Certain of uncertainty

by Ben Lilly

Doldrums

I think to myself... This is what a prisoner feels like.

They sit in a shoe box shaped room day in and day out with a single window. It has to be unimaginably boring.

There's a single 2x2 window giving you just enough of a glimpse to know things still change.That things outside of the cement box are not stagnate. The seasons still alter the landscape, daylight starts a new day, and then darkness blankets the land with stillness.

But at the end of the day, nothing changes.

Yet each day as the prisoner approaches their window of change they cling fearfully to a delicate seed of hope. A hope that maybe they'll spot change.

But instead of lingering their fear that change will never come grows. And as it begins to threaten the seed of hope, the prisoner returns to their budget soap washed faded sheets and escape into sleep.

These are the doldrums.

As the weekend ends, it's where we find ourselves in bitcoin. Weekend Recap

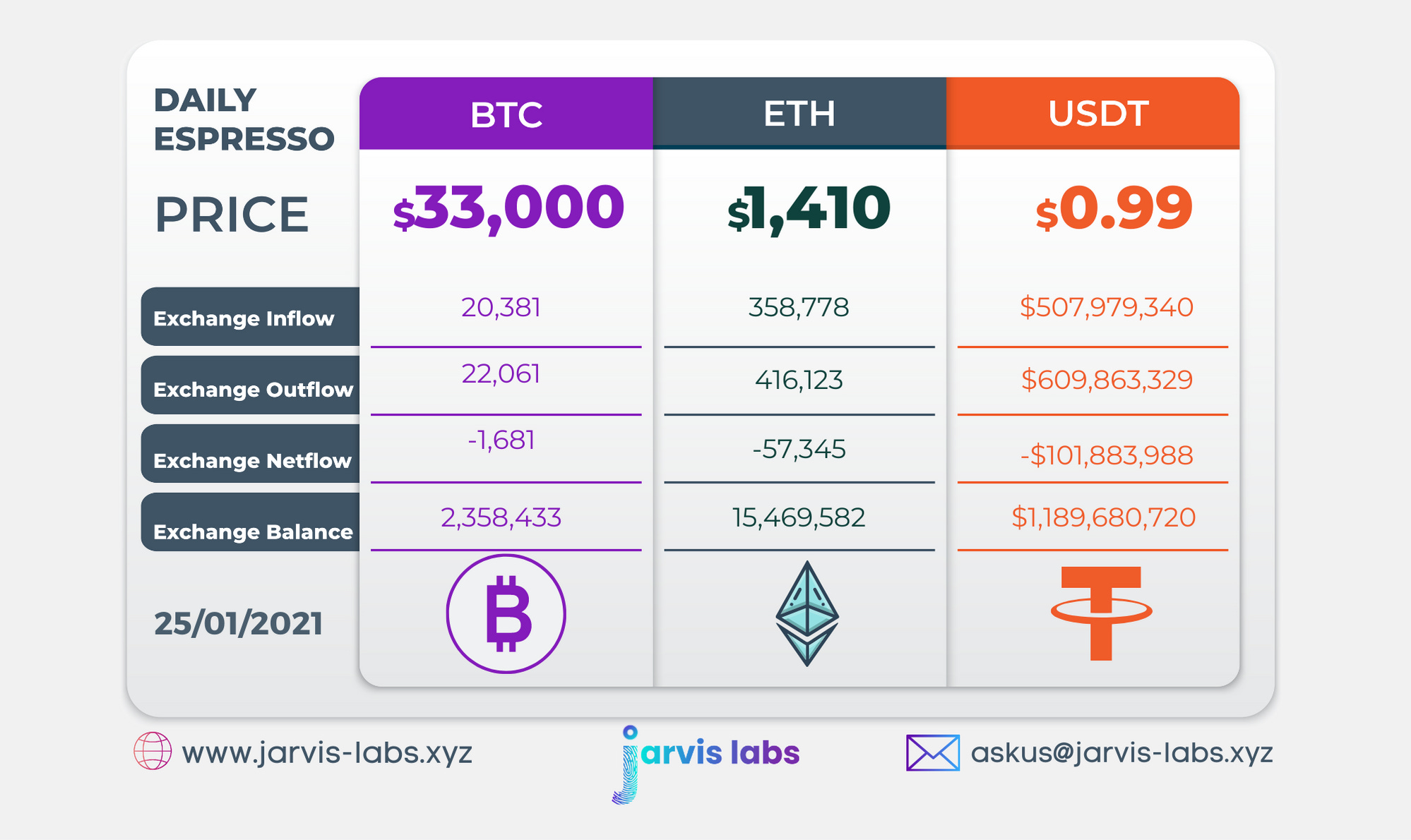

Over the weekend alerts and signals from ChainPulse were somewhat quiet. There were no bullish or bearish flows of much significance. There was some profit taking, but that was the extent of it. Nobody was positioning themselves for anything immediat.

Meanwhile, Grayscale Bitcoin Trust is still somehow able to make headlines. While you and me know it's all noise, the majority don't realize the bitcoin flowing into the Trust was purchased weeks ago. These new inflows into the trust only are significant in that the countdown begins for another round of six month lockups for us to track.

We enjoy seeing all the fanfare on social media surrounding Grayscale. Even some of the most respected analysts are a bit puzzled how tens of thousands of BTC are flowing into the Trust, yet spot price and premium on the Trust drop. This should tell you that knowing how Grayscale operates gives you a leg up on 90% of traders in crypto.

