Insights on Token Design

Case Study: Axie Infinity

The user base for the gaming industry is more than twice the size of China.

And in terms of revenue, it would slot in at #41 between Pakistan and Chile in terms of GDP.

Gaming is the literal definition of big business.

What was once seen as a domain for adolescents killing time in the basement is now one of the biggest industries in the world.

E-sports for instance has a viewership rivaling the biggest cash cow of U.S. media companies - The U.S. National Football League (NFL).

And while we can go on about how gaming’s size is size, the pace of change is also noteworthy.

The golden age of arcades began in the 1970s with giant consoles that stood next to one another like a lineup of telephone booths. This then morphed into smaller home video game consoles. Which then gave rise to PCs and smartphone gaming.

Simultaneously, gaming evolved from solo play, to multiplayer, to online play, to global tournaments with mega cash prizes.

All of these leaps in development were thanks to advances in tech. And the latest one has us the most excited - blockchain based gaming.

Blockchain game usage increased over 2,000% and comprised 52% of all blockchain activity in 2021.

Which drove in about $4 billion in investments for 2021 and $2.5 billion in the first quarter of 2022.

It even represented 41% of all NFT sales in 2021, totaling $8.8 billion.

The trend is just beginning.

Which is why blockchain based gaming is one of our primary focuses at Jarvis Labs (Jlabs) when it comes to token design. And since we take the design space seriously, we believed there was something missing from our arsenal.

This changed earlier this year when we came across Machinations. And since then, we have been able to better showcase sustainable designs to our clients.

Today we would like to introduce this tool with you all using one of our in-house models we developed looking at the biggest blockchain based game to date, Axie Infinity.

But before we do, let’s quickly walk through our tool set to model these token designs.

Methods to Success

If you design token systems or in-game economies, you need a set of tools.

Most teams employ a combination of excel, Figma flow charts, and case studies of previous projects. This is what we did for some time as well.

But at the end, there was no dedicated piece of software to really tackle the main problem of designing an economy. Which is a pretty glaring issue if you think about it…

Devs, artists, sound engineers, and graphic designers all have a myriad of software programs to choose from. Token designers, not so much.

Which is why designing these systems was always more art than science.

That was, until now.

The folks over at Machinations are convinced that they have created a game design tool that industry professionals will use for years to come.

Which is why we spent several months testing their software.

After learning more about the software, it became clear a trained user could map out and simulate complex systems, validate assumptions, model different cases, or any other simulation you wanted.

