Anxious Boredom

End of Week ChainPulse Update

It’s one of two things.

Either we get bored and it happens…

Or we get bored and it doesn’t.

Because either way, we’re getting bored.

I’m referring to bitcoin’s price rising above $60k. And honestly, I’m unsure which way it goes.

Let me explain…

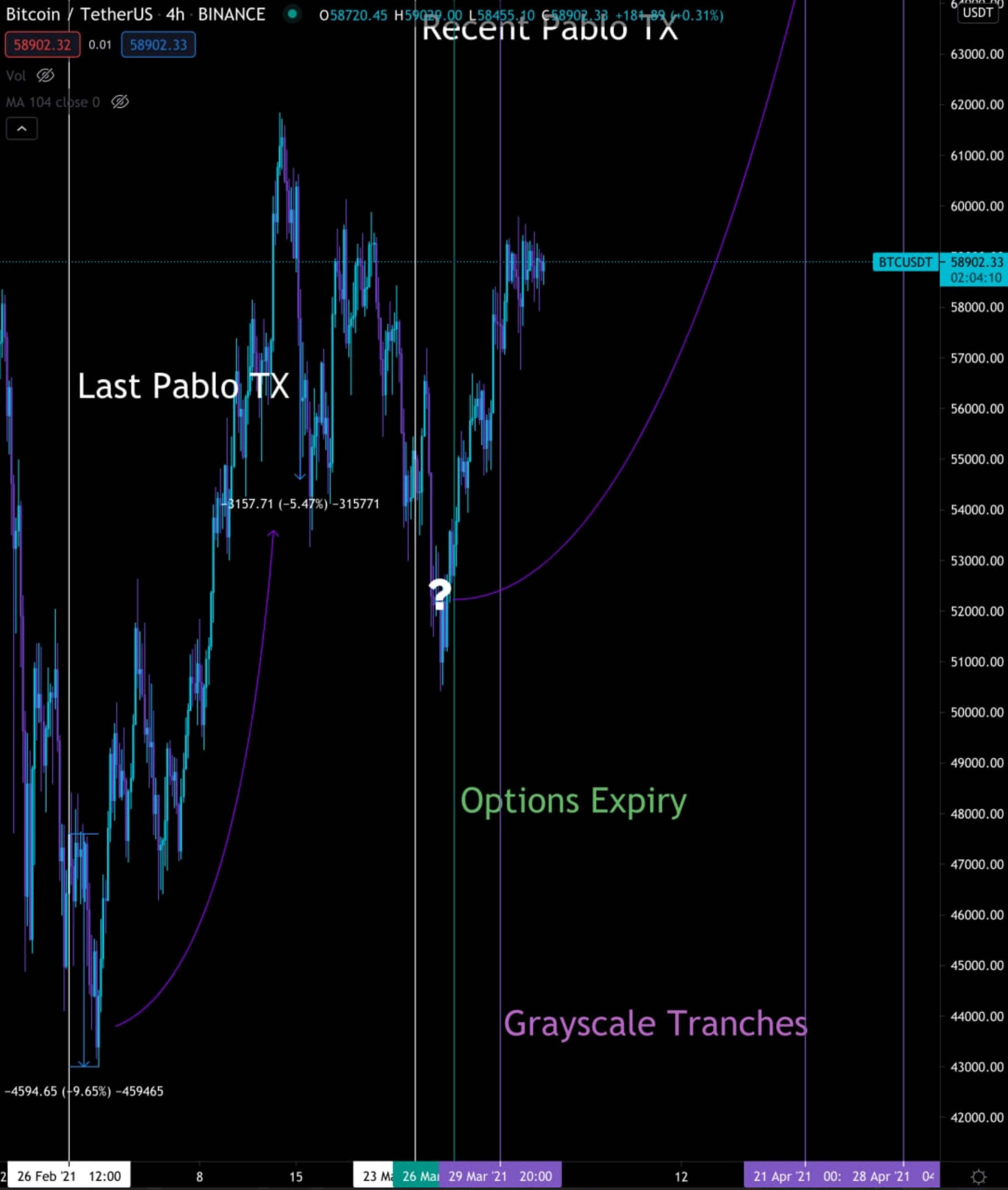

Last week we had our massive options expiry pass. In its wake bitcoin started to march towards $60k with little hesitation. This also coincided with a sizable Grayscale unlocking this week, creating a great one-two combination of bullishness.

Some of you brought up the Coinbase transfer being related to Grayscale unlockings. This is probable, but nothing I can say yes or not to with any sort of certainty.

Maybe instead of it being Grayscale it’s instead Oracle’s Larry Ellison. We’ve all been anticipating it, so it’s not like it’d be much of a surprise.

Regardless, outflows like this are definitely bullish.

