Bible sized market update

by Ben Lilly

It's Chess and The Market Has the Next Move

When trying to outline what to write about today it felt like taking all the stories on the front page of a newspaper and turning it into one story.

There's a lot to cover, but trying to make it one cohesive essay proved challenging. So instead of trying to force a round peg through a square hole, I'll run at this in a stream of conscious sort of way.

But before I start, I'll say this. Whenever I write Espresso I try not to put price targets. Nor do I say, the market will do this or that. Because there will be times I'm wrong. And I'm not really in the business of being wrong.

Our team likes to be factual and think of ourselves as the journalists of on-chain activity and the markets. Meanwhile, Jarvis AI does the trading.

More specifically, when I look at the markets my goal is to form a macro structure of the market for you. Meaning, how much strength is behind a rally, is something flashing in the market that we need to be aware of, how is the equity markets looking and why does it matter to crypto right now, or why does a social forum group on Reddit matter to crypto?

This gives you a snapshot of the weather for the week. Meaning you can hedge your weekend plans at the beach by planning an afternoon at the museum since there's a chance of rain. Or a week or two of rain is coming, best to prepare for some cleaning up around the house... Or said differently, maybe it's a good time to hedge my portfolio through a few puts.

This method of forecasting is what the Grayscale Effect article was about. It was saying after the December 29th unlocking, there was going to be one last push higher in price. But after that, we were going sideways or prices would sag until the next round of unlockings.

View each of these articles in a similar manner. Although, these forecasts are much shorter in scope.

So with that bit of housecleaning out of the way, let's jump to it!

Market Update

The DXY (US dollar index), BTC, ETH, altcoins, 5yr, 30yr, and potential cracks in the financial market beginning to form. I plan to touch on each one of those fairly quickly and try draw out some potential scenarios (ie - this goes up then this other thing will likely go down). That's because each one of these is hitting a pivot point. And depending on which one breaks first, the others will likely start making an impulsive move as well. When I use the word impulsive, it refers to a move in the market that acts as an indicator a trend has likely formed in the market.

And once this impulsive move happens in one chart, the rest are likely to follow.

