Why ETH beat BTC last two weeks

by Ben Lilly

Why ETH Went Higher and BTC Dropped

Here's a chart of the past two weeks regarding ETH and BTC.

ETH was a nice trade over that span while BTC was grinding lower. Grayscale's lack of BTC unlockings since the end of December 29th meant the biggest buyers in the market were taking a hiatus.

When the largest buyer of the market sits on the sidelines then price keeps grinding lower as sellers chew up the buy side of the order book.

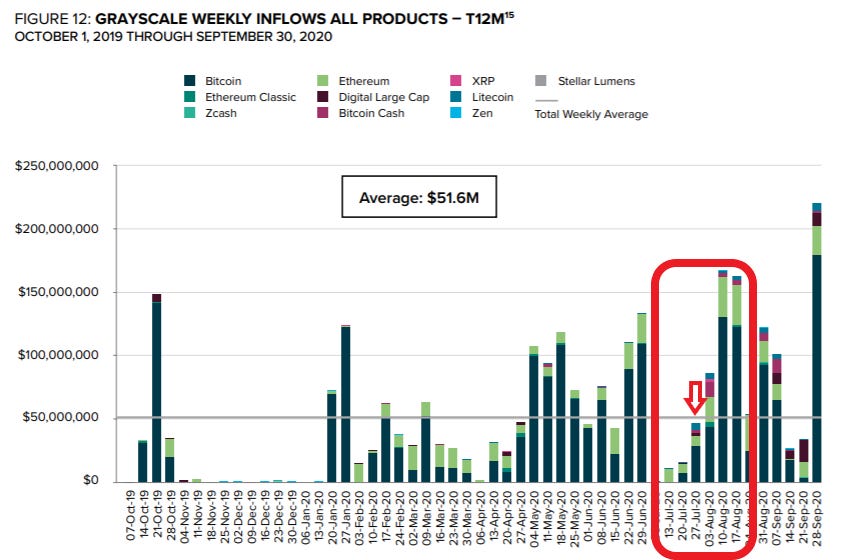

ETH on the other hand did have some buyers according to the amount of inflows seen six months ago. Looking at the bar graph below you can see it in the first two bars within the red box.

As I've mentioned before, the Grayscale Effect (if you don't know, read here) is seen when Grayscale Trust investors are purchasing assets on the spot market as they unlock their shares. These investors are predominately price agnostic with a main goal of owning more of the asset in question.

Shares unlock, shares get sold while the asset is purchased on spot, wait for the next window to send assets to Grayscale, and wait six months for the shares to unlock. No shorting, no borrowing of assets, nor any complicated way of going about it. Just simply sell shares and buy the asset on spot simultaneously. That's it, no need to make this anymore complicated.

Going back to the chart above, ETH witnessed some unlocking buyers the past two weeks and is in part why there was more strength compared to BTC.

Looking forward it appears we can get ready for some BTC action. If this bar graph holds true, the bottom is likely in for BTC. And I don't know about you, but look at the August 10th data point. That's one of the largest weeks of inflows in ten months. Let's hope this theory continues to hold water. (I wish calls were less expensive right now.)

Market Update

Regarding how the on-chain data is looking, there's still some uncertainty. But less than what we say over the weekend.