When we pair this news up with incredible amounts of dry powder, neutral funding rates and low risk… The scene was ideal for a $60k break.

Fast forward to today, and the scene hasn’t necessarily changed much.

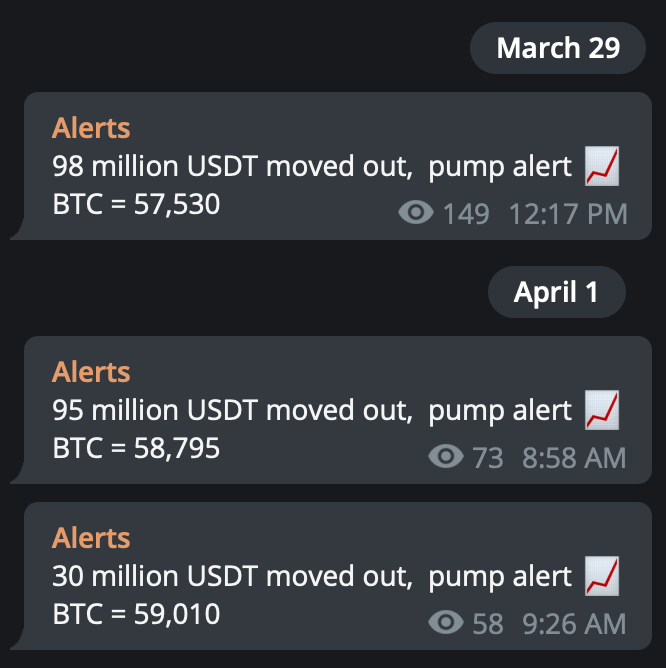

On March 29th and April 1st we witnessed strong USDt movements take place. These gave more bullish overtones…

Yet price felt stuck just below $60k… What was going on? It’s like the market was redlining our bullish meters, but it was still in park.

If somebody decided to put the market in gear it felt like it would squeal higher. I was anxious in excitement watching this unfold, and I was probably exuding kid in a candy store excitement via my tweet earlier this week.

If the gatekeepers of sell walls open up the dam, it feels like the entire financial industry will be flooded with crypto insanity. Anybody else get that feeling?