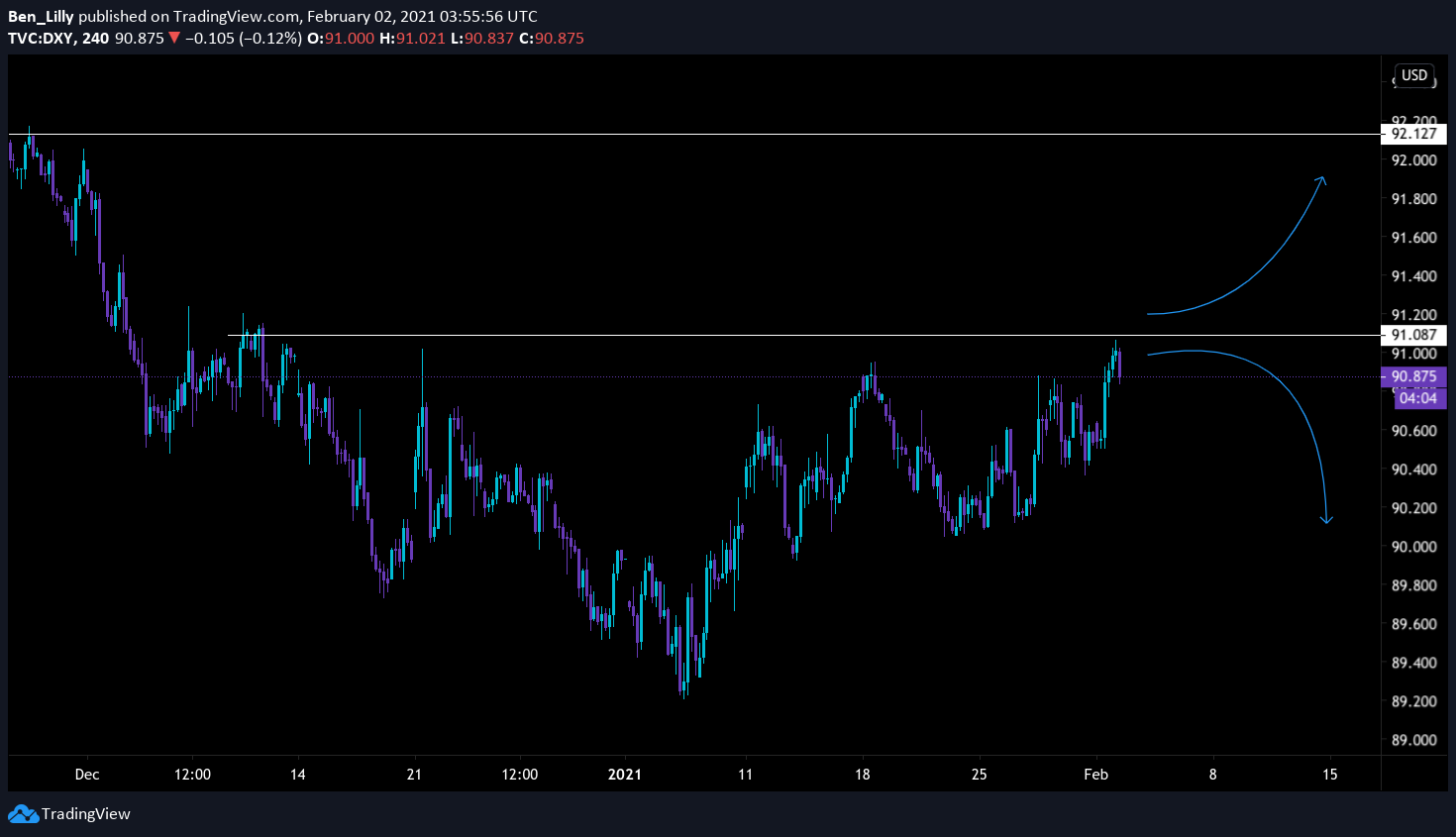

At the moment the DXY (US dollar) feels like the bellweather here. That's because any risk-off move (out of riskier assets) will likely see a rise in DXY, a drop in BTC, a rise in rates and rejection for altcoins that'll get to later.

Right now, DXY gives the impression that it's looking to take a lot of the market by surprise.

We saw a similar pattern unfold for DXY in early 2018. This time around the main difference is the market isn't really expecting it. That's why it's a bit too early to look at such a major swing. It's a bit easier to zoom in a bit and see what area to focus on for the time being..

There's some strength there with a local higher high formed. There's a rejection at the area of interest.. But don't be surprised to see DXY give it another go. If the white line breaks I expect the price action to be fast, and it's this price action that can dictate the rest of the markets.

