Is it worth it?

by Ben Lilly

The Juice is Not Worth It

If you're reading this on your laptop, there's about $35 of gold underneath your finger tips.

Chances are, you might have another laptop or computer in your home that's no longer in service. If that's the case, it begs the question, why aren't you unscrewing the panels to get at it? It's like a modern day treasure chest.

It's most likely because the juice isn't worth the squeeze.

Yesterday was a great example of this exact line of thinking. Below is an alert we got on one of our algorithms next to a chart of the ticker the alert refers to.

I have the time set to UTC so they pair up. Meaning the 4:07 time stamp is 16:07 UTC time. The trade was timed well and if taken, it'd be a risk-free trade with stop in profit.

In fact, yesterday alone our signal system alerted us of YFI, OMG, VET, RLC and BLZ before the day was over. Each one of these when looked back on with 20/20 vision were great signals. Five for five is a traders dream.

So why didn't Jarvis AI take it? The answer goes back to risk versus reward. You can see in the snapshot taken above the "RR" of the trade was 3.35. So you'd think the juice was worth it. But in the eyes of Jarvis AI, turns out it wasn't. That's because there's a host of other factors at play such as risk level, fuel meter, market mover wallets, on-chain flows, exchange flows, accumulation patterns, order book liquidity and more. Any one of these could have turned a trade into a no go.

What stood out to us was the risk in the market yesterday was insane. Our Risk meter at 19:30 UTC was sitting at 92.

A lot of this risk was found in funding rates per usual. Currently there are some altcoins exceeding 0.4% funding rates, meaning traders are paying more than 1.2% to hold a position open... Or 438% on an annual basis. It's unsustainable and not likely to come down until we see a correction.

And what was even more... ETH's price action was like gasoline to a flame. As it went on to mark a new all-time high we witnessed a gamma squeeze. I won't go into what a gamma squeeze is just yet as I'm working on a piece that'll explain it in detail for you. But all you need to know is in the options market there are entities that make a living selling options.

These entities that are selling options hedge themselves via spot market purchases. And when the price of the underlying asset starts to hit what's referred to as an inflection point, these entities are ravenous in the spot market and push prices even higher.

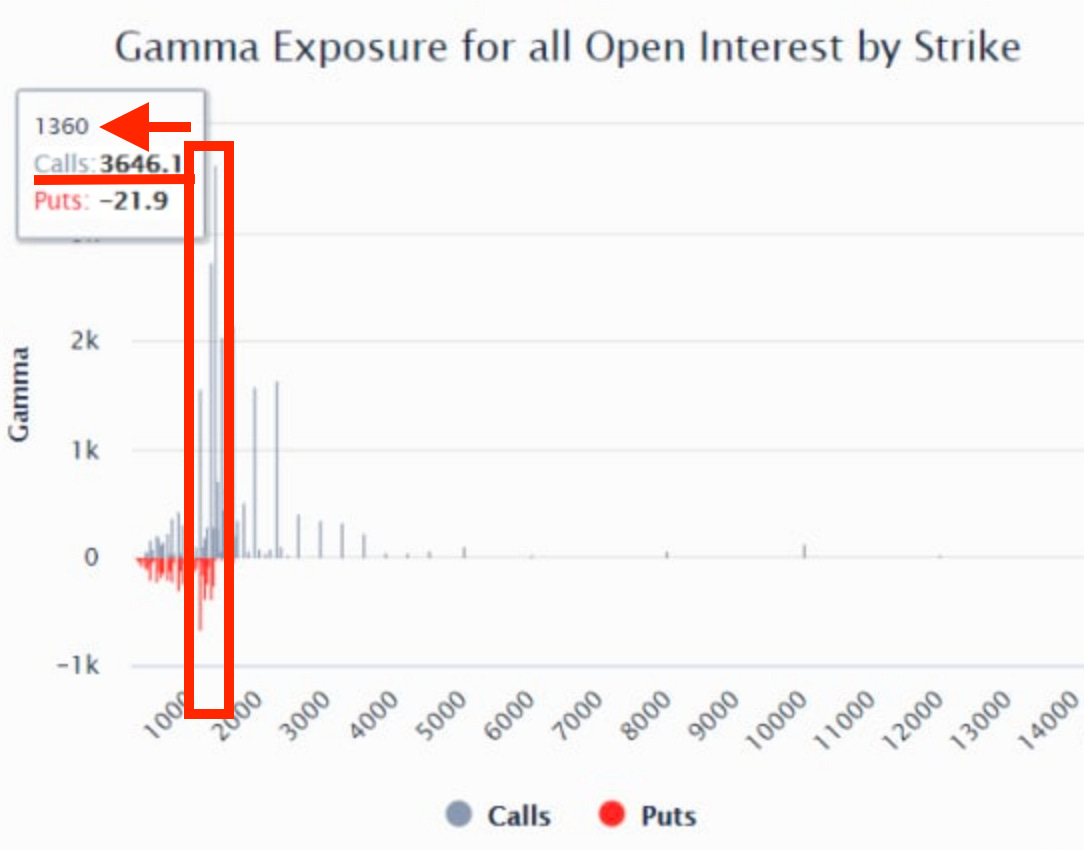

Here was the gamma exposure for open options by strike...

The $1,360 strike and the one just less than it for ETH were deemed to have the highest risk. Which means as price approached these strikes, the entities needing to adjust their portfolios ended up driving the price higher.

It's a thing of beauty. And it goes to show you the velocity at which price can move for or against you in this current environment.

Funding rates, a gamma squeeze that has now passed, and a risk meter at 92 of 100 are causing trades to be exercised with upmost caution.

