Market Update

by Ben Lilly

The Structure is Taking Shape

We can literally track trader engagement. It's a benefit of operating via e-mail, Twitter, Medium, Hackernoon, and Telegram.

You can see for yourself. Just go to our Telegram channel (t.me/jarvis_labs). On every post there's a number in the bottom right hand corner. When things start to quiet down the amount of views will be lower, and as soon as the market rips open, those figures spike.

You can actually use that to your own advantage. Let me show you how.

Last week in our we said at the end of our update, "There will be another time to catch the bullish rally, this week might not be the most ideal time."

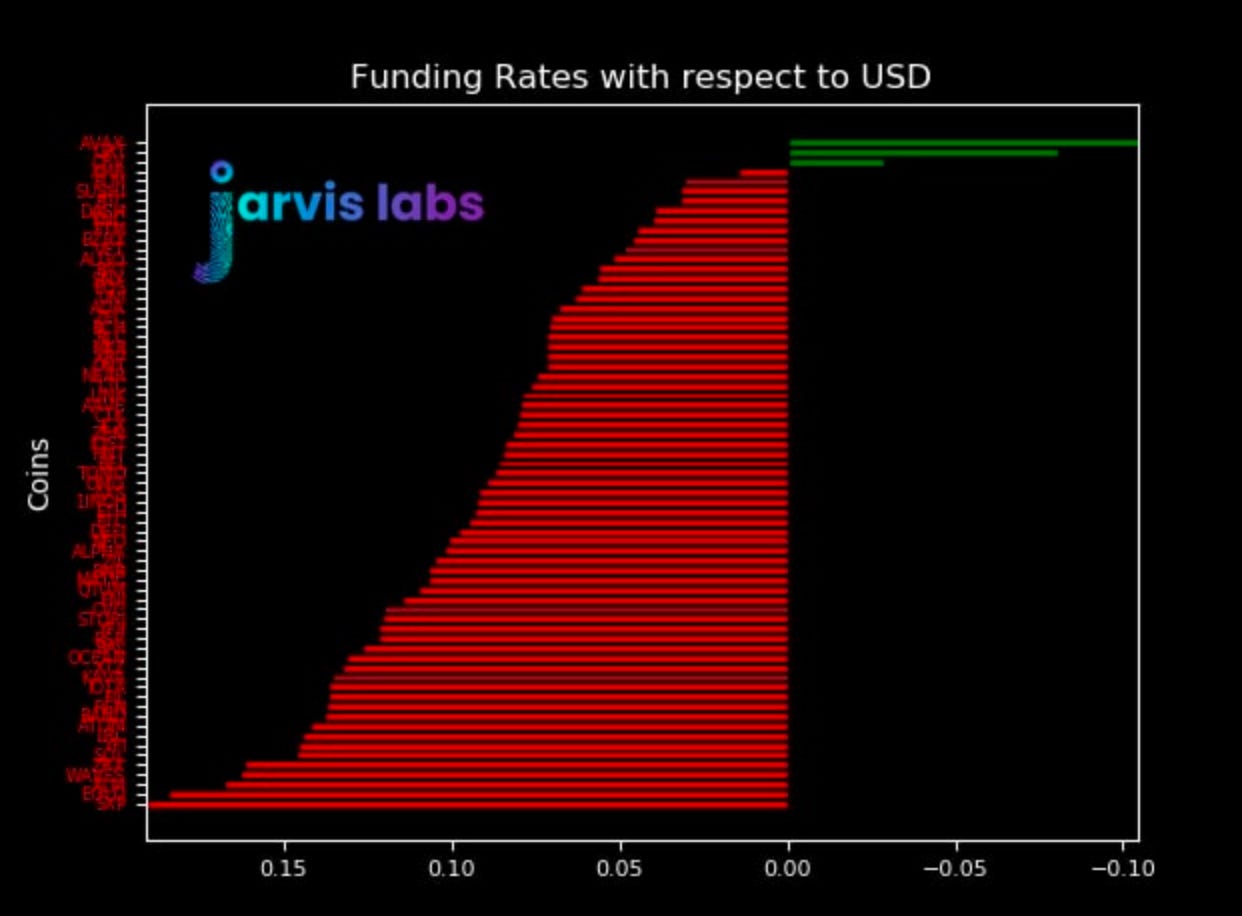

We've been consolidating since then. This narrowing trading range literally just bores people out of the market. Not to mention just sucks money out of impatient trader accounts via high rates. Regardless, it's not until we see user engagement drop do we see the market finish its structure.

