A Rising Tide

Signs of whales coming back to the market are appearing. We also dive into some of the recent trickery that led to yesterday's selloff.

The tide is slack... give it some time.

I took this comment from my friend as an indication I should clean up the knot on my fishing tackle.

As I searched for some nippers to trim the excess leader on my freshly tied clinch knot, I heard the click of my buddy's chair.

I turned to the side and saw him reclining backwards, preparing for a nap.

That was unexpected.

Turns out, his idea of giving it some time was slang for an hour or so. Meaning he wanted the tide to start coming back in and the water to have risen a little.

We were on the beach to hook some Snook. It's a fun fish if you ever get the chance. The fish itself loves to run once it's hooked and fling itself in the air with the hope of freeing itself from your line. It also uses its sandpaper like mouth to tear away the line.

The Snook's diet consists of several things, one of which is crustaceans that hang out near the shore... For anybody that likes to eat what they catch, this is the type of diet that produces the best tasting meat - at least in my opinion.

It also means once the water starts to come back in with the rising tide, the fish come with it in search for a crunchy lunch.

And that's what we were waiting for, them to show up and start feeding.

Sure enough, my buddy was right and knew just when to start up for the day. We snagged a few, but none of them were the right size for dinner.

Regardless of our failed hunt, his seemingly laid back approach was baked in wisdom and comes to mind when listening to Benjamin yesterday on the Trading Pit by xChanging Good.

And to see what Benjamin aka TheWhale_Hunter is talking about, here are a few charts that hint at his message for everyone.

Empty Waters

Back in late Q2 and into Q3 last year, larger wallets were very active.

We can look at this activity by pulling up a Divergence chart. This chart breaks whale and small wallet activity into four outcomes, and assigns a color to each outcome. These four outcomes are:

- Whale & Fish Down (pink)

- Whale Down & Fish Up (green)

- Whale Up & Fish Down (yellow)

- Whale Up & Fish Up (red)

When we see red and yellow, that's telling us whale accumulation is taking place.

When we go back and check out the Q2-Q3 period of 2023 (black box below), we can see a lot of red activity... About 80% of the black box.

The feeding was relentless. And once price really started to take off, the line went solid yellow. Solid yellow is where Whales are accumulating and smaller wallets are not. That's on the far right hand side of the chart below, and price was ripping.

The period of accumulation highlighted above was the most active period we'd seen since July 2021.

If we fast forward to today, we don't see the same type of activity with wallets. We simply see some...

As far as when this activity gets triggered, it happens as price is near the lower side of this range.

With a quick glance we can see it's not the same level of accumulation as witnessed last year. Nor is there any strong follow up in accumulation behavior when price rises.

Not a good sign.

But we can go a step further here to really showcase why we want to see whale activity pick up more.