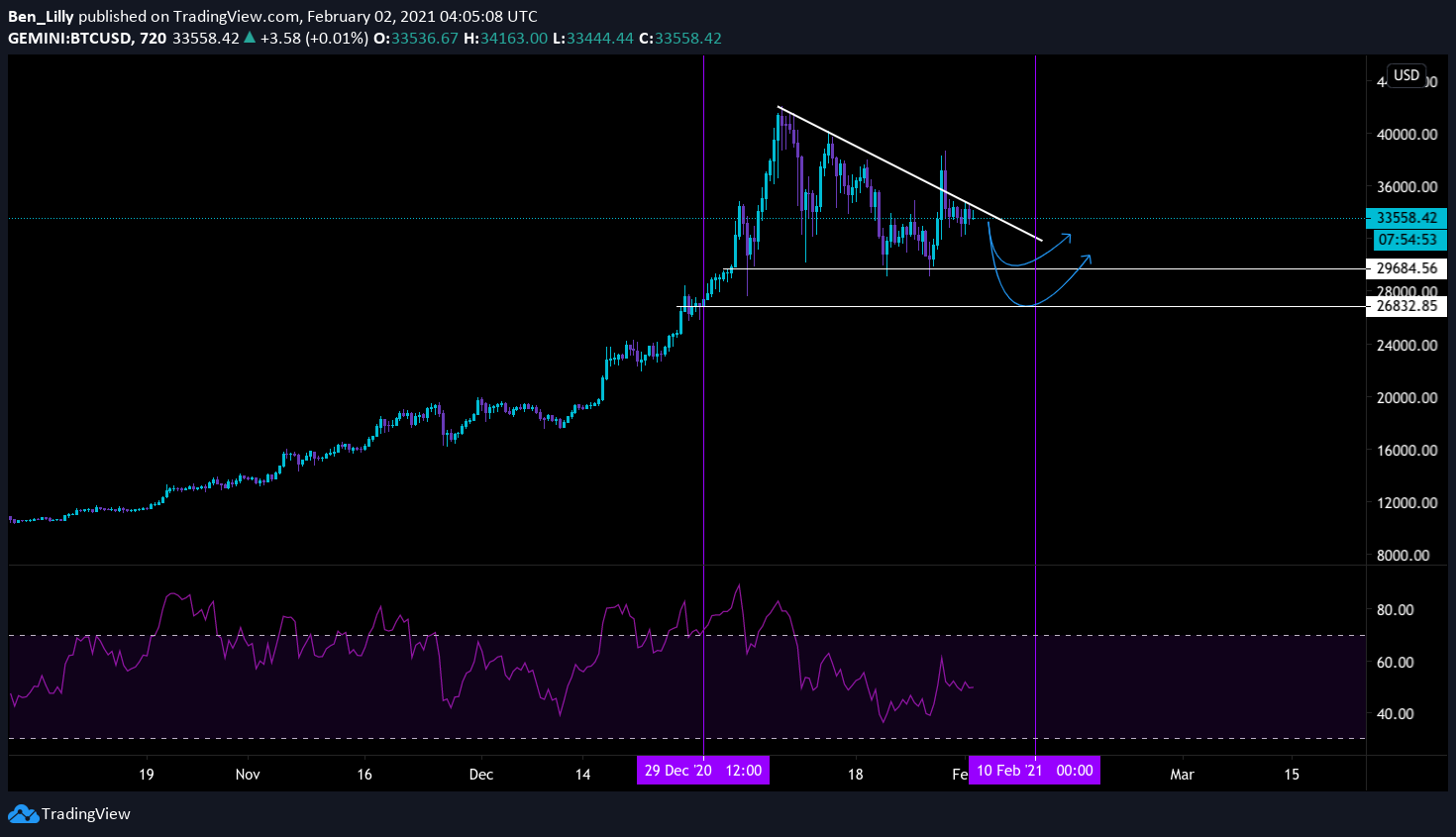

Bitcoin is one of them. Here's the scenarios I'm currently looking at for bitcoin...

I know, it's not a popular one. But I'd give this a 60-70% of happening right now. Mostly because the derivative market is putting the pedal to the metal and price is not budging.

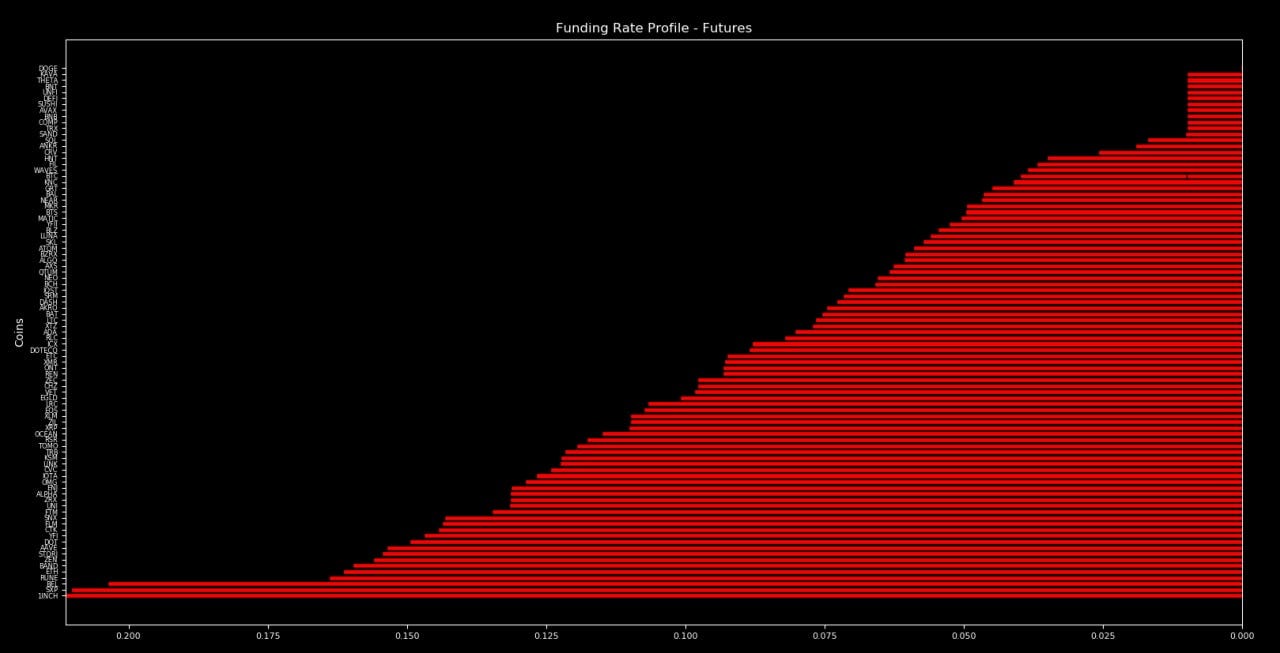

You can see this in the funding rates...

