They just turned off

by Ben Lilly

Trade with Conviction

How were the last 30 hours?

My guess is some of you got less sleep than normal, others were rather deflated as price dropped, and many more were scouring the news for a reason behind the madness.

For us at Jarvis Labs, it highlights why Jarvis AI exists. We like sleep. We love our families. And we feel time is too scarce to spend it on a computer waiting for something to happen.

Here's the thing, let’s say you were sitting in front of the computer while price began to drop. As it’s in free fall, when do you buy? If you do buy, was it the right time? Can it go down even more? The train of thought that can happen as price gets obliterated can be debilitating.

Which means as you spend the hours sitting there watching price, it’s a waste of time. Because at the end of the day you won't be any better off emotionally nor in terms of account size.

The traders and investors I know in this space tend to have one theme in common. Conviction. They know the trades they take. And when the trade is there they'll take it.

If they are wrong, it's just odds. Their trade pattern might hit 4 out of 10 times. And with those 6 losses, it's minimal. While the 4 heavily outweigh the amount lost on the 6 losers.

I like to view this mindset as 'trading with authority'. It means you don't get too emotionally attached to your losses and know when your trade is working. It's like trading in such a way that your correct in your loss.

Now, we aren't so fortunate to be so cold hearted. Which is why we leverage data, algorithms, machine learning and artificial intelligence. Using a system allows us to trade with authority.

Yesterday was no different.

