Nothing Happened

by Ben Lilly

We Waited...And Nothing Happened

There was an eagerness when I got out of bed at 6am yesterday. I had several things to take care of before the FED determined what direction the market would turn.

I pounded my black coffee like fuel getting pumped into my car as I whipped through my e-mails.

Checking on the market, it was similar as the day before, all calm. It seemed all traders were holding their breath as if a storm was starting to close in.

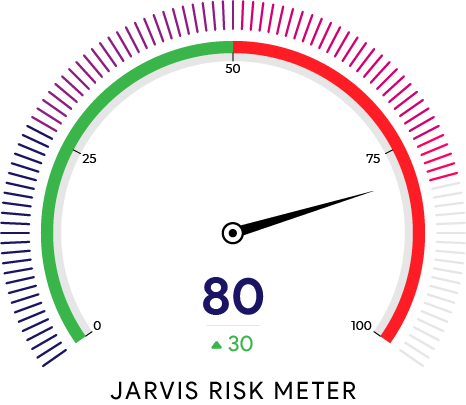

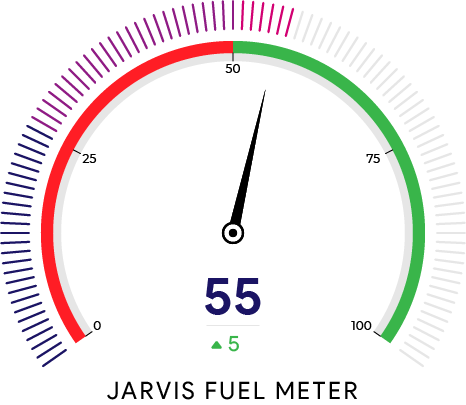

As I waited, and Jerome Powell finalized his notes, the crypto markets were starting to sag. As they sagged Jarvis AI's risk meter began to tick ever higher and that's when we knew the real storm wasn't what Powell was saying.

It was the utter stillness.

Liquidity was drying up, and the market seemed to float in zero gravity.

This cause Jarvis AI's risk meter to rise. In response, it closed out a swing trade at a loss. Ugh.

This one hurt more than other losses for some reason. We knew the undercurrents at play, bullish activity was periodic, accumulation was steady... Heck, there was even a market mover lathering the order books with sell walls to fill their own bag on the buy side.