Moving forward there are three things we are looking at this week. They are ETH, VC coins and Biden tax cuts.

The first things we're keeping an eye on is ETH. After several weeks of no unlockings for Grayscale's Ethereum Trust (ETHE) we're coming up to multiple weeks of unlockings. I would put an unlocking chart on here, but I'm writing this on my chromebook as I'm on the move with family. I'll try to drop it in tomorrow's Espresso. Regardless, this could when we see ETH really separate itself from BTC.

Now, what's so interesting with ETH is if the Grayscale Effect is significant enough, when it's about mid stride into unlockings, the Chicago Mercantile Exchange (CME) begins trading ETH future contracts. This is significant because when CME opened up BTC futures in December 2017 it marked the top of the bull cycle. Also, when COMEX introduced Gold futures in 1970s, it also marked a top for that asset. So providing a new vehicle for institutions to short can be viewed as a bearish event.

But, is it in fact bearish? Maybe initially. We personally aren't sure at the moment and believe we won't really know until the event is days away. But if we had to take a guess at it, ETH might be a bit overextended from a Grayscale Effect rally as we go into the first day of futures trading. This would set it up for a temporary setback

Again, we try to take things day to day, but wanted to put that on your radar as it's fast approaching.

The second piece is Venture Capital tokens. We've spent a lot of resources (time and money)j into building out what we think is the most valuable data set in crypto. It's the holdings of VCs. It's well known that VCs are one of the groups that move the market, and we don't know of anybody else who has this. So we're really excited to see how powerful it is in the coming weeks.

Right now we're seeing some accumulation of WBTC (wrapped bitcoin), LINK and USDT. They are also dabbling as a liquidity provider on Aave.

This is a nice change as the past 30 days we witnessed about $170 million worth of WBTC being sold. Over the last seven days we're seeing more accumulation.

Last thing we are thinking about is Biden's tax cuts. There's a lot that can play out here, but the most concerning is the rush to liquidity that can impact crypto markets. If investors are spooked in the overvalued stock market, this can lead to the DXY going on a run higher. This can have a gravitational like effect on the rest of the markets in such a scenario.

I personally hate politics, but this is something that's a must watch. I'm not sure if you remember what happened during the Trump years when he started to cut taxes... market ripped open. If taxes are added back on, I don't see how this doesn't take a toll on certain stocks even if inflation is rearing its head in asset prices.

So I'll leave you here with you knowing bitcoin is boring right now. These are the doldrums.

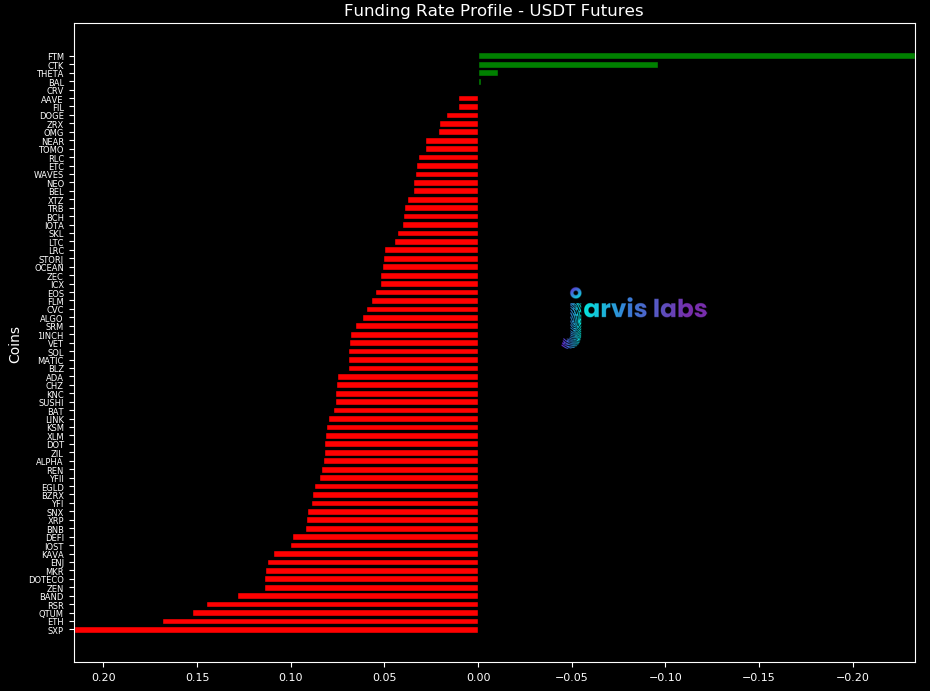

And even with these boring times, funding rates are spiking a bit off any local bottom that forms.

Risk meter is at 70 and the fuel level is just above 50 meaning there's not a ton of liquidity in the market to move it higher.

Not much one way or the other for on-chain flows. In fact, there's uncertainty of price direction in our eyes as of now.

This gives us time to watch for the things mentioned before regarding ETH, VC tokens and Biden policy to develop.

Your pulse on crypto,

B

Jarvis AI

We are Jarvis Labs, a research, actionable data provider and independent software vendor. Our business is to provide on-chain alerts, research, algorithms and autonomous artificial intelligence trading solutions such as Jarvis AI.

If you are interested in what Jarvis Labs or Jarvis AI can do for you or your fund, reach out to askus@jarvis-labs.xyz. You can also use the chat box in the bottom right hand corner of our website: www.jarvis-labs.xyz. Or find us on Telegram @benjamin_bc.

Grow your portfolio while you sleep.