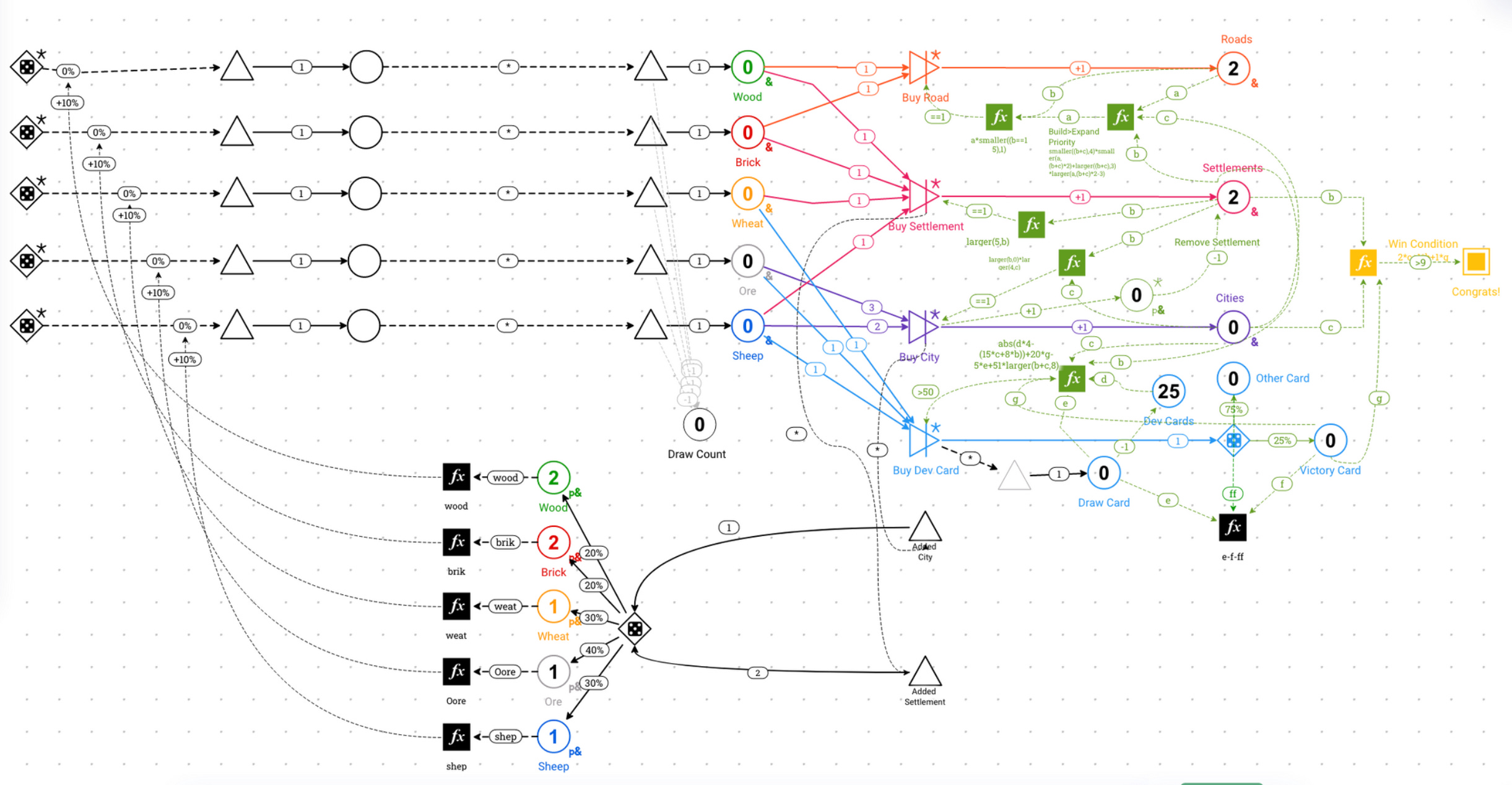

Here is an example of a popular board-game Settlers of Catan:

I know, it look intimidating. And don’t be fooled, the learning curve is steep.

Regardless, Machinations is a great tool and currently one of our main weapons of choice when it comes to designing game economies. Or any other token economy really. We even use it to model revenue projections.

And to prove its effectiveness - and also showcase our skillset to the public - we thought we could launch a series in which we explore various token economies in the cryptocurrency space.

In doing so, we hope to make a case of why healthy token design needs to become a larger focus in the industry. The reason being, most projects don’t even survive long enough to find product-market fit. The token often times ruins the project before it can even deliver.

This is why we have spent the last year building our database of 2 trillion transactions, 200k tokens, over 200k wallet labels, and more than 200 allocation schedules. We are confident this might be one of the biggest repositories dedicated to token design in the industry, and it drives our insights when building the next generation of token economies.

For today, let’s first show our model of a game that is one of the biggest success stories in blockchain based gaming.

Axie Infinity

Axie is a blockchain-based game in which players buy, sell, battle and raise cute, little monsters named Axies. Each Axie is a unique non-fungible token (NFT), stored on the Ronin blockchain, with a particular set of characteristics.

The characteristics give them uniqueness that stands out during gameplay.

Sky Mavis, the group behind Axie Infinity, did not want to stop at just another game though. Their stated mission involved creating economic opportunity through play. This is where AXS and SLP, both tokens native to Ronin, come into play.

AXS is the governance token, meant to decentralize the ownership of Axie Infinity. This has led to market participants using AXS as a way to gauge the success of Axie Infinity.

SLP is the in-game currency of the Axie universe. Players can earn SLP through gameplay and contributions to the ecosystem. They can in turn use it to breed more Axies.

The success of Axie is nothing short of ordinary. The same goes with its fall. In an industry riddled with tales of meteoric rises and spectacular crashes, the story of Axie deserves its own page.