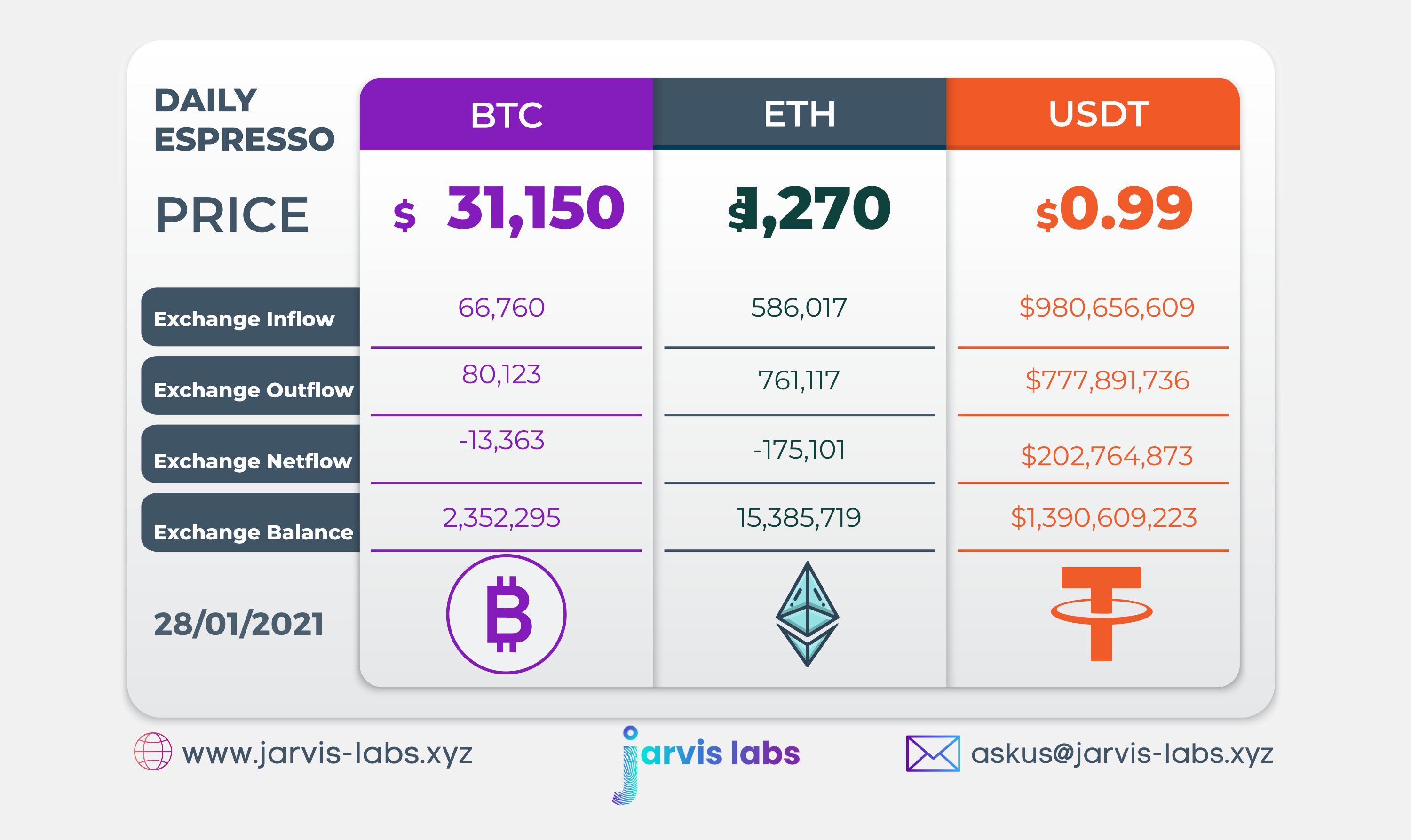

Not to mention, a fresh minting of USDT hitting the chain.

Regardless, Jarvis AI has strict risk management protocols in place depending on the trade strategy employed. For this trade, it was a swing play with high upside. And since it was a swing the main way it can go sour is if on-chain activity gets too risky for the trade to stay open.

When the dust settled we found ourselves sitting at 7% for the month. (Note: on smaller accounts this percentage is smaller, while for larger accounts this figure is a little higher due to fees)

This is a strategy built on the premise that over time we average 6-10% a month. The algorithms we employ have high probabilities and the risk management attached to each one of them improve these probabilities even more.

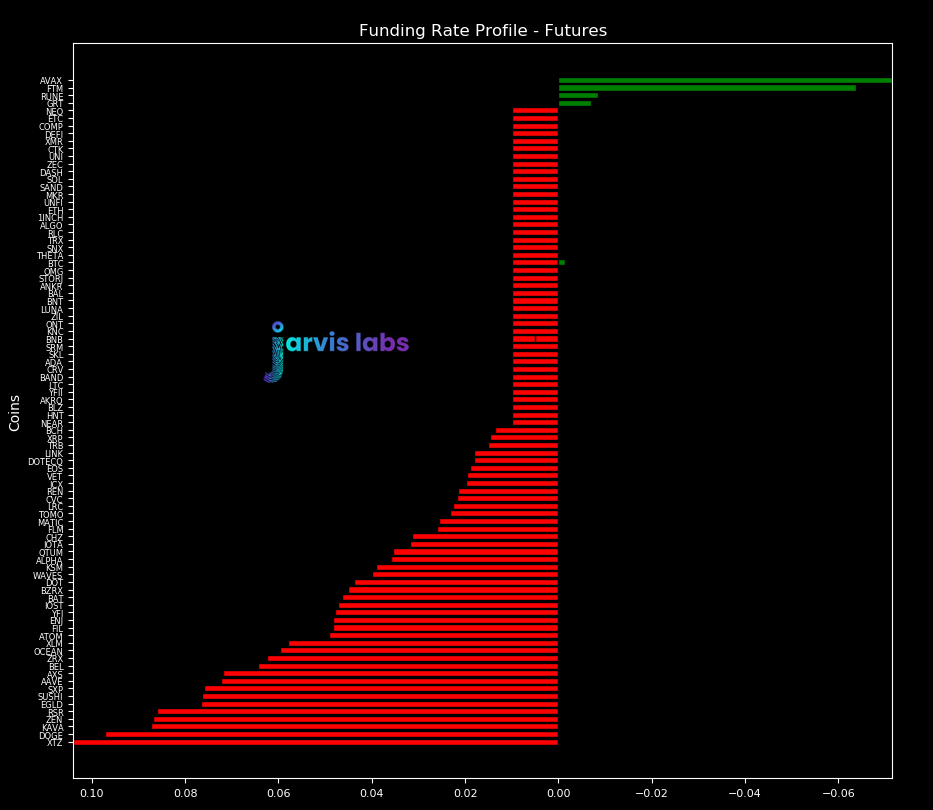

Looking forward, we have a lot to be exited about. Funding rates now have a full reset, giving the market room to start a new trading range. Here's the funding rates.