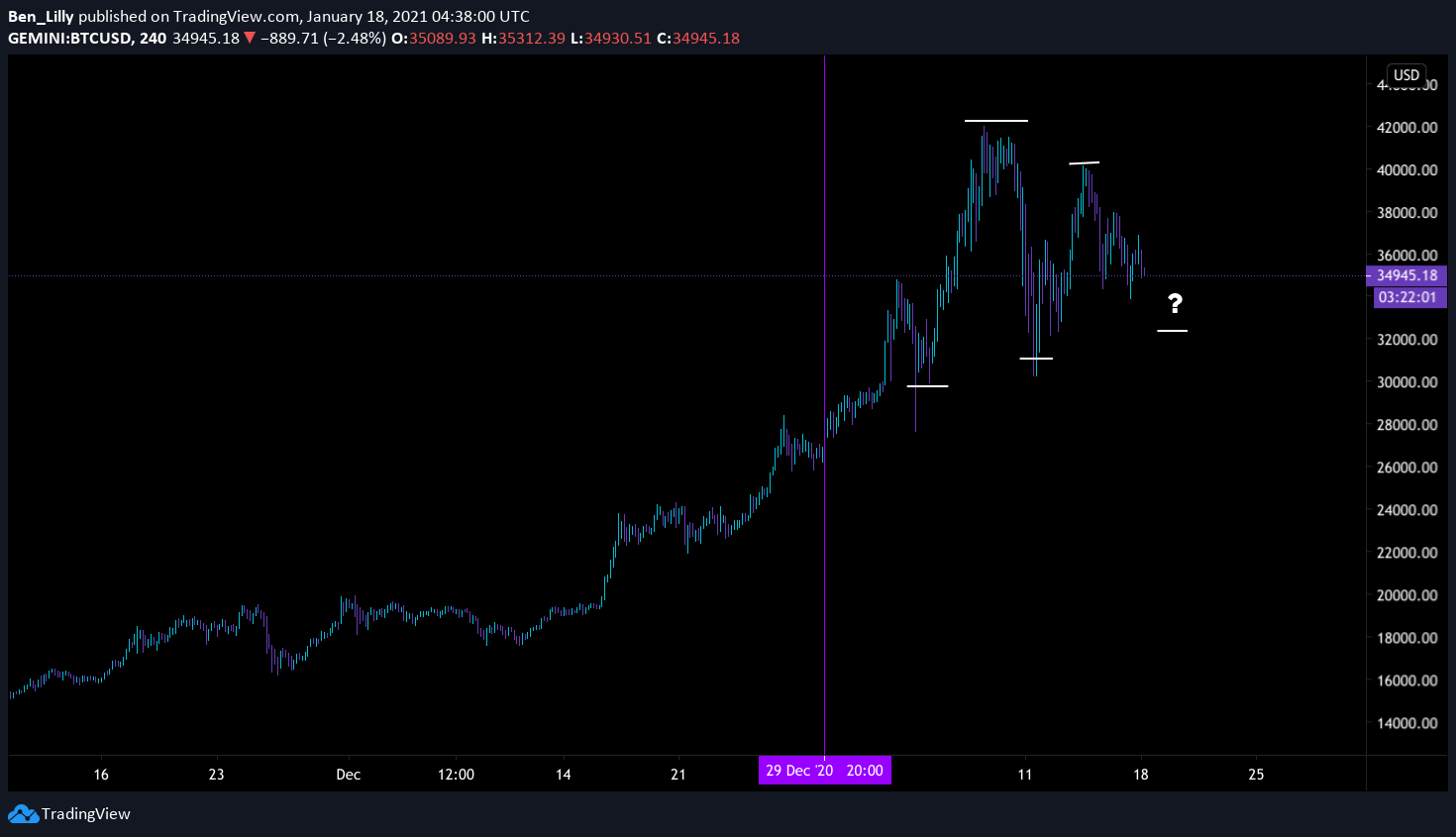

Here's what I mean by consolidation...

