We learn more tomorrow

by Ben Lilly

It's About Credit

Most of the crypto traders saw it. Yesterday, Grayscale added 47,000 ETH to the Ethereum Grayscale Trust (ETHE). As I write this, that's about $77.5 million worth of crypto.

In two days it's received almost 70,800 ETH. This is on the heels of a two month dormant period of inflows to the Trust.

Now, what I'm interested in is what will we see later today in terms of inflows. Because if we see an even larger amount than we saw yesterday, than in six months we'll get an incredible rally.

What it also means is the structure of ETHE is becoming more defined. You see, a recent rule change from the SEC shuffled the deck temporarily. The result was a tidal wave of unlockings in early January and shares poured into the market like a waterfall.

Now with the rule change behind us, we can have consistent six month lockup periods. Meaning new accredited investors into the Grayscale Trust receive ETH shares to sell in the market six months after their investment. It's more straightforward.

This also allows us to filter out the static from the signal and really isolate the new entrants into the Trust.

Now, at this point you're probably thinking to yourself, I don't care about six months from now. I care about what's happening now... Did those recent ETH lockups into Grayscale in fact push prices up over the last couple of days?

My unsatisfactory reply is, It's possible. I'll be honest with you, as of right now we don't have enough data to confidently say yes or no.

Typically, what we see is investors in Grayscale purchase their crypto before it gets transferred over to them in what's described as a like-exchange. That's when BTC or ETH for example and in turn the investors receives the same value of the asset in the form of shares

The exception to this is when USD is given to Grayscale. That's when things operate a bit differently. And it's entirely possible this was the case. That's because the structure of the market prevented the leveraged trades from pushing the market up higher like we saw.

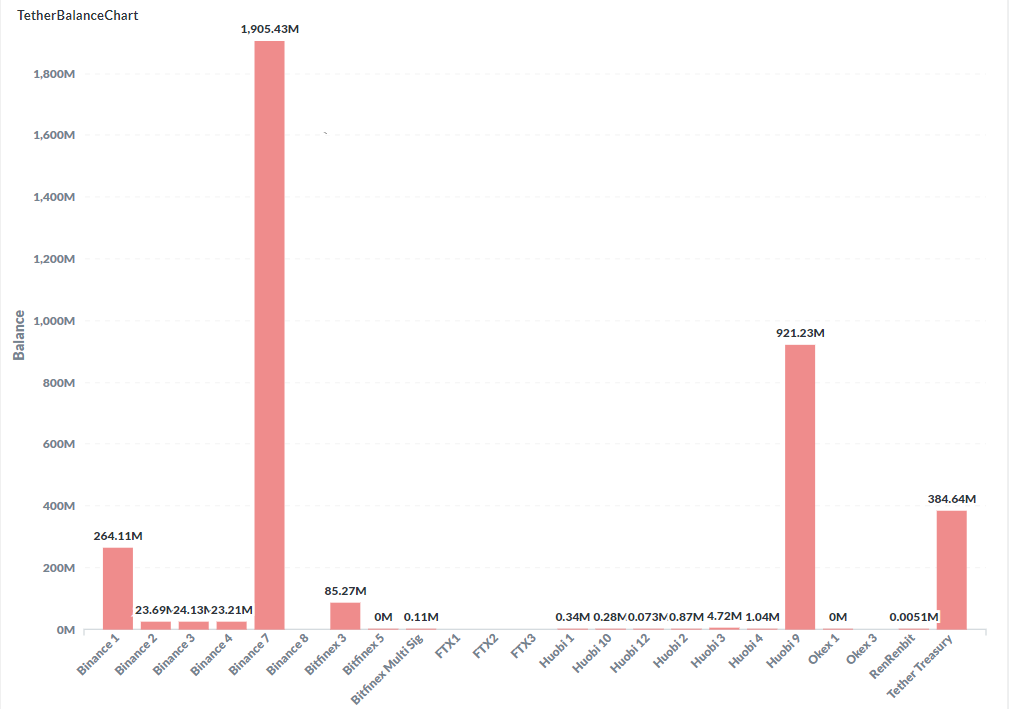

Also, the purchases on exchanges via USDT was nothing to crazy. In fact, here's the USDT balances on some of the major exchanges.

Tether (ERC.20) Balance across exchanges

As you see, there's a ton of dry powder ready to take action.

So if it wasn't USDT spot or derivatives, then it most likely happened using USD, a metric that isn't on-chain.

I'm sure we'll be learning more in the next few days and look forward to sharing it with all of you soon.

Your pulse on crypto,

B

Jarvis AI

We are Jarvis Labs, a research, actionable data provider and independent software vendor. Our business is to provide on-chain alerts, research, algorithms and autonomous artificial intelligence trading solutions such as Jarvis AI.

If you are interested in what Jarvis Labs or Jarvis AI can do for you or your fund, reach out to askus@jarvis-labs.xyz. You can also use the chat box in the bottom right hand corner of our website: www.jarvis-labs.xyz. Or find us on Telegram @benjamin_bc.

Grow your portfolio while you sleep.