A Feeling Out Period

ChainPulse Update

The stock market is closed 112 days per year.

Forex and futures markets are similar, but trade non-stop between the week’s open and close.

Balancing this type of schedule with a social life, taking part in your community, or family is rather manageable.

And for anybody who’s worked this schedule, it is unnerving when looking at crypto. It’s a 24/7/365 market with jacked up volatility. It’s not for the timid.

For any traditionalist coming into the space it takes some adjusting. To see what I mean, let’s run through a quick example…

It’s your 7 year old nephew’s birthday this Saturday. Your wife is looking forward to it, her family is looking forward to having you over for the day, and the trade you’ve opened a few days prior is still running.

You can’t close the position as the momentum looks to continue in your direction. The trade is minting profit left and right. And that morning price just blasted through a prior resistance. Needless to say, you will not fully be present at the party.

Does this sound like something you’ve experienced when trading crypto?

In 2018, I lost track of the amount of scenarios I had similar to this. It was exhausting. And it’s one of the main reasons Jarvis AI exists. Being able to trade without needing to check the markets every five minutes literally allowed me to be closer to those nearest to me.

Then when Monday comes around, my time is spent with the team improving the trading system. It’s how the Jarvis Labs team makes trading a non-stop market manageable.

And the reason I’m telling you this today is because I spent the entire weekend with family. It was great. Times like this now feel few and far between. It’s the reality of a post-COVID world. And it’s not likely to end in the next few months.

What this means for you is our normal Weekly ChainPulse is postponed until Wednesday. Typically today is the long-form update on the structure of the market from the lens of macro markets, on-chain crypto metrics, and ChainPulse data on how it looks for the week ahead.

While this might feel a bit underwhelming, it’s actually a good thing. Besides for the fact I’m super pumped to get back to it after enjoying some time off… The market hasn’t changed much since Friday.

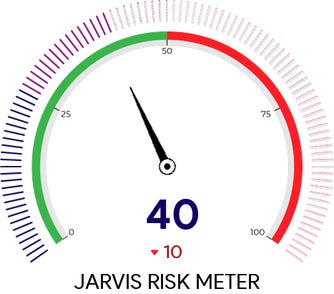

The risk meter is still rather low considering where its been for the last nine months.

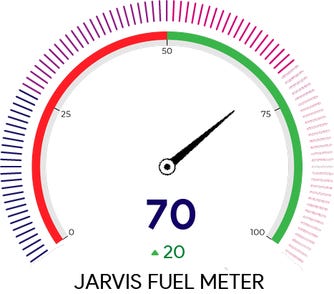

The amount of liquidity and fuel in the market is still strong from when we showed you the reading last week.