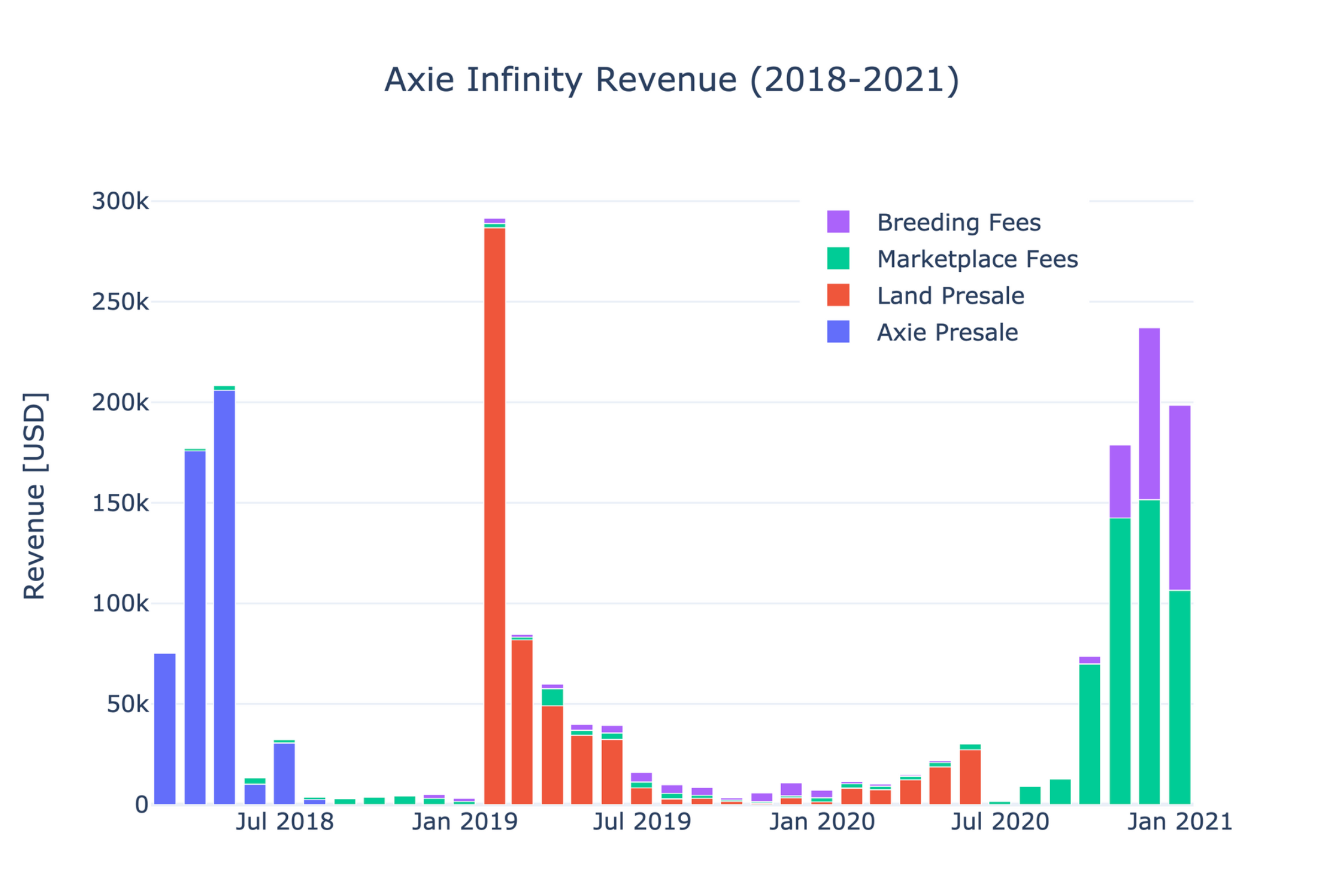

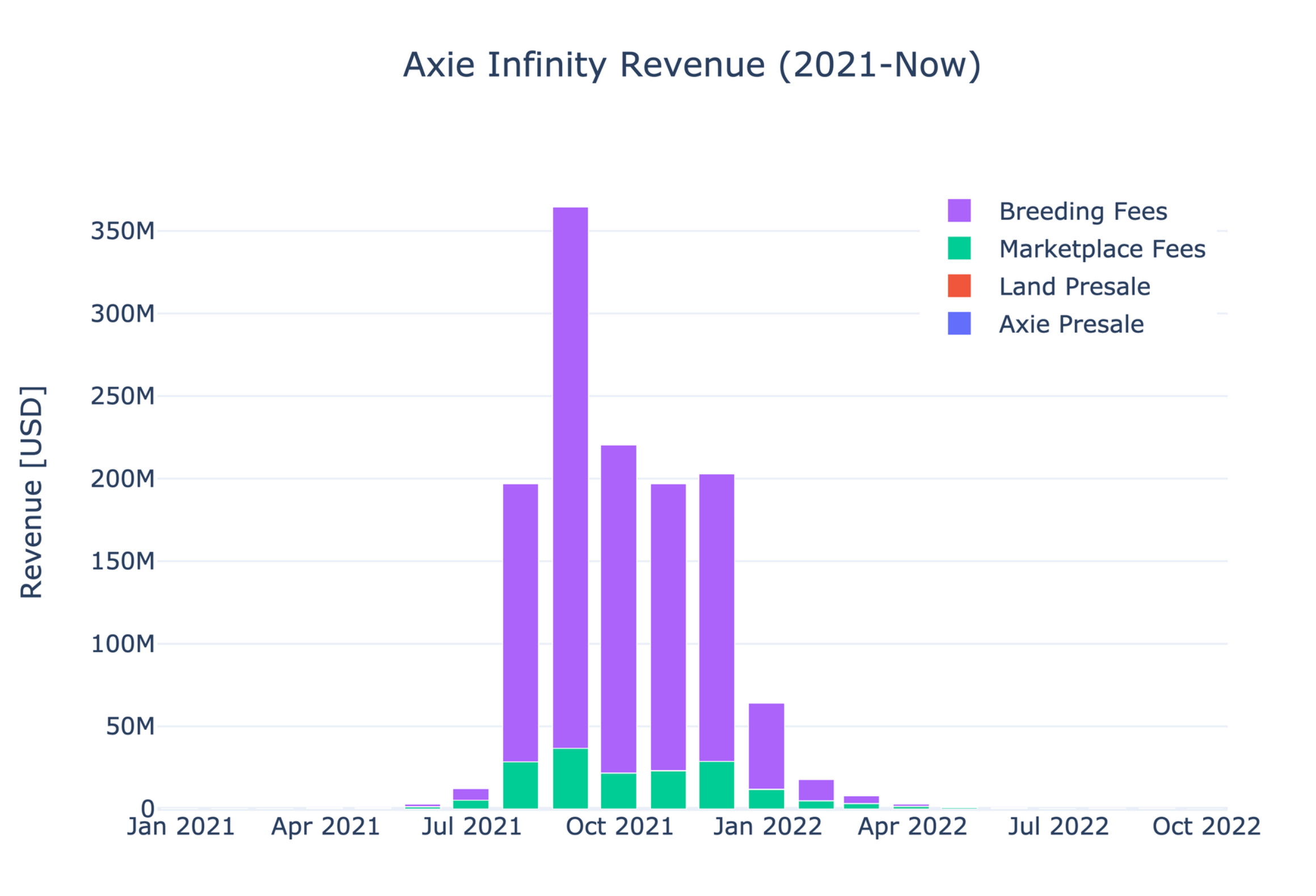

Axie, created in 2018, went from a game with no traction and text-based UI to a world-wide phenomenon with almost 3 million daily active users (DAU). Revenues were in the hundreds of millions of dollars. It became the poster child of a new way of gaming, Play-to-Earn (P2E). It promised financial freedom and stability through play. “We believe in a world future where work and play become one” Axie’s website stated in the past.

In the charts below we can see some of the massive revenues being pulled in. The first is revenue for 2018 to 2021. The second chart is the massive leap in revenue that took place in 2021 and drop in 2022.

The Play-to-Earn dream unfortunately didn’t last. SLP, the life-blood of the in-game economy, experienced a period of hyperinflation that stopped Axie’s rise on its tracks. Now, the DAU are counted in the thousands, not in the millions, and revenues are barely non-existent.

Did Axie ever stand a chance? Or was it doomed from the start?