— Ben Lilly (@MrBenLilly) 8:39 PM ∙ Mar 31, 2021

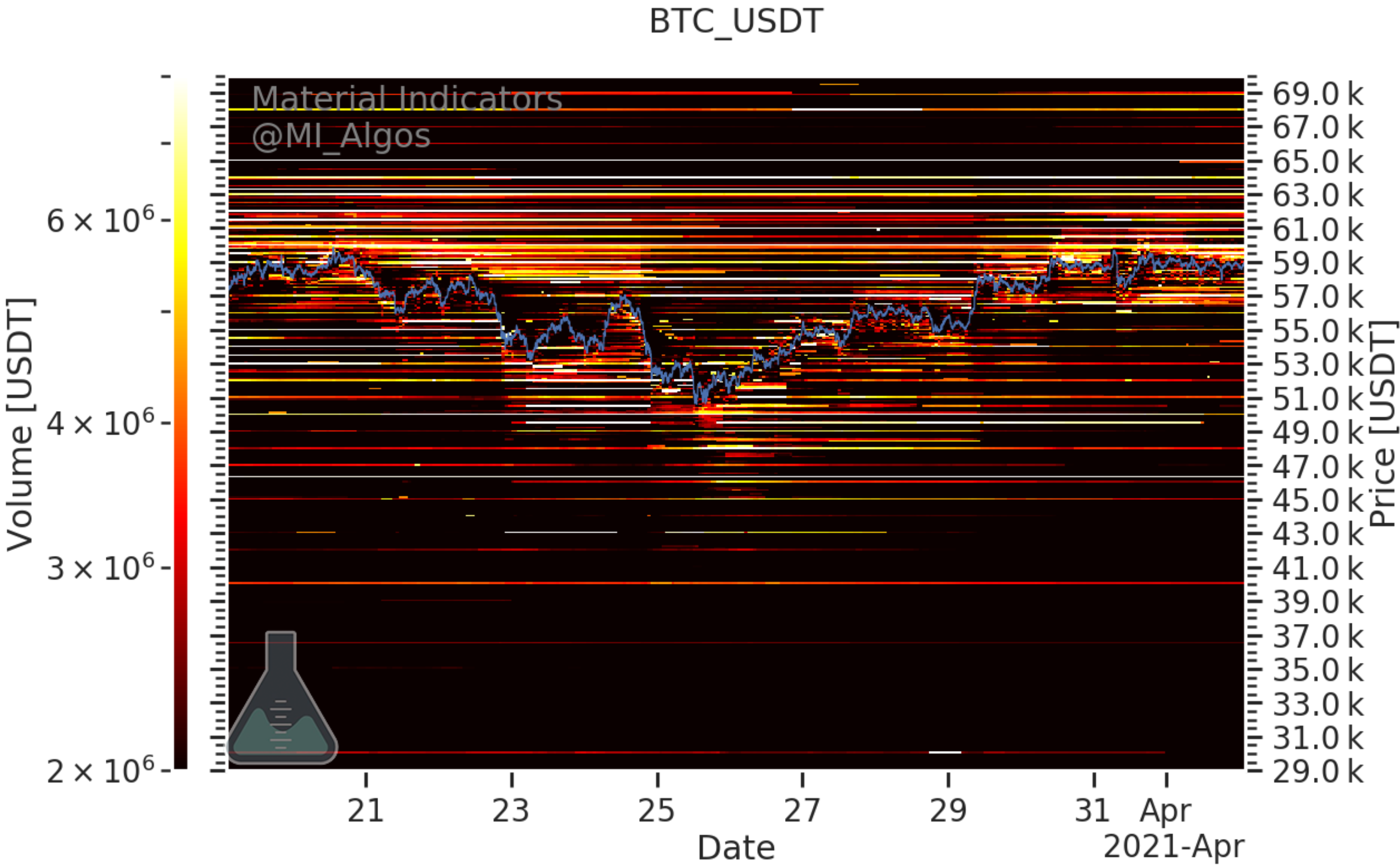

So what was and is happening? Well, courtesy of our friend at Material Indicators, we can see there were strong walls in place. These are shown here with white and yellow lines signifying large orders. The lathered on white/yellow sell walls near $60k are a clear sign.