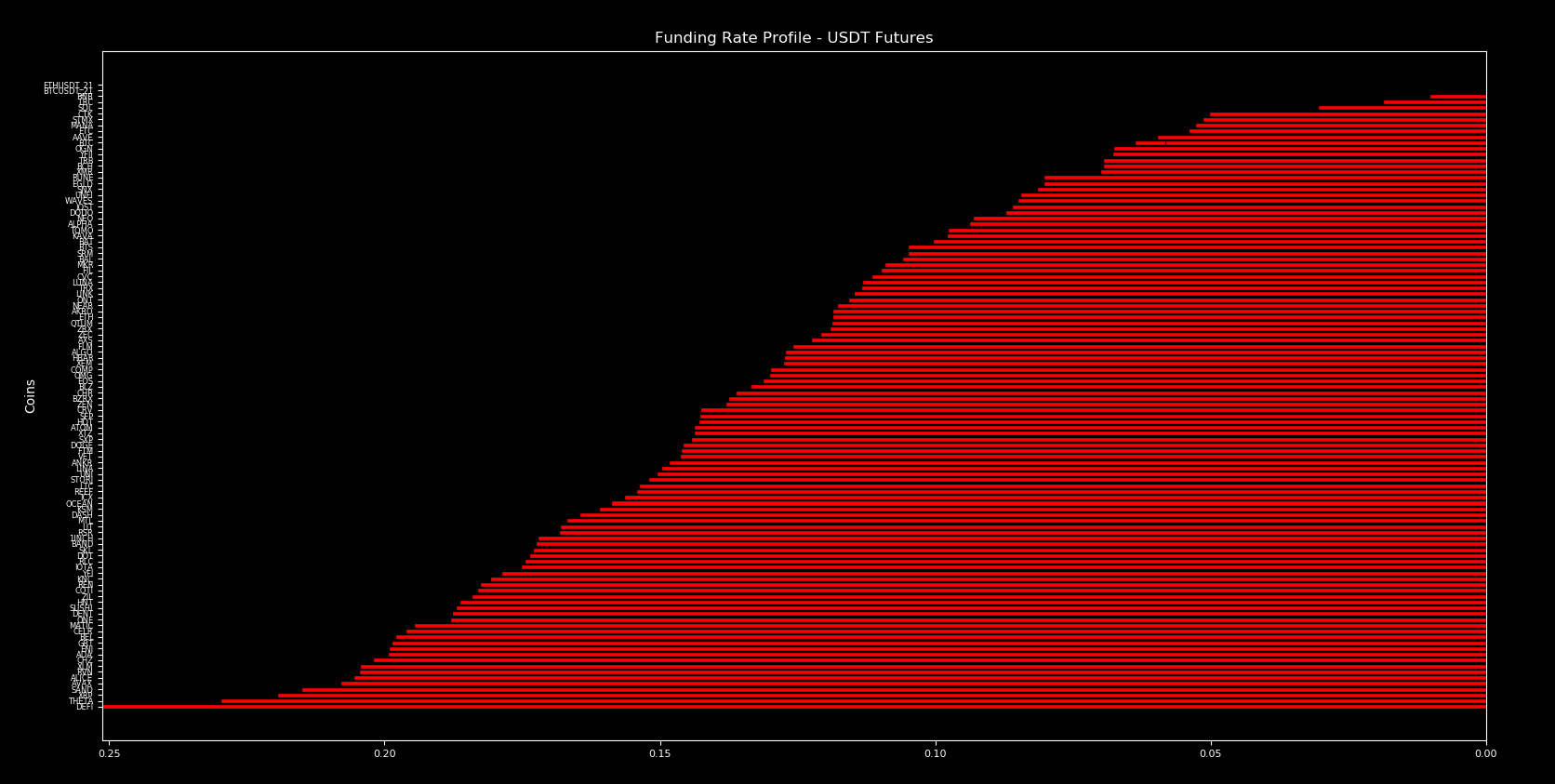

Funding rates are similar to what we showed you last Friday. They are elevated, but not causing any sirens to go off.

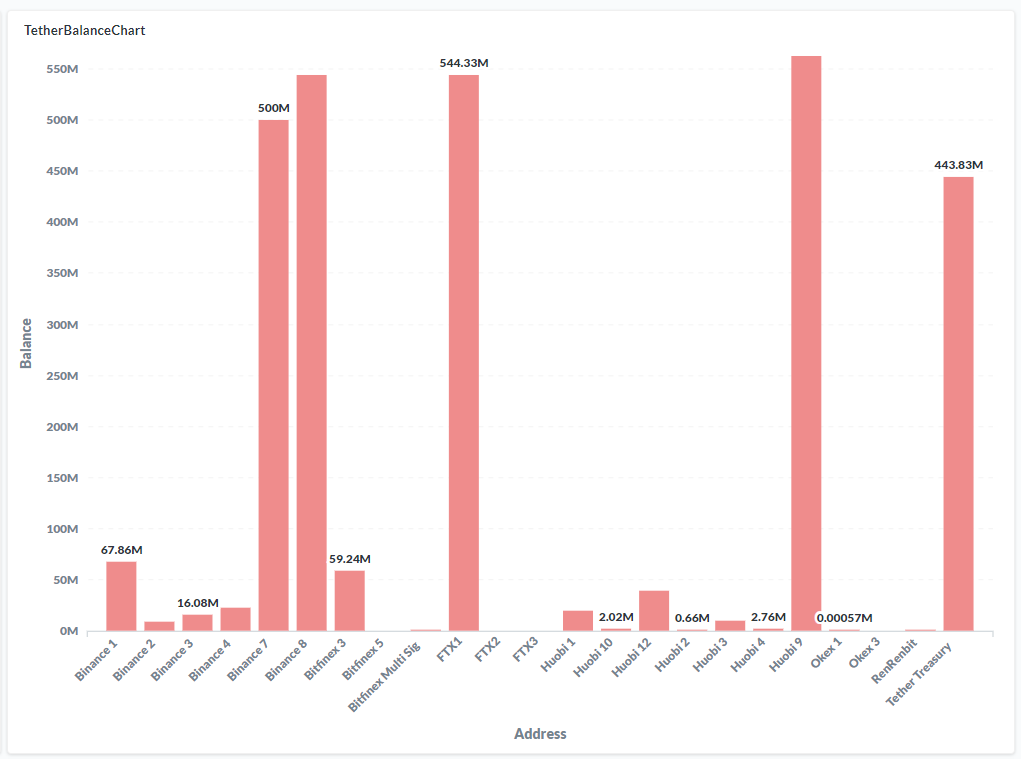

And the dry powder is still waiting…

The only difference is after we breached $60k, over $1 billion worth of longs were liquidated. It’s one of the scenarios we laid out last Friday. And now we’re inching sideways.

Looking back on our alerts for Sunday, we didn’t see much on-chain activity that suggests one way or another. In fact, the long positions Jarvis AI entered during the drop on Saturday were already exited in profit. This is likely because there’s a bit of uncertainty right now.

When this happens price direction can be influenced by macro markets more than normal. So be sure to take note of the US dollar, yields and growth stocks. Any impulsive moves in these markets could be felt in crypto.

The multi-month bullishness looks strong, but the very near term requires some feeling out over the next day or two.

Until tomorrow…

Your Pulse on Crypto,

B