delphi Digital. I’m not entirely sure if it got the nod for token design. But if it did, it’s important to note this team was involved with Axie Infinity before it took off.

For those unfamiliar with Axie Infinity’s parabolic rise and crash, our team did a breakdown on the project using economy simulation software. If you take a read, it should be noted that it’s easy to see some of the shortcomings in hindsight.

Even if the team anticipated the economic shock that was coming on the user growth side, any adjustments they made would have had very limited chances of success. The growth rate was too astronomical.

For perspective, just think of what happened with the economic shock from COVID and how hard it was to navigate that mess as Mr. Jerome Powell of the U.S. Federal Reserve. Not an easy task.

Delphi deserves a lot of credit, and knowing that team’s involved in a Triple-A blockchain-based game should make this a fun one to watch.

And while MetalCore looks impressive… What has me interested here is that I stumbled across other Triple-A games built on blockchains. There is a wave of Web3 games with impressive graphics coming our way.

Everybody who was around in 2022 likely remembers the massively hyped Star Atlas game being built on Solana.

But ever since its tokens, ATLAS and POLIS, suffered from insane inflation rates – our team did in fact reach out to them in the hopes of fixing some of the glaring problems, economically speaking – most forgot about it.

And while I’m like 80% certain I still own some of the governance token of Star Atlas, POLIS, I just learned the game is still alive (queue up the typical bag holder response of “devs do something”).

There were many photos to pick from, but this one below I thought was most interesting. It shows a work-in-progress level.

The team is building out in the open and listening to community feedback – very Web3 since users will own commodities and in-game assets. It’s a unique twist to building a game.

Each project has its own niche. And what I find fascinating about all of this is that I expect these worlds to lure many of us into them. Meaning these will likely be the first metaverses that many inhabit.

The games that win this race will likely be incredibly successful. But what I’m waiting to see is something more in line with brands and their avatars being able to enter these worlds… And play.

In the poorly taken photo (by me) below, a player called DCInvestor is taking out another CryptoPunk named Andy in the game Nifty Island. It’s currently in closed Alpha, so this is just Twitter fodder since I’m just a wannabe CryptoPunk holder.

Pushing my wants and desires to the side for a moment, this game is fascinating to me. And if the game is pulling image data from the chain, then I’d have even more FOMO here. After all, CryptoPunks are one of the few that store their image data onchain.

If we see this level of composability with avatars taking place, then it’s the innovation I’ve been waiting to see. If you know of one, please reach out. I would love to check it out.

OK, that’s enough rambling out of me.

Until next time…

Your Pulse on Crypto,

Ben Lilly