A Tally Mark for the Supercycle

The first checkmark on the list

I am procrastinating…

Several fund managers and wealthy clients have asked for my input on a particular subject making the rounds in crypto.

The reason for my delay is not because it is a new topic. I simply have not spent the proper time to properly analyze it.

There is so much to digest. Network effect growth rates, number of participants in the network, end user growth rates, prior internet technology growth rates, adoption curves...

To form a thorough analysis regarding the most bullish argument for bitcoin ever is almost debilitating.

It’s not to say I haven’t started…

I estimate nearly fifty hours of actual pen to paper work have gone into this single thought.

And in all honestly, I’m finding it very difficult to pitch a tent in the supercycle camp.

Each time I start digging into the question I find myself pushing it to the side faster than before.

I just can’t force myself to it.

The reason why is not because my team and I are afraid to make such bold claims. I’m ok if our team does it as long as we have conviction.

In fact, back on June 29th of last year when bitcoin traded at $9,100 we issued a statement to the press, “The market wrote off the halving: Wake up call incoming”.

Price was trading at the same price range for exactly sixty days when the comment went out. The market was turning very bearish and many were expecting some major price movement to the downside in the days to come.

Yet, we went out on a limb. Our trading system showed spot markets were incredibly strong. It was a different strength than what we saw in the run up to $14k in 2019.

Bitcoin went on to break its all-time high less than five months later.

Now, I don’t bring that old comment to gloat. But to show we don’t hesitate in making a bold claim like the supercycle… as long as we have the data to back it up.

As of today, we don’t have enough to make such a claim on the supercycle.

But what we do have is one of the strongest tally marks you can have for building a case.

The Purpose Bitcoin ETF (BTCC) now has over one billion dollars worth of bitcoin under management. This is the first North American listed ETF for bitcoin. And its proximity to the U.S. makes it a big deal.

That’s because U.S. investors and brokers have greater familiarity with stocks listed on Canadian exchanges. This is in part because most junior precious metal miners are listed in Canada. And if you want exposure to small cap miners, this is where you go.

Now, I know many readers might point to Grayscale and other proxy stocks available on U.S. stocks exchanges and say they provide bitcoin exposure. But we can all agree an Exchange Traded Fund brings a pure play feel to it.

It’s exactly what people want. Managing their keys, transacting the tokens, or even sending fiat to a cryptocurrency exchange is not for everyone. People want a bitcoin ETF. As of today, most want exposure to bitcoin to diversify their holdings.

An ETF is their answer.

Fund managers, family offices, financial advisors, pension funds, and corporations are also begging for it. None of them wish to setup custodians.

And seeing an ETF start trading north of the U.S. border means a U.S. traded ETF is imminent.

Here’s the interesting part of the ETF story… In terms of how an ETF acts as a catalyst for a supercycle, I don’t believe we need the U.S. ETF for anytime soon. The effects are already unfolding now.

Let me explain…

The gold market got its first ETF in March 2003. It listed in Australia. And it wasn’t until 20 months later in 2004 that the first gold ETF began trading in the U.S.

What’s interesting is price was already on a multi-year run. It was steady and gaining momentum. Once the ETFs hit, price ripped from the $300s to $1900 per ounce. Here’s the chart.

The two white vertical lines are the ETFs. As you can see, gold went on a tear.

The main reason was accessibility. Prior to the ETF most investors gained exposure through futures contracts or buying the physical metal.

It's a situation similar to what is happening today.

Investors looking for exposure need to buy futures or the ‘physical’ bitcoin for the most part.