What tends to happen is high money market rates come down to sane levels, funding rates on futures come closer to earth, volume starts to drop, volatility shrinks, and about this time price starting to complete its current structure.

Does it mean price goes up or does it mean it'll go down? We'll see.

But right now we do see some accumulation occurring in market mover wallets. Market mover wallets are wallets we track that tend to dictate the market, and it helps us determine what the overall flow of money is - bullish or bearish.

So if we know market movers are accumulating, we need to figure out just how long this accumulation might happen for.

To help form some way points, let's lean on some of the charts from last week.

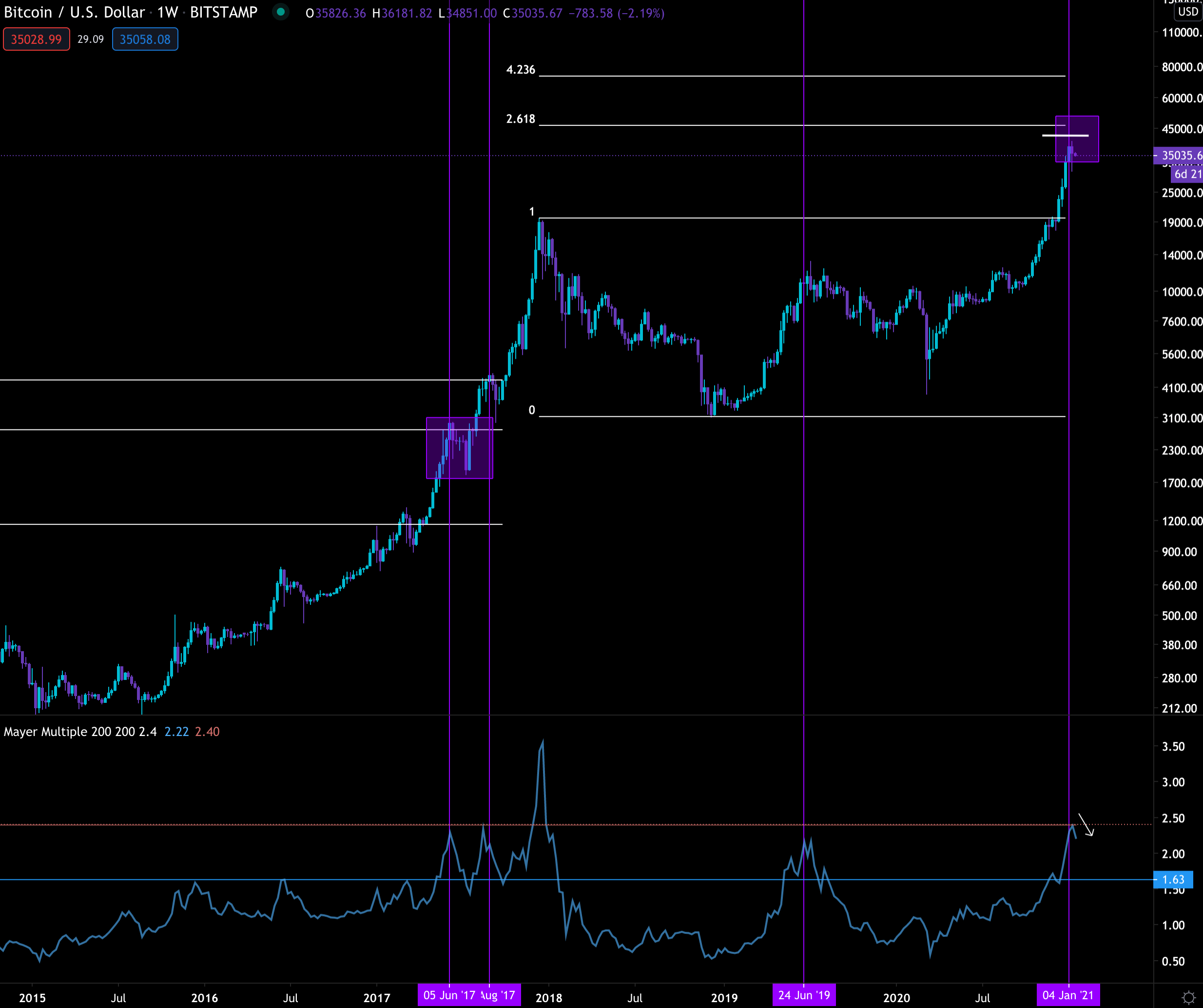

Last week we introduced the Mayer Multiple. It's a way to look at the price of bitcoin in relation to past price. Specifically, it's 200 average. To figure out the Multiple divide bitcoin's current price by the 200 day moving average.

The rule of thumb is buy below 2.4 and sell above. The bottom third of the chart below is the Mayer Multiple over time to give you an idea. We just bounced off the 2.4 line. It now appears ready to go sideways. Similar to how we saw in June 2017 in the early stages of an epic bull run.