In this report we argue that the economics of Axie Infinity were poorly designed from the get-go and, unless something were done, it was always going to end in disaster.

Show me the receipts

All models are wrong, but some are useful

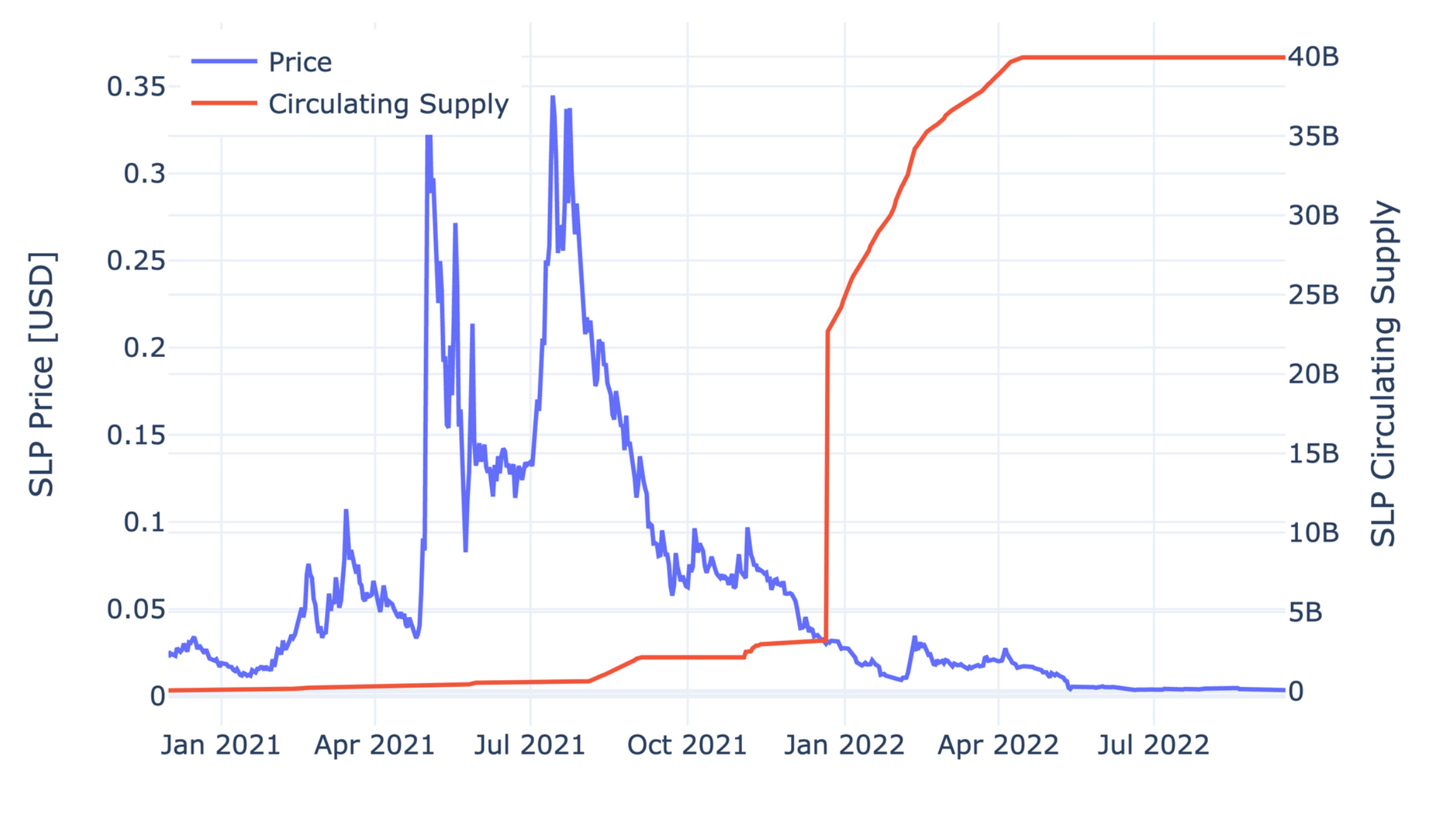

Our thesis was simple: there were too many ways for SLP to be created, and not enough ways for it to be used up.