It's extremely one sided. The token 1inch is paying 0.75% per day, which is almost 275% per year. It's not sustainable.

This is also telling us the spot market is not driving prices right now. Without the spot market driving prices upwards and no chance at a short squeeze, the chances we break upwards out of this consolidation pattern (triangle) is low.

That's why our near term view is bearish. Which lines up with the DXY potentially breaking higher. If this does unfold and we sweep below the triangle formation we expect Grayscale spot buying to kick in just as price start to build momentum for the new low.

Also, the fear this type of lower low would create in the market will not only reset the funding rates, but likely result in positive funding rates. Meaning traders holding a short will be paying the traders holding a long position. This would be a great short-term bullish indicator in a long-term bullish market. Meaning that's your ideal buy the dip moment.

ETH... this is an interesting one. I just drew out a bullish case for DXY and a bearish near term case for BTC. ETH on the other hand has a bullish looking chart. So if the DXY and BTC both act accordingly, ETH will have a tough time breaking to the upside. And since BTC is still the dominant force in crypto, we need to respect its structure more.

I show you this merely as a setup in case DXY gets weaker over the coming days. If DXY gets weaker, ETH looks poised to break upwards. However, the funding rate will see an even bigger spike which hints at the rally not being sustainable.

Now, here's an interesting chart I pulled up... It's "TOTAL2" on tradingview. This is the market cap of crypto MINUS the market cap of bitcoin. Aka it's the altcoin market cap.

We recently tested the previous all time high. The current market cap is down about $100 billion from that figure, but what I like about this chart is the two weekly candles that came after the rejection of the all-time high... they are both bullish. Meaning price is still forming higher closes each week. If this chart retests the all-time high, don't be surprised if the market goes ballistic.

For that to happen I think we need to have the spot market begin driving BTC to new highs. Until then, this remains a bit of a pipe dream and more of a potential uber bullish scenario. Or said differently, if BTC breaks to new all time highs the altcoin market might keep pace this time.

Now, I said I'd cover the 5yr bond chart, 30yr bond chart, and potential cracks... but this is getting excessive. I'll bring those charts up later on. Just note the yields are rising and are approaching a resistance. Depending on how the DXY reacts, yields could pose a problem for the FED. Meaning the FED might actually need to tamp down yields in some way or they will let them run, a scenario that seems doubtful.

This might spill over into China markets where they recently saw their overnight lending rates spike. This tends to be a liquidity issue and sometimes occurs because entities don't trust one another as much. The response China chose, similar to what the U.S. did in later 2019, pump more money into the market... Something that's still happening.

This is the second crack that's now formed that's being plugged up by more fiat currency.

The setup for a big event is growing. Not saying imminent as this can play out for years.

Hope this helps you out this week.

Your pulse on crypto,

B

p.s. - Regarding GBTC's premium... I will say I don't follow it much. I know the premium went negative, which isn't a warning to me. I don't see a negative premium as a drag on BTC spot prices. That's because the feedback loop for GBTC is one way. BTC goes in, and it doesn't come out.

The only warning sign with GBTC is if the premium does not expand after a major unlocking. To me this would signal that investors chose not to re-purchase BTC for the next tranche. OR the amount of investor re-buying on spot is not enough to push prices higher anymore.

In mid-February if we don't see the premium expand again, then that can be regarded as a warning. Until then, just consider the negative premium as a buying opportunity. It's only happened but a few times in history.

Jarvis AI

We are Jarvis Labs, a research, actionable data provider and independent software vendor. Our business is to provide on-chain alerts, research, algorithms and autonomous artificial intelligence trading solutions such as Jarvis AI.

If you are interested in what Jarvis Labs or Jarvis AI can do for you or your fund, reach out to askus@jarvis-labs.xyz. You can also use the chat box in the bottom right hand corner of our website: www.jarvis-labs.xyz. Or find us on Telegram @benjamin_bc.

Grow your portfolio while you sleep.