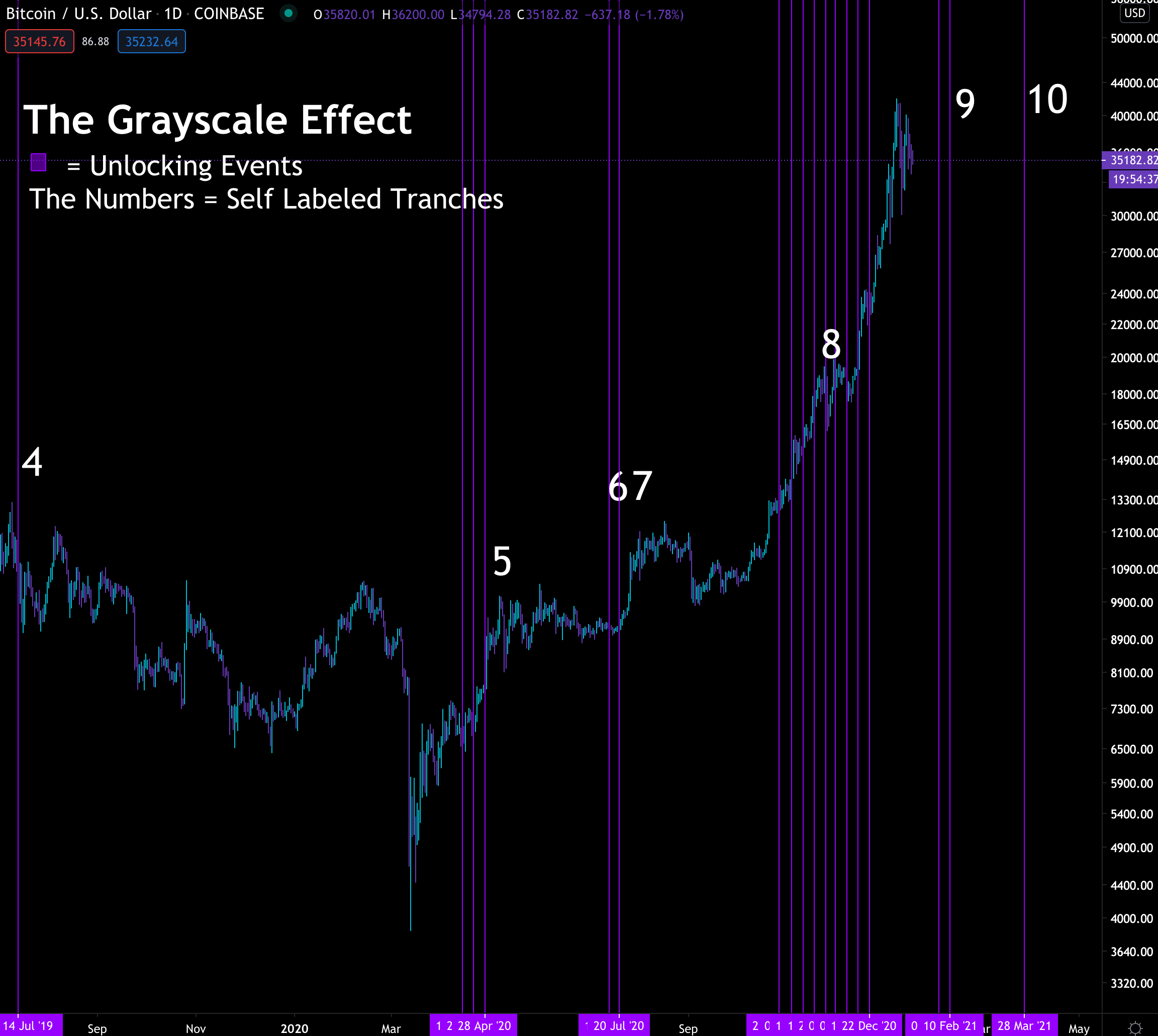

What's also important to remember is the Grayscale chart of unlockings. As we mentioned in our Grayscale Report, The Effect tends to last for about a week or two after the last unlocking. The two week mark was a week ago, meaning our analysis is holding true.

The next tranche we are eyeing is in February. This gives us another waypoint for just how long we can go sideways for. Here's the chart below for reference. You can also bookmark the chart using the link here.

The Mayer Multiple and The Grayscale Effect are both hinting at more sideways ahead of us.

The Money Market is another cue that hints the market is still cooling down. On Defiprime.com lending rates are at 7.5-15% across dYdX, Compound and Aave. Lending money is compelling at these rates and wit such high rates, opening positions in the derivative market is less attractive.

Funding rates in futures are echoing what's happening in the Money Market as well. Here's a snapshot from Sunday. Traders are still FOMO'ing into positions whenever possible. The only trades that are reasonable in times like these are very well timed market entries. Jarvis AI has made several BTC entry and exits in the past few days.