Then Powell basically said nothing and is letting the market continue on with its Gamestop like activity. Also, rates aren't moving, the fed is still buying US Treasuries and mortgage-backed securities, and they still target 2% inflation.

This is all good for bitcoin and crypto.

One thing that's really set to help bitcoin and crypto is inflation. To date, we haven't quite seen it. The FED noted the decline in oil and weaker demand across the board as what held inflation at bay. I find some truth in it, but also disagree a bit.

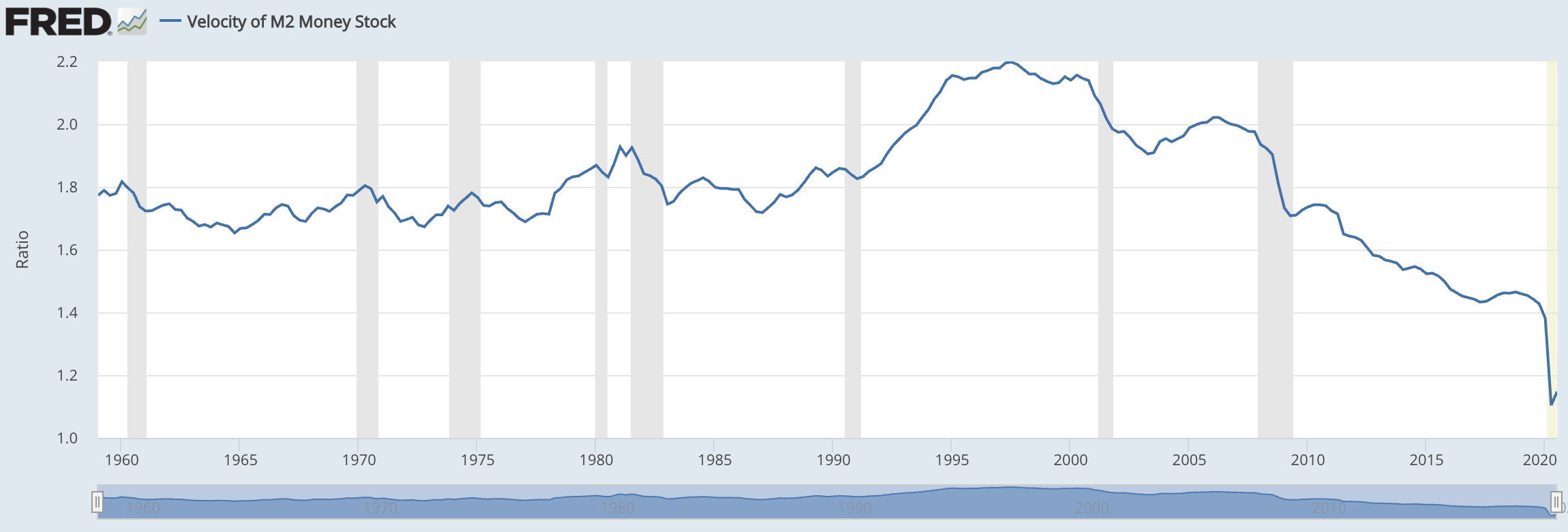

A quick look at M2 velocity, which can be interpreted as the churn of money through the system... ie - you get paid, then you pay the gardener, the gardener buys some food, the sandwich shop owner pays their employees... all with the same dollar. And with COVID you can see another reason why velocity might not be surfacing yet (and also why oil and market demand in general are weak - to support Powell).

Here's M2 velocity.

Now, since the late 1990s this measure has been cut in half. It's not just the last year. This is a progression, one I tend to view as a result of those with more, don't spend as large of a percent of their income as those not as fortunate.