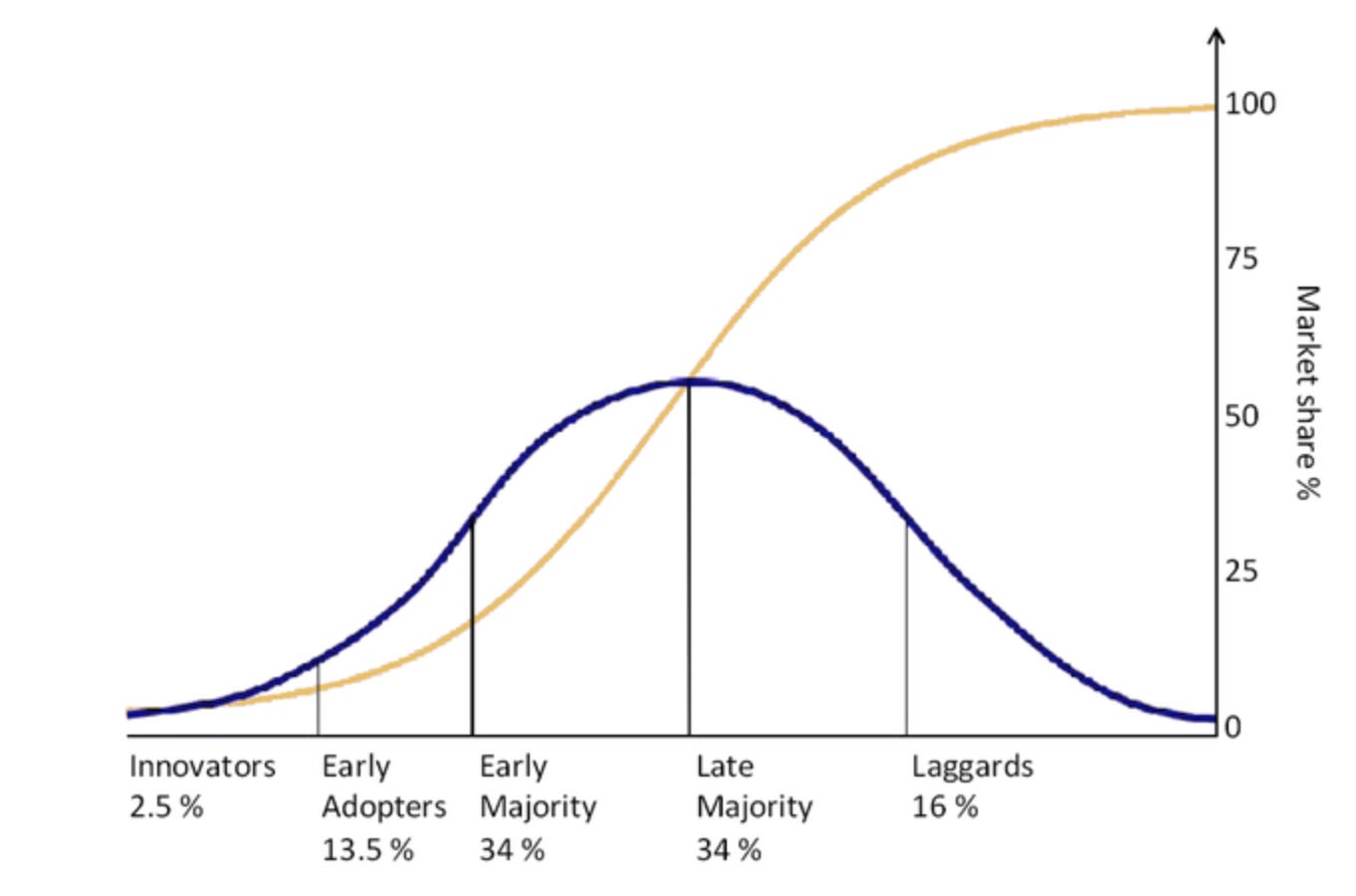

And the reason this is so important is adoption. The more accessible bitcoin becomes, the easier it is for bitcoin to hit its stride on the adoption curve. It’s the yellow line in the chart below.

You’ve likely seen a bitcoin or cryptocurrency advocate point to a chart like this and say it’s still early. I agree with them, but this isn’t what an adoption curve looks like…

It looks like this.

