Exhale

by Ben Lilly

Slightly Cooling, We'll Take It

What a beautiful wick down to $33,400 yesterday for BTC. A lot of traders were predicting a crash down to $20,000 or less with nothing to support it besides pointing to some support areas. While doomsday talk will attract eyeballs, it rarely pays out. And frankly, on-chain flow was showing signs of accumulation.

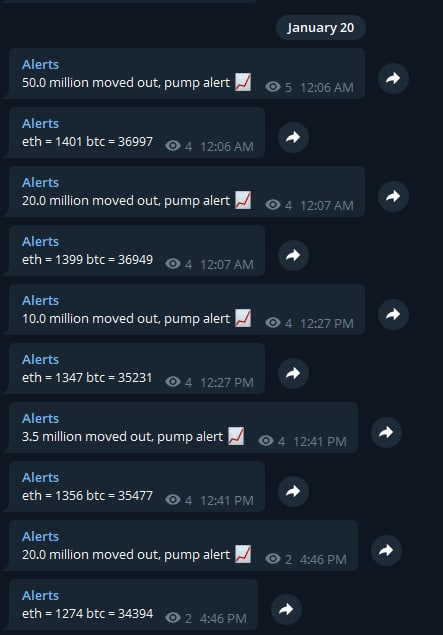

Here's a snapshot from yesterday of this behavior.

Accumulation is not typical prior to an epic selloff.

Sure, there's chance of a selloff... a low percentage change... but its likely wallets accumulating need to turn off their buying algorithms. And as it stands right now, that's not happening. Taking it one day at a time seems like the best approach.

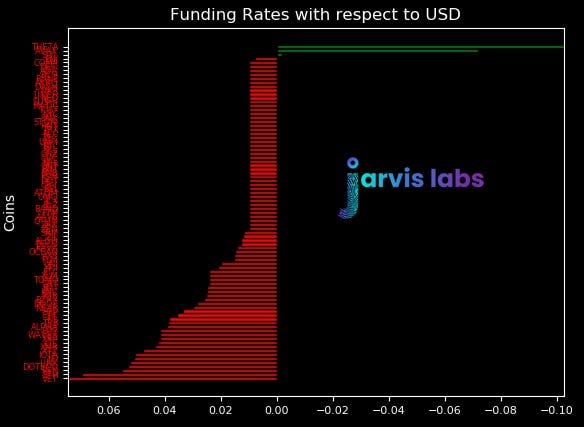

Now, today we got a taste of what we've been waiting for. Some cooling off. It feels like we've been sitting at elevated risk levels for a couple weeks now, and funding rates have gotten so extreme lending DAI on dYdX fetched a more than 40% annual lending rate.

The market still running hot, but we will gladly take this slight cool down. Here's some proof of this happening. Below is our funding chart with a bit less meat on it than we've grown accustomed to the past week. About half the coins are now running at average rates.

This happened just as we wicked down near $33,000. The wick was in part due to longs closing out. Once longs exited the market, the mild cleanse was enough for price to reverse a bit.

Jarvis AI was able to fill in a bid as well for our subscribers. If you recently joined us, you might not have this trade on your account since the order was placed several days ago in anticipation of this range bound price action. But don't worry... The risk level is now at 70 and fuel levels are above 50 (sitting at 58 right now), which means the market is more favorable now than it was over the last two weeks for finding a trade.

Only other thing to consider for the time being is what we addressed earlier this week and yesterday. Which is Joe Biden taking office. During the next few weeks we will begin to get an understanding of what the next four years will look like in terms of U.S. policy.

Any type of talk that hints at the equity market cooling off, the corporate debt bubble deflating or rates increasing are things that will cause a reaction in global markets. Bitcoin is included in this even though any immediate impact to its price would only be a temporary effect.

In fact, if Biden did begin touching on any of those points, itcoin's narrative of being a chaos hedge with incredible upside is would strengthened.

Your pulse on crypto,

B

Jarvis AI

We are Jarvis Labs, a research, actionable data provider and independent software vendor. Our business is to provide on-chain alerts, research, algorithms and autonomous artificial intelligence trading solutions such as Jarvis AI.

If you are interested in what Jarvis Labs or Jarvis AI can do for you or your fund, reach out to askus@jarvis-labs.xyz. You can also use the chat box in the bottom right hand corner of our website: www.jarvis-labs.xyz. Or find us on Telegram @benjamin_bc or @ben_lilly.

Grow your portfolio while you sleep.