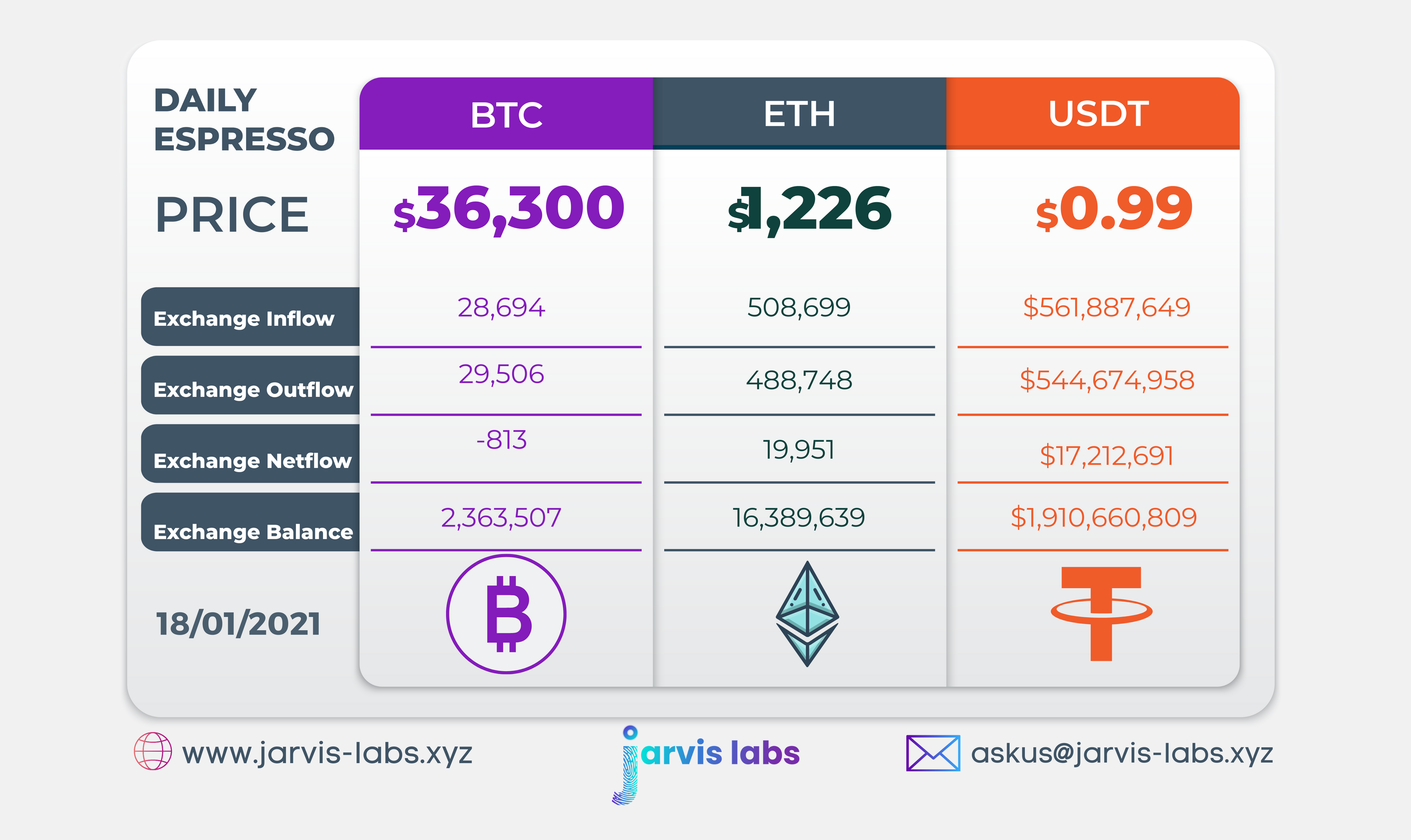

The structure within crypto hasn't changed much from last week. Metrics are signaling a cool off, rates are signaling a cool off, and Grayscale is signaling a cool off. There's some accumulation ongoing in a few market movers, but nothing that's hinting at an imminent upside break. Stabelcoin flows weren't very attractive over the weekend either. And as usual, just as alt-coins start hitting new highs, a drop in BTC spoiled the fun.

This tells us BTC is still able to suck the liquidity right out of alt-coins.