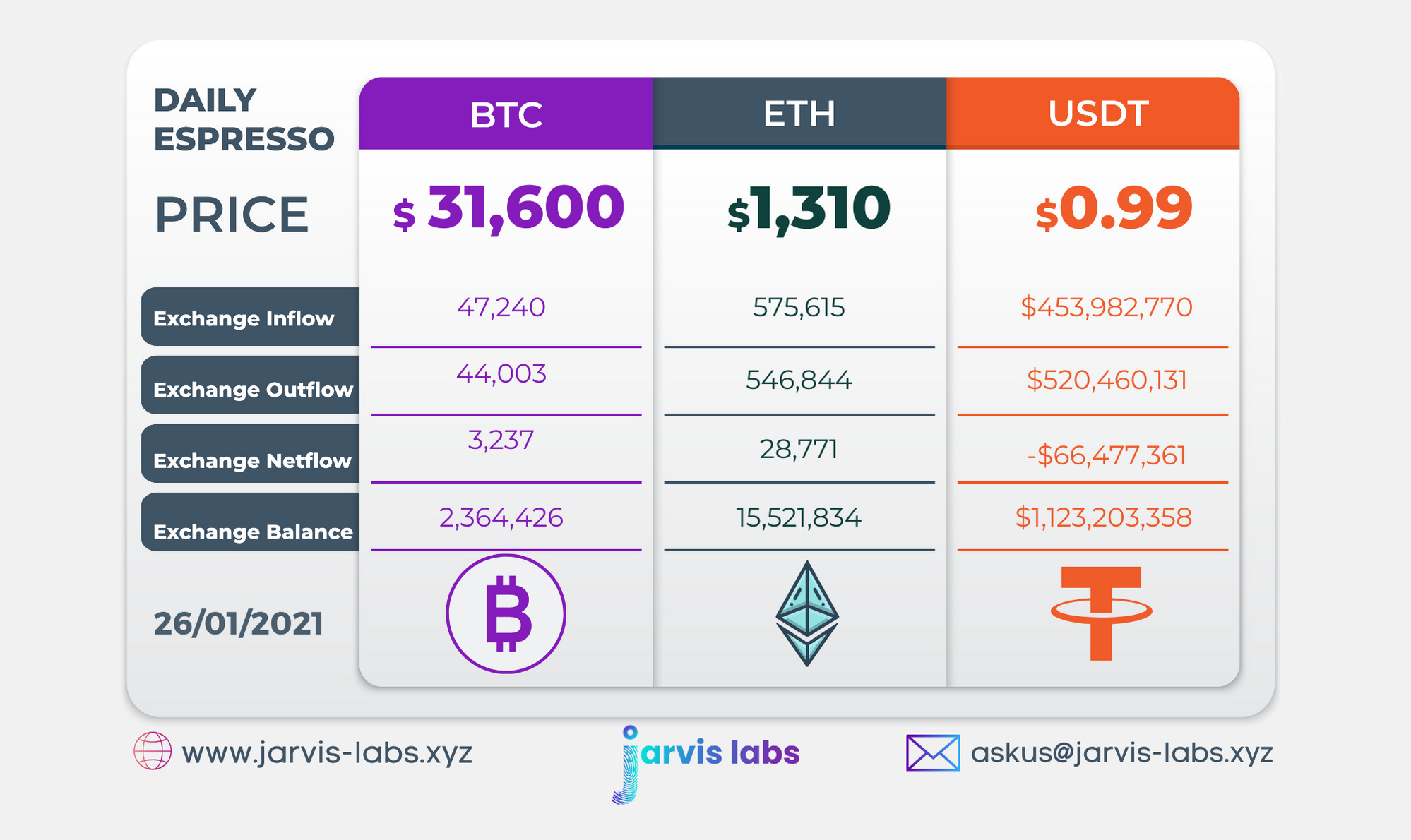

We had some alerts regarding the exchange flows. If you follow our Telegram you may have noticed us mention that our Jarvis AI subscribers know what's about to happen. This was in reference to $35 million leaving exchanges earlier in the day.

Then as price began its retreat from $35k the inflows began to pick up. $100mn, $65 mn and then $25 million worth of crypto began to flow out that was correlated to bullish price action. This is when price began to slow down and began its attempt at a reversal.

As I'm writing this at 4:00 UTC price hasn't shown much strength yet and the signals haven't come in for eight hours now. For us, this is about as uncertain as things get around here. Tends to happen when we're near the end of a consolidation period and nobody is ready to make the first move.

Tether printing more USDT would be a welcomed event right now... It would add necessary fuel, provide some certainty and direction. The doldrums continue, but thankfully we're beginning to see some alerts coming through. Let's hope for some more.

Your pulse on crypto,

B

Jarvis AI

We are Jarvis Labs, a research, actionable data provider and independent software vendor. Our business is to provide on-chain alerts, research, algorithms and autonomous artificial intelligence trading solutions such as Jarvis AI.

If you are interested in what Jarvis Labs or Jarvis AI can do for you or your fund, reach out to askus@jarvis-labs.xyz. You can also use the chat box in the bottom right hand corner of our website: www.jarvis-labs.xyz. Or find us on Telegram @benjamin_bc.

Grow your portfolio while you sleep.