Game economies need to balance the number of faucets, or ways for money to enter the game, and sinks, or ways for money to disappear.

In the case of Axie, faucets were plentiful: Player-Vs-Player battles, the Adventure Mode or PVE game, daily quests, etc.

There was only one major sink for SLP though, breeding. And one can hardly expect most players to collect an ever-growing number of Axies.

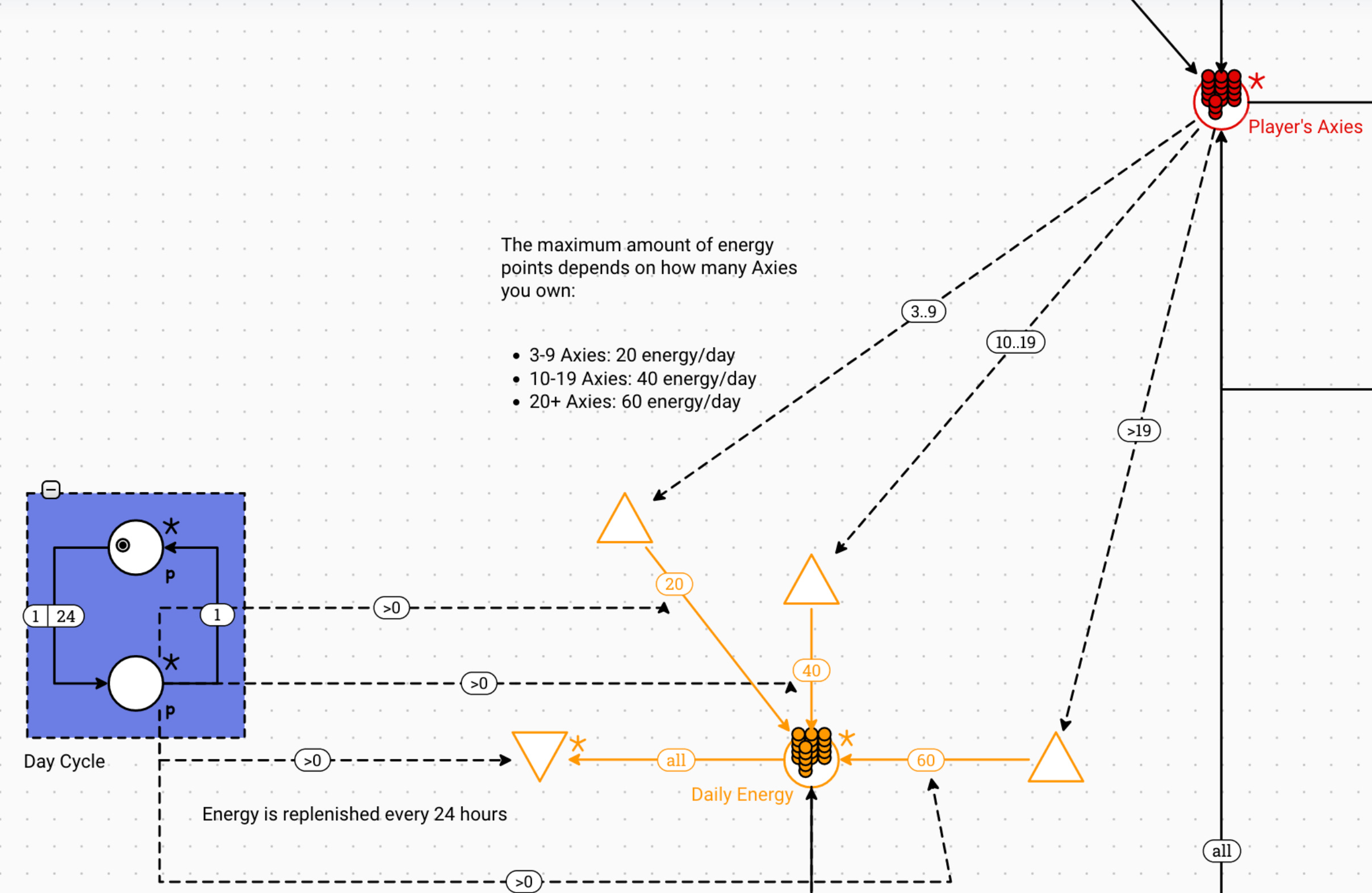

To compound this concern, players are rewarded a finite number of energy points to use for their Axies each day, placing an upper band on how much SLP supply would go towards Axies.