Market Structure Update

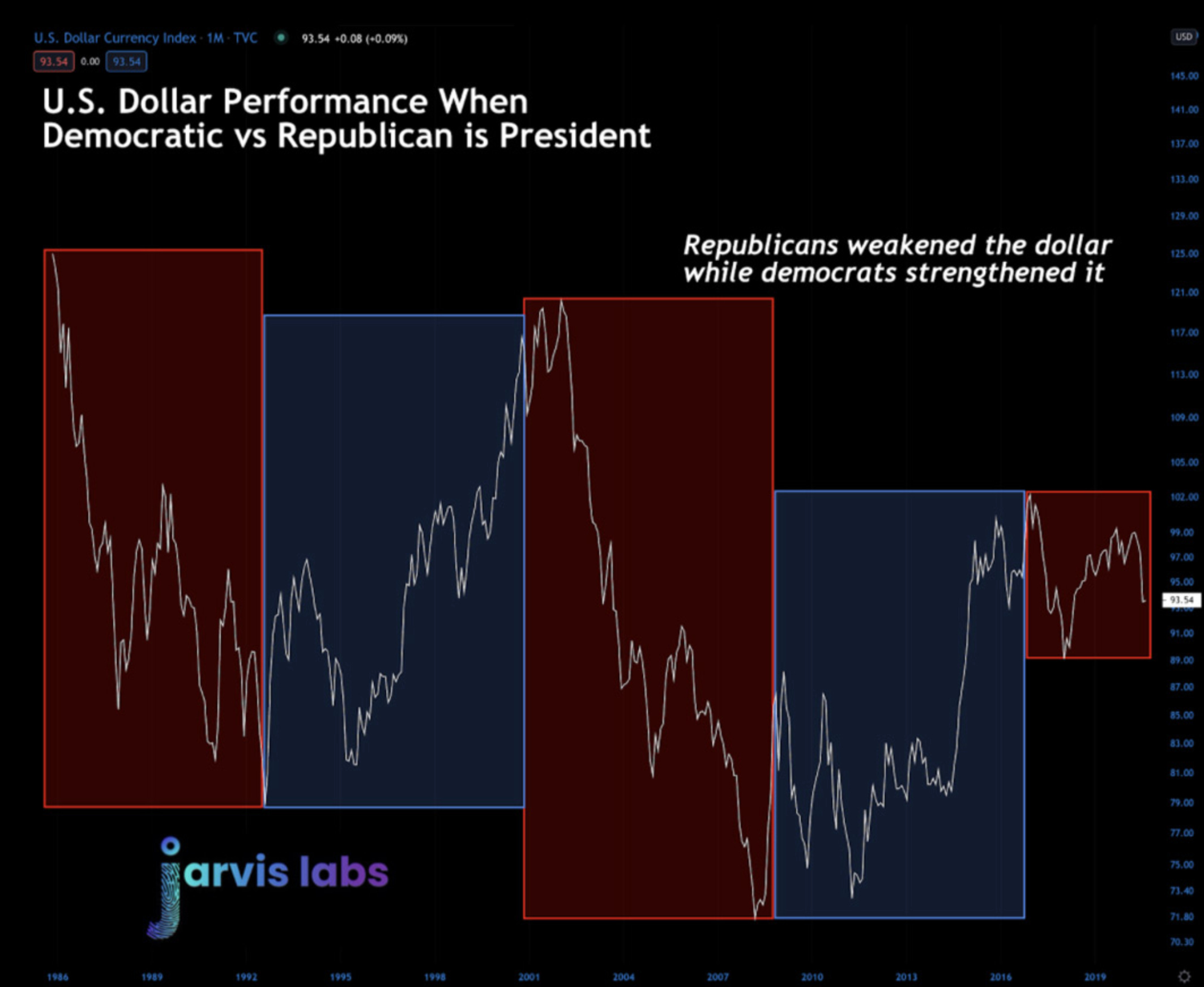

DXY (US Dollar) showed a bit of weakness yesterday the day before America's Presidential inauguration. Watching the DXY head lower made me pull this old chart up.

It highlights how the DXY behaved when Republicans and Democrats were in office. I'm beginning to take a renewed focus on U.S. fiscal and monetary policy in the next few weeks because any strong, impulsive move on DXY to the upside could really bring BTC down a peg or two.

Combine this with no Grayscale Effect in the next few weeks... We might finally get the reset all of us have been waiting for. We'll see. Don't get ahead of yourself, keep taking this bull market one day at a time.

BTW, one more chart I found interesting as I scrolled through my lists... 5 year U.S. bonds. Looks like it might make an attempt at a reversal. It might be short lived, but it still might go for a run here. The timing is just quite the coincidence.

It also makes me wonder if there's a scenario for 2021 where we see rates climb, DXY climb, and gold climb. And at the same time equities (corporate debt bubble finally get popped?) and emerging markets get whacked.

Bit of a tangent, I know, but it's important to keep these global scenarios in the back of mind as we ride this bitcoin bull run cycle because you need to ask yourself, is bitcoin still the asset to own in such an environment? I say absolutely.

Distrust in government backed money will be sky high like it was in 2008-2009 and emerging markets will look for a way out of the Greenback gamed system. These are strong narratives for owning a chaos hedge like bitcoin.

That's enough out of me today.

Your pulse on crypto,

B

Jarvis AI

We are Jarvis Labs, a research, actionable data provider and independent software vendor. Our business is to provide on-chain alerts, research, algorithms and autonomous artificial intelligence trading solutions such as Jarvis AI.

If you are interested in what Jarvis Labs or Jarvis AI can do for you or your fund, reach out to askus@jarvis-labs.xyz. You can also use the chat box in the bottom right hand corner of our website: www.jarvis-labs.xyz. Or find us on Telegram @benjamin_bc

Grow your portfolio while you sleep.