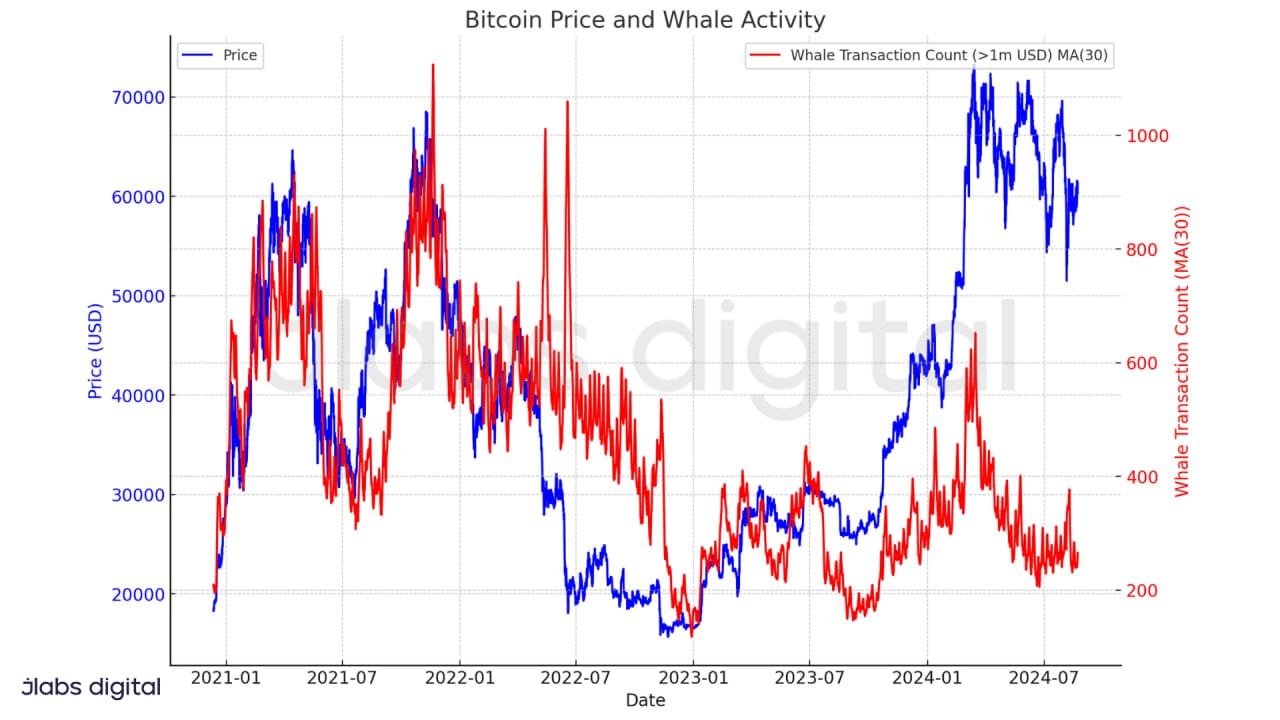

Below is whale transaction accounts over time chart. It's smoothed out a bit (red line) to help see how it moves in tandem with price.

You can see that the price top in March of this year resulted in the red line quickly falling... And not trending up much since.

Needless to say, whale activity is just nowhere near where we want it.

But that's starting to shift...