In traditional games, this isn’t a bad situation. That’s because there are walled gardens with very limited on/off ramps.

Blockchain based games on the other hand magnify any supply/demand inefficiencies. That’s due to instant liquidity.

This supply/demand inefficiency led users to “farm” the SLP. Meaning earners would sell it on an exchange shortly after receiving it.

To model this economy we had to make a few assumptions. Mostly because we wanted to hone in on the main in-game token - SLP. Also, a simple model is less likley to be wrong than a more complex system. Here are a few items to note:

- AXS token was not included, as it is not relevant to the in-game economy.

- SLP finds willing buyers at the start of the simulation. However, as time passes, the demand for SLP decreases as the token is farmed. This means the supply of SLP sold on exchanges (modeled as an AMM) increases.

- Axie players sell a set percentage of their SLP each turn.

- We tried and stick to the original game mechanics and rewards. These have been tweaked by Sky Mavis, but the core mechanics remain the same.

So, without further ado, here is JLabs’ take on Axie Infinity.

A bit overwhelming, I know.

We don’t want to bother you with all the minutiae of the model. It also doesn’t fit very well in a compressed image. If you are interested in seeing the model in greater detail, feel free to reach out. But we do want to show a small sample, so you get an idea of how the model works.

The module below tracks the energy that a player has. A player uses energy every time they engage in PVP battles, or in Adventure mode. The amount of energy points depends on the number of Axies a player has, and is replenished every day.

Machinations is built on nodes that show as solid shapes. And these nodes interact with connections that seen via the solid and dashed lines. The circles represent pools, which are resources (Axies, energy) in this example. The upward looking triangles represent sources, and the downward looking triangles represent drains.

The solid lines distribute resources (in this case, energy points) and the dashed lines can change the state of the elements they interact with based on certain conditions (e.g. the energy sources will be active only when the player has a particular number of Axies).

Now, starting from the left, there is a small module shaded in blue that tracks the passing of a day. The 1|24 connection is a delay of 24 steps; once those 24 steps have passed, the resource (the little solid ball) on the pool above moves to the pool below. This activates the dashed >0 lines. The drain will absorb whatever energy points are left in the Daily Energy pool. Then, one of the sources will send either 0, 20, 40, or 60 energy points depending on the amount of Axies the player holds on the red resource pool on the top.

This little component re-energizes the Axies at the end of the day. Again, a small component of the larger system. But instead of putting you to sleep by going through each one, let’s see what the results looked like.

The chart below produces a price simulation of SLP.

As expected, notwithstanding heavy demand for SLP at the beginning of the simulation, the constant selling of SLP by Axie players proves to be too much.

The price action of the chart above and below should look fairly similar. (The price looks way off due to the way in which we adjust decimals to run things more smoothly.)