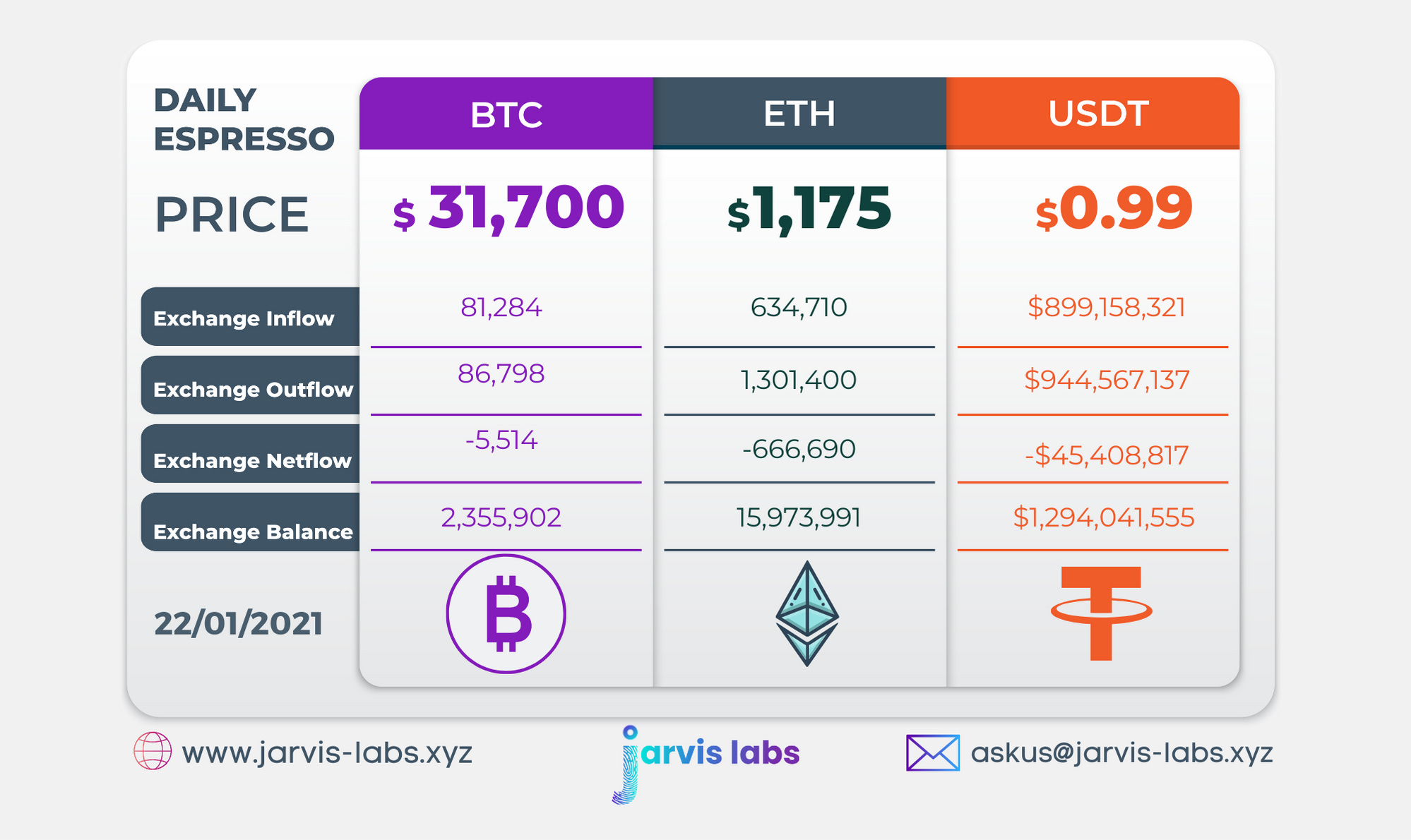

We wrote Espresso about seven hours before it hit your inbox. At the time, the market looked great. There was good liquidity, the risk was dropping, funding rates were dropping, accumulation was ongoing, and exchange flows were ok.

However, the exact thing we mentioned yesterday regarding accumulation algos... It happened. They literally shut off. In fact, here's us informing our subscribers before the selloff unfolded.

This was followed by half a billion dollars of U.S. stablecoins exiting the exchanges. The reasoning was the false reporting (per usual) of Cointelegraph that a double spend on the bitcoin network occurred. This was utterly false. The transaction in question was really just an invalid transaction. It was a result of miners operating as should. If anything it highlighted how bitcoin wards off double spends from happening.

Which begs the question... Was it preplanned? Not sure, we'll get back to you on that. We hope to look into this in the coming days and if we find anything you'll be the first to know.

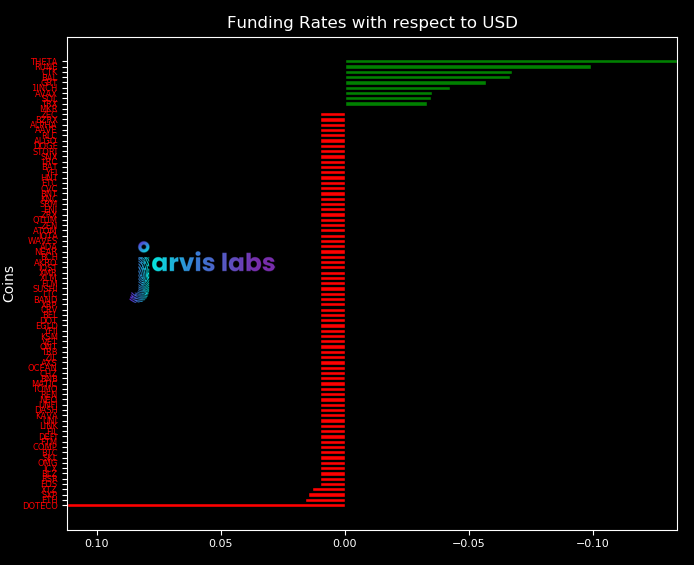

Binance funding rate profile shows that leveraging has calmed down, most fomo longs are rekt. Important to keep watching how this progresses as the week opens.

Anyways, moving forward, this is par for the course. We wrote in Hackernoon about a month ago that 2021 would start off slow because of the last unlocking happening on December 29th.

The effect unlockings have on the spot market last a week or two after the unlocking, which brought us to January the 10th selloff. Since then we've been bleeding lower. This is what happens when the largest buyer goes on hiatus.

Keep in mind, every report you see regarding Grayscale is noise. These are BTC purchases that unfolded a while ago. They are not fresh. Merely the transaction of sending the already accumulated BTC to Grayscale is fresh. And that's what the media picks up on.

The fact you're reading this right now means you have a leg up on 90% of the market. That's because you know the biggest buyer isn't taking part, funding rates were ludicrous,and the biggest buyer will return soon.

Many traders and investors love to mention the phrase "when there's blood in the streets..." or "buy when others are fearful".

Consider this that time. Which means consider averaging your cost over the coming weeks if you've been sitting on the sidelines. That doesn't mean just "ape in" as the young reckless crypto traders might say. Instead spread your purchases of BTC out over the course of the next few weeks. Because we might not be at a bottom yet. In terms of on-chain activity, we haven't seen exchange inflows pick up since we started to drop. Meaning the buyers that matter are sitting on their hands still.

Your pulse on crypto,

B

Jarvis AI

We are Jarvis Labs, a research, actionable data provider and independent software vendor. Our business is to provide on-chain alerts, research, algorithms and autonomous artificial intelligence trading solutions such as Jarvis AI.

If you are interested in what Jarvis Labs or Jarvis AI can do for you or your fund, reach out to askus@jarvis-labs.xyz. You can also use the chat box in the bottom right hand corner of our website: www.jarvis-labs.xyz. Or find us on Telegram @benjamin_bc.

Grow your portfolio while you sleep.