Compounding Amplified

by Ben Lilly

Compounding The Right Asset

It's no secret, inflation is coming.

Finding an asset poised for long term growth is crucial. For most of you that asset is bitcoin. For others it's gold. And maybe for a few it can be shares of the S&P 500.

Whatever your choice asset is, the power of compounding gets amplified if timed well.

Earlier this week we wrote a piece on this exact line of thinking.

You can find it below or view it on Medium here. Hope you enjoy.

How Bitcoin Amplifies Compounding

You’ve heard the stories before.

Start with one grain of rice in the square of a chessboard and double the amount of rice for each of the following squares. By the last square you have 18,000,000,000,000,000,000 grains of rice.

Or maybe something along the lines of…

Two young adults start saving for retirement. One at 22 and another at 31. Both earn 10% per year on their investment.

The 22-year old contributes $300 per month (total of $21,600 of capital)… And if the 22-year old doesn’t contribute another cent after six years, then by 65 they will be a millionaire.

The 31-year old on the other hand does the same thing and contributes $300 per month towards retirement and earns the same 10%… By age 65 they will also be a millionaire.

However, the 22-year old invested $21,600 while the 21-year old invested $126,000.

No mater how anybody frames it, compounding is an incredible investing lesson. And once you understand it, the way you approach trading and investing will change forever.

Today, I want to show you what happens when you apply this same lesson to an asset that’s poised to grow over the next decade — bitcoin.

What we see is the compounding effect is amplified. And it’s why I’m calling it the 9th wonder.

It’s About the Asset

At Jarvis Labs our goal is six to ten percent on average per month. People love it and people hate it.

We find in crypto this amount is the sweet spot.

That’s because our focus is on the best risk to reward available in the market. If there isn’t anything that looks good, then there’s no trade to be had.

If you’re a baseball batter, take what the pitcher gives you. In this way you can maximize your success rate when you swing the bat.

It’s how Jarvis AI operates. It takes the trading opportunities that work for it. It might not be sexy, but it works. And it translates to a higher “hit” rate. And the key is using it on an asset that’s poised for growth over the coming years…

So here’s how six percent per month of the course of one and two years looks like.

January 1st you have 2 BTC.

Six percent over twelve months places your account value at 4.024 BTC by the end of the year. That’s more than double your account.

After two years… 8.0978 BTC.

Pretty incredible. But here’s where things get amplified…

Your account grew in terms of BTC, not US dollars. This means we need to take into account the growth of bitcoin over that span. And for our purposes here, we will assume on average bitcoin grows in value over time.

Let’s say in year one bitcoin starts at $10,000. By the end of the first year, its value doubled to $20,000.

In terms of your account value in the US dollar, this translates to annual growth of 302%.

By the end of the second year bitcoin’s value doubled again to $40,000.

This means from your first day of investing $20,000 your account grew by about 1,520% to $323,912.

An account value of $323,912 from where you started is substantial. It means that over the next thirty days if you realized another 6%, your profit would be $19,434.

That’s compounding amplified.

The key to such a setup is in finding an asset that can act as a store of value and is anticipated to see its market expand. That’s bitcoin.

(Gold is another great asset since it’s expected to grow over the coming years in light of the money supply expansion globally. Although it isn’t going from a small niche market to a main stream audience. Regardless, it’s a great store of value and if you prefer gold, we can set you up with custom instructions for that as well.)

What to Do

OK, so compounding bitcoin seems like something you want to give a stab at. And you've generated a strategy that's consistent and will earn a small percentage gain each month.

Then assuming you understand the risks associated with trading, here’s a way to book your trading profits in bitcoin using FTX.

First, here’s how the program works…

If bitcoin falls from $10,000 to $8,000 and you profit $2,000 from the trade, your $2,000 with be used to purchase 0.25 BTC (minus fees).

If bitcoin rises from $8,000 to $10,000, the $2,000 you made from the trade will be used to purchase 0.2 BTC (minus fees).

This is because the profit that’s in USD will be used to buy BTC at the end of the trade.

It’s done via a code you can copy and paste into FTX’s Quant Zone.

Find the step by step guide at the bottom half of this article.

Market Update

Today was pretty boring on-chain. Actually got a good nap in, first time in a while.

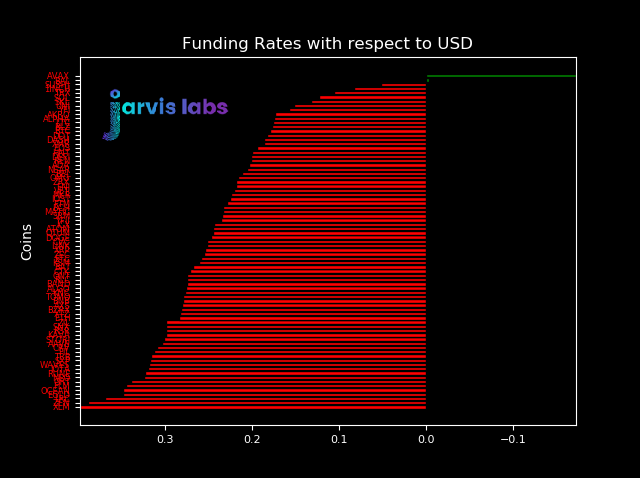

Funding rates are now beyond bonkers with various tweets highlighting 300% APYs on various exchanges. The FOMO is real in derivative traders trying to catch the breakout.

Also, bybt.com reported a big uptick in Grayscale inflows. About 16k worth of BTC. This is one of those events where the news is reporting an event that has passed. We reported these inflows to you over a week ago.

Funding rates bonkers and on-chain flows boring make this potential ETH breakout as of 4:00 UTC a low probability event.

While we did see a particular venture capital group load up on ETH a few days back, we still see this as low probability... but not impossible. Just not a good risk/reward trade that I'm willing to get involved with.

Funding rates have escalated to quite high rates on Binance futures.

Let's see if we can get a reset in rates soon, the market is almost begging for it at this point.

Your pulse on crypto,

B

Jarvis AI

We are Jarvis Labs, a research, actionable data provider and independent software vendor. Our business is to provide on-chain alerts, research, algorithms and autonomous artificial intelligence trading solutions such as Jarvis AI.

If you are interested in what Jarvis Labs or Jarvis AI can do for you or your fund, reach out to askus@jarvis-labs.xyz. You can also use the chat box in the bottom right hand corner of our website: www.jarvis-labs.xyz. Or find us on Telegram @benjamin_bc or @ben_lilly.

Grow your portfolio while you sleep.