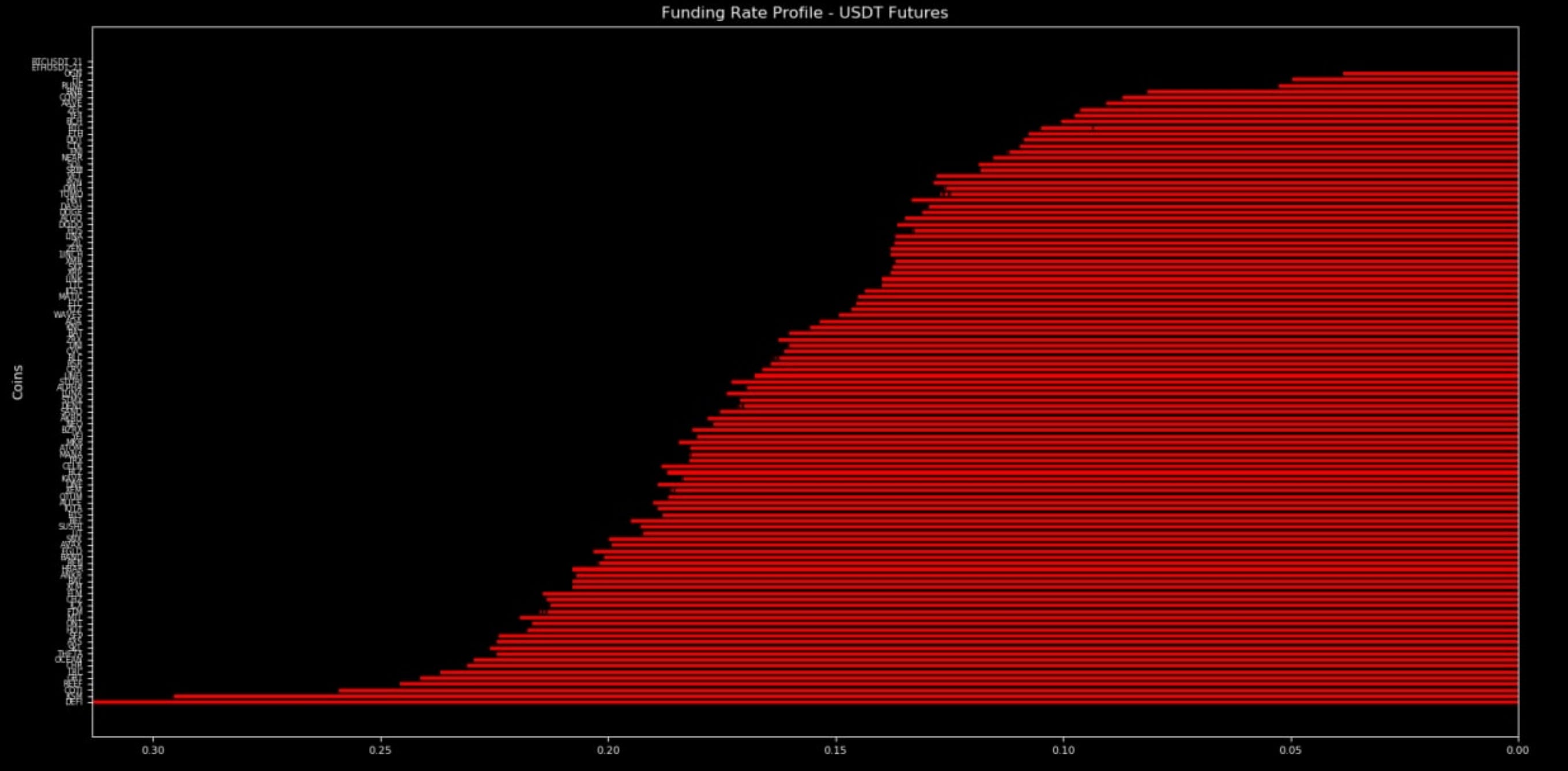

Meanwhile, the anxiety wasn’t just building with me… But with leveraged traders as well. Here is a funding rate profile showing a healthy amount of rates at 0.2%.

It’s not crazy… But definitely growing.

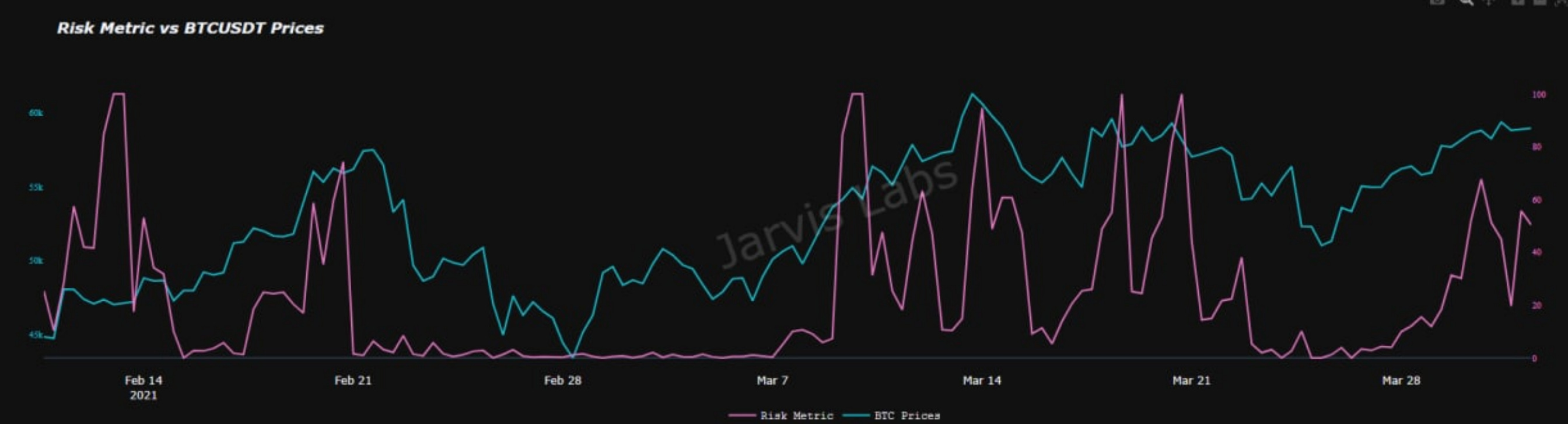

The anxiety could also be seen in our risk metric that’s focused upon funding rates. It was beginning to spike a bit as well. (The pink is the risk metric while teal is price.)

Then a third metric from ChainPulse that’s based upon a combination of net unrealized loss/profit and funding rates reflected something similar, again.

The main reason why this is noteworthy is the fact we haven’t closed above $60k despite the bullishness.

This is characteristic of the tactics whales use to attract liquidity. They do this by stalling price near a break out. Then after releasing the valve a bit, they can liquidate those built up as well as the newly added positions.

So if price stalls at $60, price then does a quick move to $61kish before dropping back to below $60k… That’d be the signature.

If this whale fake out were to happen then the next series of Grayscale unlockings later this month can prove to be very bullish. Assuming price go sideways from the fake out, then the unlockings that start to unfold on April 21st and take place every week for approximately 10 weeks (ball parking) would be an area of focus.

To me this continued sideways scenario makes the most sense given how quickly we have climbed since last week… But when it comes to bitcoin, if those walls get lifted and the fake out/liquidity grab maneuver does not take place… then we’re off to the races.

Ignoring all the potential scenarios the on-chain continues to look strong while risk rising only slightly.

Hope you all have a great weekend. And to those that celebrate Easter, I hope you can spend it with loved ones.

Lastly, for the Jarvis AI subscribers, we have some very exciting news for you next week. Over the last couple months we’ve been fortunate enough to hire several new helpers… This is translating to some new alpha upgrades.

Until next week…

Your Pulse on Crypto,

B