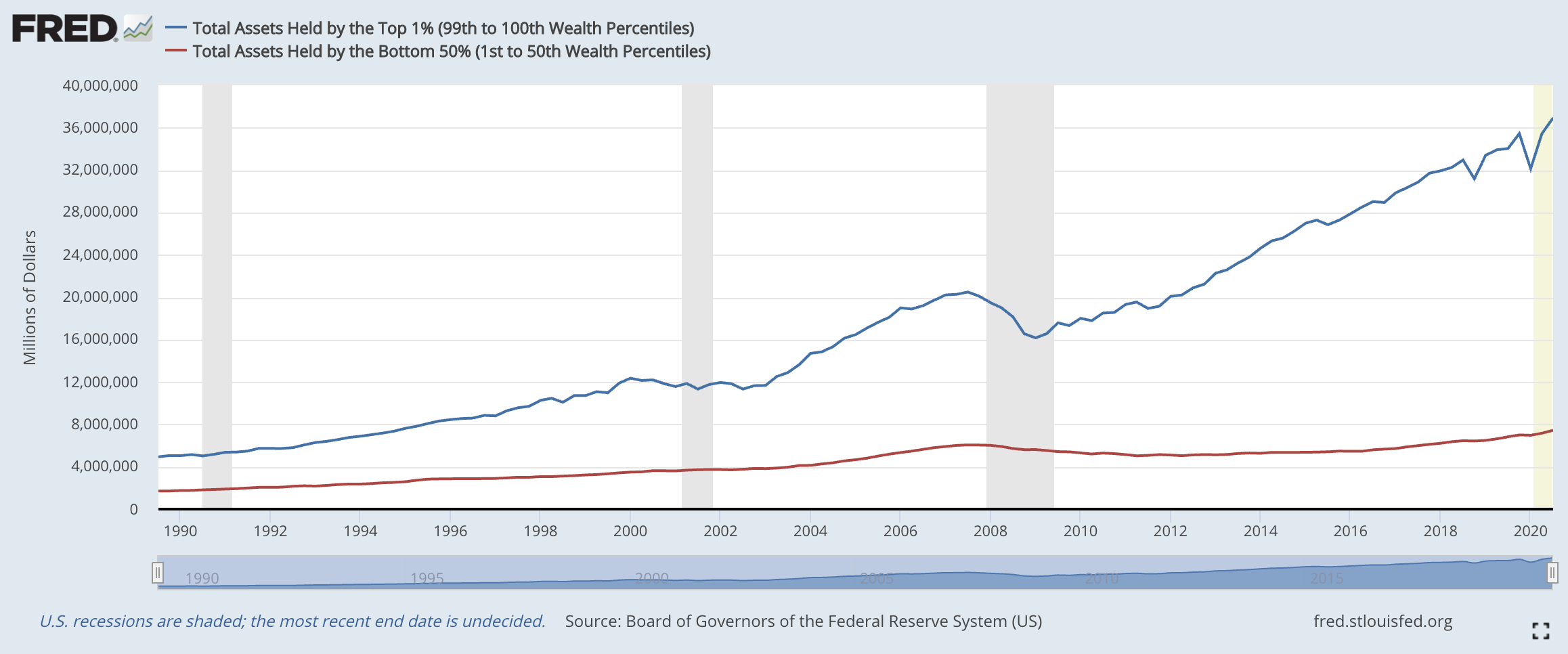

Said differently, the rich have a lot of cash they have stuffed away. Here's a chart of total assets held by the top 1% versus the assets held by the bottom 50% of U.S. household.

It's a difference of roughly $30 trillion.

So, this begs the question. If those with trillions of dollars stuffed away and the expectation that inflation is getting ready to run, what do you do with it all?

After all, we know there was trillions of dollars pumped into the system. This means more dollars are fighting over the same amount of food items as before. And when that happens, price can only move in one direction, up.

However, those that have been 'winning' over the last few years won't be buying more bread loaves. No, that money will look for premium scarce assets. Assets that are sure to rise due to being only a few or one.

This means sectors like collectible cars, wine, art, or jewelry might benefit. And it's where we'll see inflation hit first - assuming asset prices aren't already reflecting it.

Unfortunately, I couldn't find an updated chart on fine art, collectible cars, or anything similar. You'll have to take my word for it that it's seen some good years as of late.

Anyways, outside of those fine collectible items, what else is there?

This is where bitcoin can shine. It's a scarce item, an inflation hedge, and is required to use the peer-to-peer network. Bitcoin has a narrative and about to take a seat at the table of some major elites.

Get ready for the ride.

Your pulse on crypto,

B

p.s. - The Gamestop situation is incredible. It's as if the protestors of Occupy Wall Street all went to Finance school to seek revenge. This touches on the have's vs have not's issue a bit... and such distrust of the system only gives bitcoin more appeal in an environment where people look for chaos hedges.

Jarvis AI

We are Jarvis Labs, a research, actionable data provider and independent software vendor. Our business is to provide on-chain alerts, research, algorithms and autonomous artificial intelligence trading solutions such as Jarvis AI.

If you are interested in what Jarvis Labs or Jarvis AI can do for you or your fund, reach out to askus@jarvis-labs.xyz. You can also use the chat box in the bottom right hand corner of our website: www.jarvis-labs.xyz. Or find us on Telegram @benjamin_bc.

Grow your portfolio while you sleep.