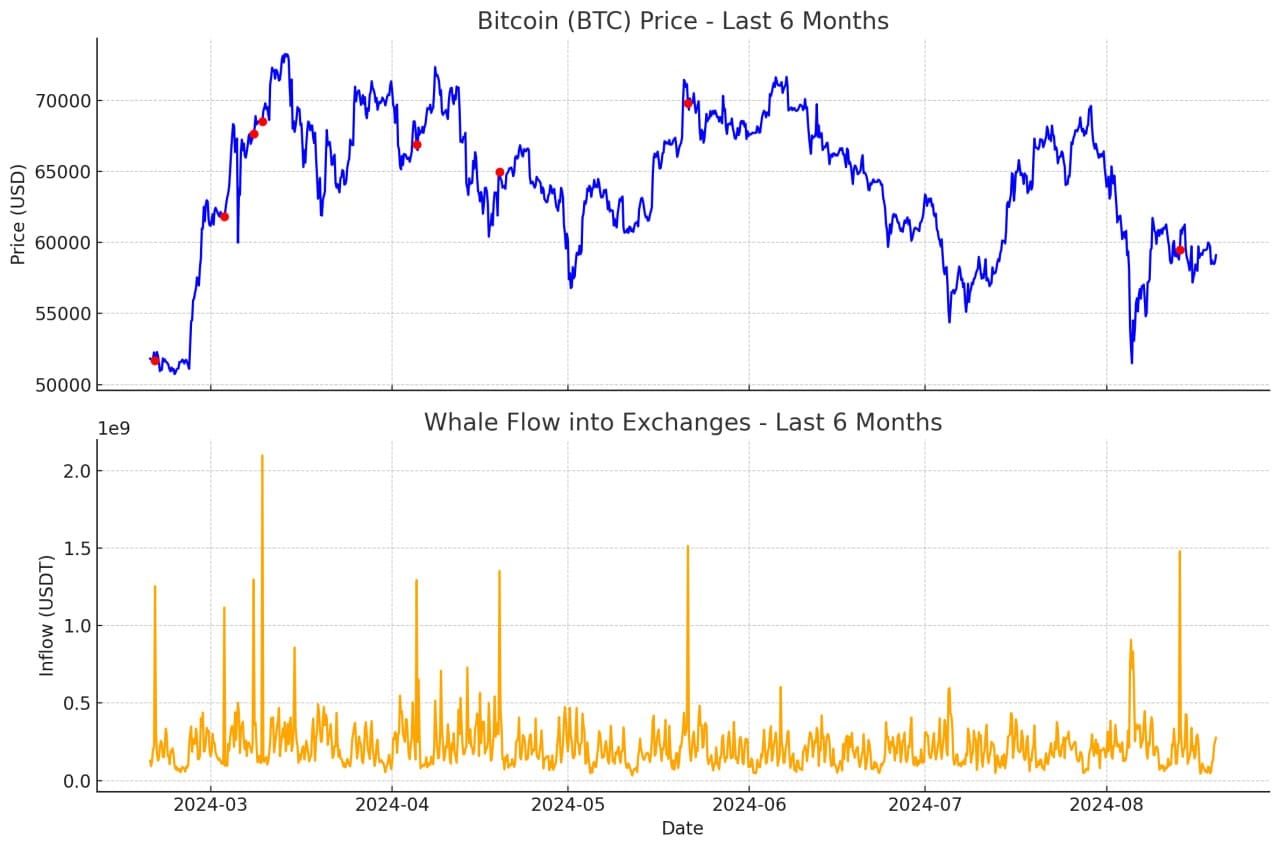

For those that listened to last week's Trading Pit on X with me and Benjamin, you might recall this chart.

It was a much more nuanced and onchain view of something similar. We brought this up in order to showcase that we do in fact see some very early signs of activity returning.

This would be the tide beginning to come back in.

It's not an indication that it's time to start fishing right away, but more like be aware the time is near.

Now, another indication of early signs is certain trade behavior on the trade flow. There's a little trickery unfolding that is becoming apparent.

We see this early on before price breaks range. Exactly how the trader is entering their position is not fully known, and it's best we don't draw assumptions. Nonetheless, trickery in general is an indication that it's time to be alert.

Yesterday was no exception.

I went ahead and pulled up the orderflow stats that Benjamin frequently uses to showcase what's going on with bigger trades.

The white line below is the bid/ask ratio between 1-2.5% from price. As you can see, it's was strong before the nose dive.

We saw some big 1m-10m sized transactions come through that were nicely absorbed before the big drop. We know it was absorbed since the white line held firmly above the mid-line.

But the big sells were relentless. And if we look at the bid/ask ratio between 2.5-5%, there was some softness that got exploited... GG.

Since the relentless selling, the bid side has strengthened. And when we look at Coinbase, we can see it's starting to show signs of strengthening as well. It's still relatively "meh", but getting there (far right side of pink bars).

If we see some strength on Coinbase's books show up in the next couple days, I'd fully expect to see price make a nice bounce here.

It's what TheWhale_Hunter has been alluding to on the show where spot sells and strong bids create divergences that cause price to move the other way.

Let's see if the market gives us that move into the weekend, even though we still think it's early on regarding the arrival of market whales.

Until then, be sure to go out and send a note to J-AI on Telegram to see if you qualify to give our autonomous trade execution software a trial. It uses AI to monitor market conditions and trade positions in real-time as it leans on 48 models that create over 80 trade algorithms.

Much of the insights you read here have been studied and turned into models that power the software in order to avoid the 3am trade alerts and reading more Espressos like this...

See you soon. Until then, let's wait for the tide to come in.

Your Pulse on Crypto,

Ben Lilly

P.S. - If you missed the latest Trading Pit on Tuesday, find it below. It was great to have Marconi back in the studio with us. The guy nails it every time, even with just a few hours of sleep.

Let's go!!!! https://t.co/SPy05yt4sC

— xChanging Good (@xChanging_Good) August 27, 2024