Bitcoin Might Be Cooling Off Now, But Not For Long

Market Report: Popping the Hood on CVD to Forecast BTC’s Next Move

40…45…50…

My eyes are fixed on the red needle as it slowly creeps up and up.

55… 60…

I put a little more weight on my right foot…

65…

All of a sudden, the inside of my car resembles the scene of an earthquake. My dashboard is rattling violently, sending my sunglasses tumbling into the passenger seat. The rearview mirror shakes so violently it looks like it’s about to come apart. The engine starts screaming like a wounded animal.

After a few glorious seconds, I let my foot off the gas pedal. The noise and the shaking dies down. Everything returns to normal as the speedometer ticks back down.

It’s a familiar experience for anyone who’s ever owned a beater car, especially when you were young. The car comes with certain, uh, “quirks.” Like… if you go above a certain speed, it all threatens to fall apart. It’s almost like you’re arming the bomb on the bus in the Keanu Reeves movie Speed.

And after this week, it’s hard to shake the feeling that crypto has a “built-in speed limit” as well.

On Wednesday, Bitcoin (BTC) climbed over 5% to break $29,000 earlier in the day, before falling 7% in just an hour to under $28,000. It was a wild swing that probably has you wondering whether this year is going to be another rickety ride for crypto… and if you should get out now.

But there’s more going on under the hood than you think.

Easing Up on the Gas

As we said on Tuesday, we’re keeping a close eye on spot and derivative volume in BTC. Based on Wednesday’s price action, it appears that derivatives are still in the driver’s seat.

When BTC took off early that day, open interest (OI) – the value of active derivatives contracts in the market – spiked significantly as well. That indicates money was flowing into the market and it was pedal to the metal. And based on how fast price moved, it was a liquidity grab as shorts got squeezed.

Then, the gas got let up, price retreated, and in about 36hrs the open interest returned back to what it was before the rise.

This tells us the entire move was driven by derivatives – not spot. So before we can get excited about BTC breaking the next threshold, we need to see spot activity return.

Still, when we drill down into this large change in open interest, we can go back and see a pattern similar to what happened today.

Below is a year-to-date chart of BTC with OI on the bottom. Each blue line marks a time when we saw a steady rise in OI followed by a major drop in both OI and price.

Each time, we saw a consolidation period afterward that lasted between six to 10 days, highlighted by the red boxes… And price returned to levels before the OI whiplash.

Think of the rise in OI as giving gas to the rickety car of BTC… but once it gets going, it needs to lay off the pedal and coast for a while before the market can gun it again.

The real question is, where is BTC headed once this consolidation period ends?

Thank you for reading Espresso. This post is public so feel free to share it.

Forecasting the Next Move

When looking for a hint as to what direction price will take next, we can turn to cumulative volume delta (CVD) of both spot and derivative trading.

CVD measures how much of the volume in an asset is coming from buyers or sellers. The higher it is, the more buyers are dominating the market, driving up price – and vice versa.

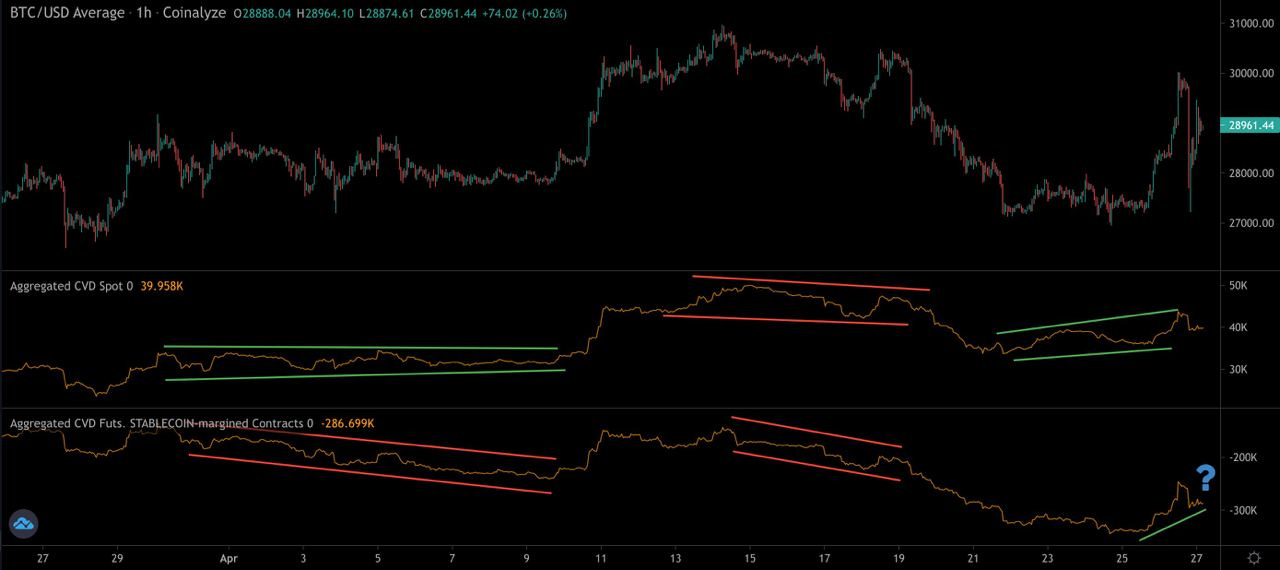

Here’s a chart of BTC with CVD for spot and futures derivatives at the bottom. The green and red lines indicate when each metric was hitting higher lows or lower lows, respectively. Green = higher lows. Red = lower lows.

It’s important to note this is looking at the consolidation period after the OI whiplash.

Previously, when CVD spot showed higher lows, like it did last week, price broke out of its consolidation to the upside. This happened at the beginning of April as well (furthest to the left time period).

Meanwhile, in mid-April (middle time period), CVD spot and futures had lower lows. And price then broke to the downside.

As we said before, we’ll need to see more spot volume before we can feel confident that BTC is in a healthy uptrend.

If BTC lets up on the gas and cruises into another consolidation period after this latest action, it’s worth observing CVD to see if spot can return with strength. And to see if it forms higher low or lower lows.

Right now, it's hinting at a trend higher. This would be positive for price action as we move into May.

But it's still early. Don’t put the pedal to the metal just yet.

Your Pulse on Crypto,

The Bens