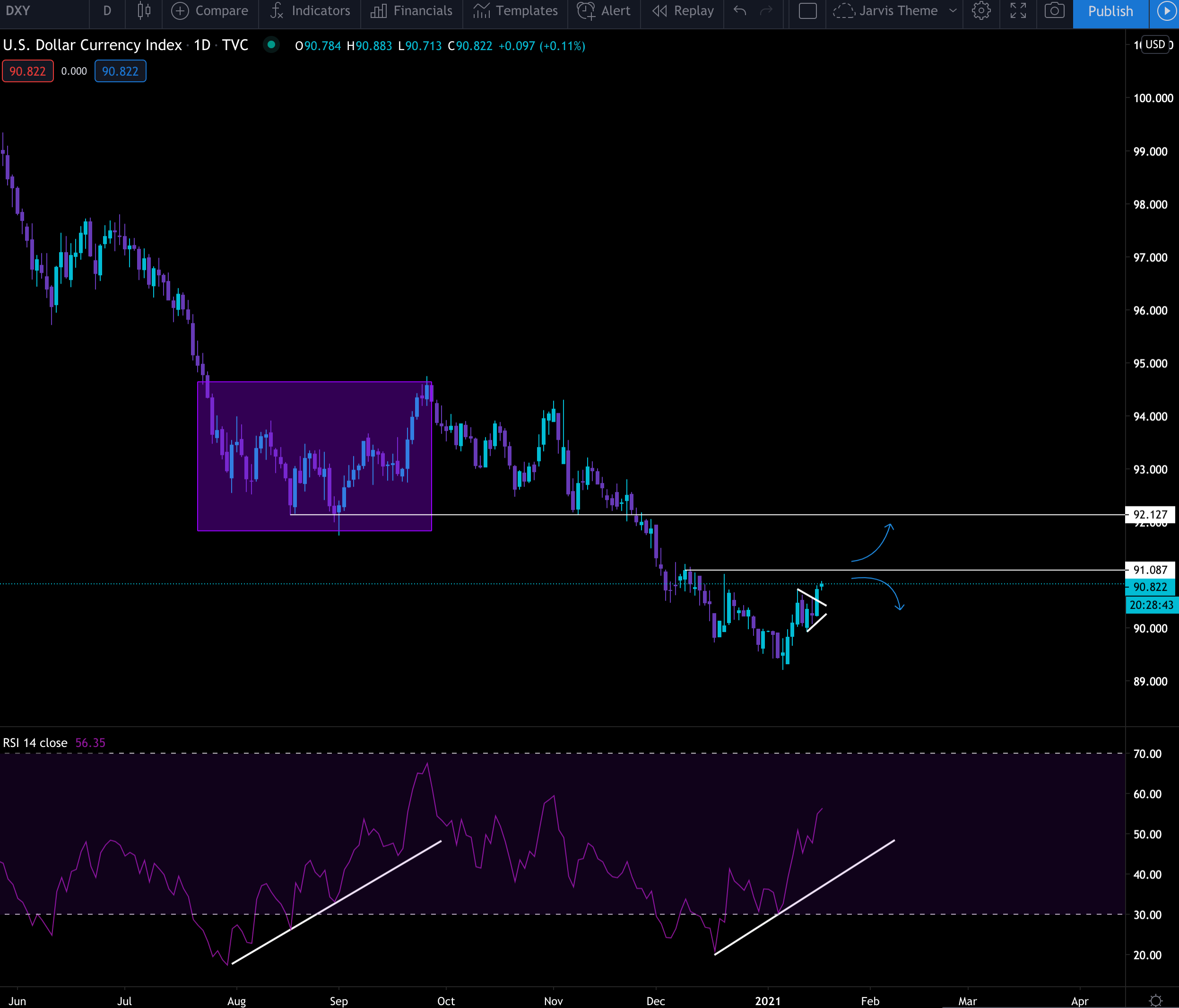

The only other thing we are keeping an eye on is the DXY (US dollar index). We mentioned a week ago a possible setup where DXY breaks to the upside out of its range just as BTC tops out. We ended up witnessing that. Looking forward for this week we're now waiting to see what happens as DXY approaches its next level of interest.

As I write this at 5:00 UTC, the index is still making its way to 91.087 area shown below. If it breaks through there's a sizable move higher that can take place. This is bearish for BTC since much of the narrative for BTC of late is being driven by its use as a hedge against inflation. A strong DXY would hurt this.

Funding rates, DXY, and market mover wallets are what we are watching right now.

The Grayscale Effect isn't really on our radar until February. However, there are small inflows happening right now. These are not considered fresh purchases but "like exchange", meaning investors are simply transferring their already purchases BTC to Grayscale.

On Monday we might see some fresh purchases. That's because any fiat that hits Grayscale needs to buy up BTC within 24 hours. And since the Trust began receiving funds again last week, some fresh funds might just be settled on Monday for buying.

We don't expect it to be significant, but it's important to acknowledge its potential.

OK, that's enough out of me today... Hopefully you like this new structure. We want to try to do a weekend recap on Monday's and also set you up for the week ahead. Let us know if you prefer this. This way we can quickly reference this analysis throughout the week while we hit on other topics.

Your pulse on crypto,

B

Jarvis AI

We are Jarvis Labs, a research, actionable data provider and independent software vendor. Our business is to provide on-chain alerts, research, algorithms and autonomous artificial intelligence trading solutions such as Jarvis AI.

If you are interested in what Jarvis Labs or Jarvis AI can do for you or your fund, reach out to askus@jarvis-labs.xyz. You can also use the chat box in the bottom right hand corner of our website: www.jarvis-labs.xyz. Or find us on Telegram @benjamin_bc or @ben_lilly.

Grow your portfolio while you sleep.