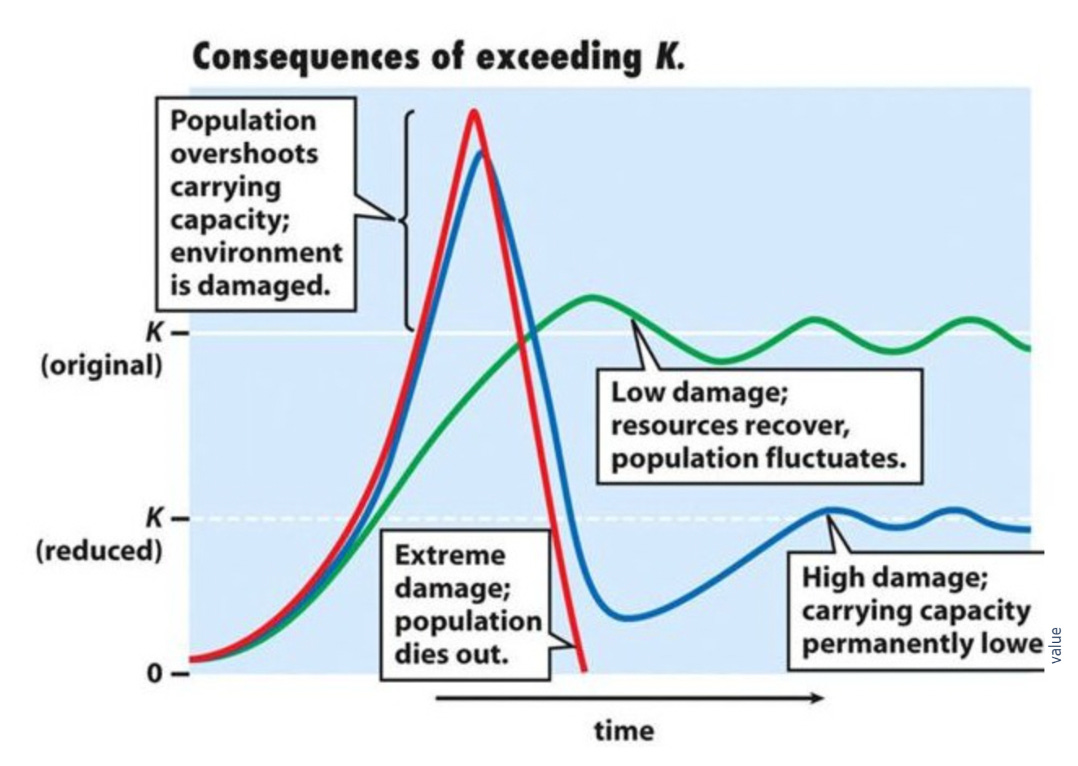

This price chart should look fairly similar as many tokens have realized something similar to this. And the after effects to the token and application/game/blockchain is could be permanent damage to the economy.

We refer this to a reduction in the max carrying capacity of the economy. It can no longer sustain as many users due to is low productivity state.

So what could Axie creators have done differently to stop this barrage of selling and try and find an equilibrium?

Well, they could have introduced different SLP sinks. This is the easiest first method, and a few examples are:

Taxes for land use and other economic activities

New game items purchasable only with SLP:

Rare collectibles

Land

Pets

Donations; players earn badges or other recognitions depending on how much they donate

A ‘food’ component to keep Axies fit to fight

These are just a few ideas. But ultimately, these conversations are best had with creators in coming up with ideas that pair up with their vision.

If the idea of in-game sinks and faucets is interesting, check out this article by 1kxnetowrk. It was one of the better ones we’ve seen.

At the end of the day, the main takeaway is players need to be willing to put in more resources into the game (aka money) than they take out.

It is unreasonable to expect all players to make a profit off a game. Or that new users will continually enter the market to help sustain higher prices (sound familiar?).

Because someone must always foot the bill.

Sky Mavis knew this. They set up a variety of different avenues to grow the Axie universe and created more ways to use the token: a free-to-play (F2P) game, land usage, user-generated content, etc.

Regretfully, these new introductions to avoid the devaluation of SLP and the crash of the Axie economy might have happened too late.

Rising Axies from The Ash?

We do not think the game will realize the same success as it did before.

Part of this has to do with carrying capacity. Similar to growing populations, if economies grow too fast, then the population can exceed the amount the economy can sustain.

If this takes place, then either two things happens. The economy dies out or the amount of users the economy can sustain is permanently lowered.

Which is why whenever we discuss growth, it is all about sustainable growth. If you grow too fast and introduce price instability, then you’re likely to damage the upper band in how much the economy can sustain.

To visualize this, here is the chart we show clients on this topic. Many of us might remember this chart from biology class in discussing Reindeer on St. Matthews Island that died off.

This new line of thinking in crypto might feel out of place. But when we adjust our thinking to view these economies as sustaining users based upon resources (the token), we can start to view them in this light.

It is a quickly evolving space. And while Axie is far from dead, we wish them the best of luck. Their success helped many of us realize how big blockchain based gaming can be. And for that, they are truly trailblazers. For that we should all be grateful for their success. And genuinely do hope they bounce back.

As for us here at JLabs, we hope you enjoyed this article. We look forward to doing more of these, and begin to put our philosophy forward on what token economies should be.

Do reach out to us if you want to talk token economics, want to know more about what we do, or want us to consult your next or existing project.

Until next time.

- The Token Design Team at Jarvis Labs