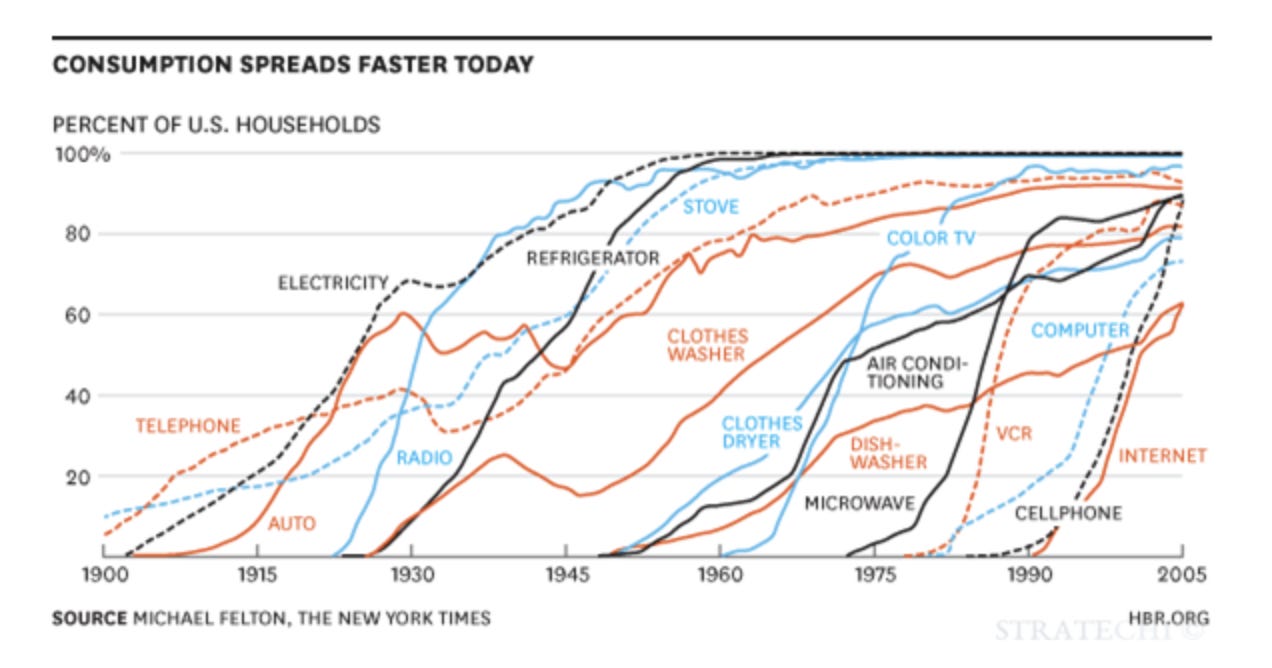

They progress much faster than what that first chart would lead you to believe. Especially of late.

Meaning a wave of mainstream adoption will come into bitcoin like a tsunami over the course of years. Not decades.

If that’s the case, the fastest part of that adoption curve will likely happen when this bull cycle nears its end.

And if the adoption curve typically takes 5-10 years to go from 20% adoption to 80% adoption - a rate like the cellphone, computer, and internet - that means the fastest growth will take place 2.5 to 5 years from now.

That likely puts us on course for a time period before the next halving in 2024. That's assuming the Canadian ETF now holding over $1 billion AUM in Canada is our inflection point.

Which is how I see it. But for me to go out on a limb and say we're entering a supercycle... I need more conviction.

There are a few more checkpoints I want to cross off my list. I promise to reveal more of these checkpoints in the coming weeks.

Your Pulse on Crypto,

B

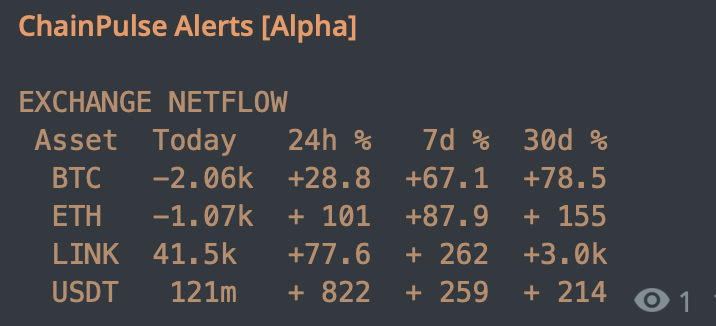

P.S. - ChainPulse / Market updates will come soon. For now, here’s a quick 200 words…

On-chain activity over the weekend was quiet. It wasn’t just prior to the pump yesterday that I noticed a few pulses finally coming through our system. In particular, 5k+ of BTC got transfered out of an exchange to a wallet that corresponds to bullish price action, a sizable outflow of a mid-cap token to another market maker wallet, and a few decent inflows of USDT.

It’s the most activity I saw over the last three days.

Further, we also had negative netflows for both ETH and BTC with positive inflows for stablecoins. Both bullish signs. It’s the first time we’ve seen this combination since almost a week ago.