The Media on Grayscale

by Ben Lilly

Like a Walt Disney World Turkey Leg

"Bitcoin's 20% price hike in the last 48 hours occurred immediately after Grayscale reopened its trust to investors. Coincidence or not? You decide."

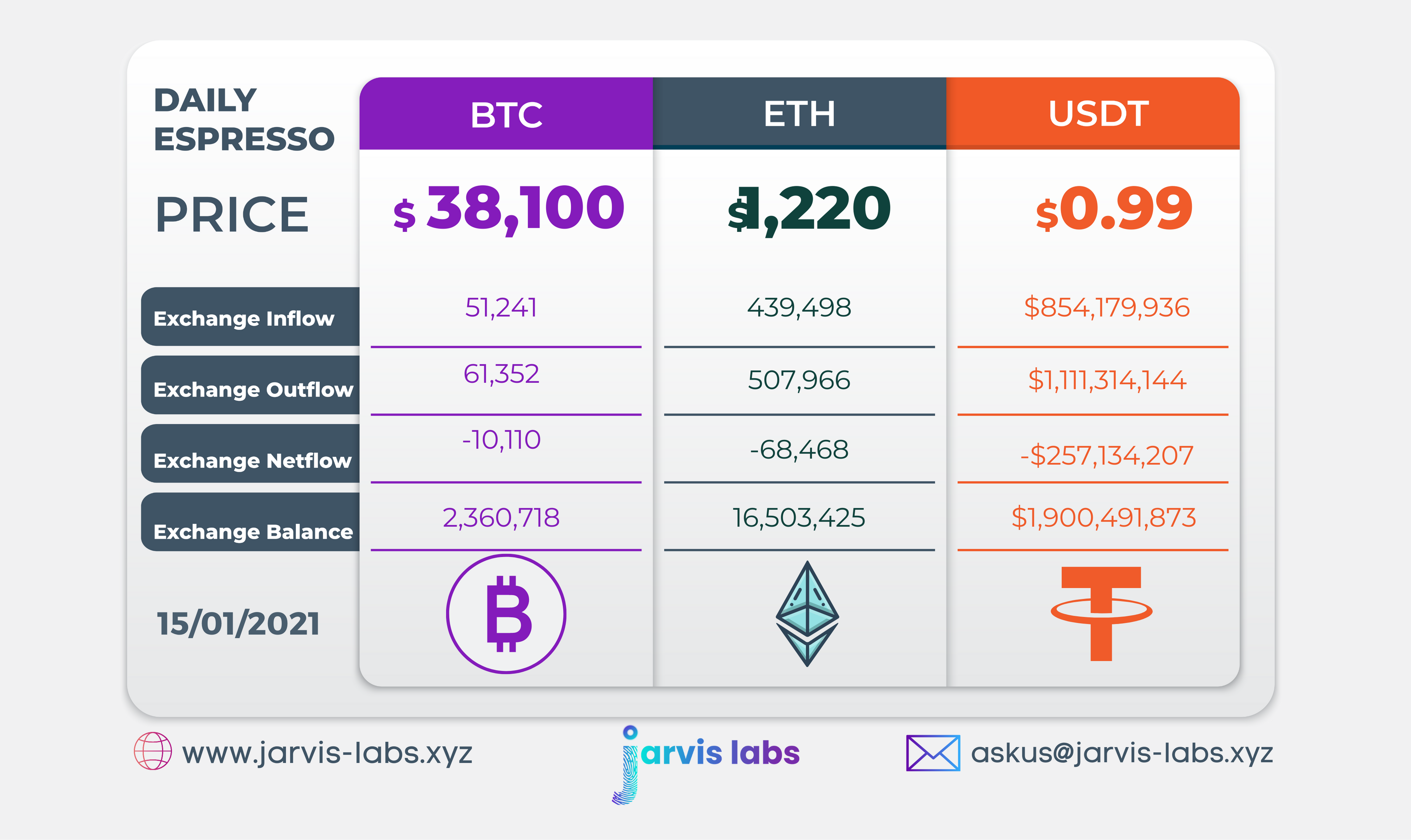

That's a quote from CoinTelegraph yesterday. It hits on the 4,618 BTC hitting Grayscale's balance sheet over the last two days.

My response to the question above is, sort of.

Here's something to consider that should help explain my answer... What if I sold GBTC shares a month ago and immediately followed it up with a spot or OTC purchase of 1,000 bitcoin. Then waited until the fund opened its doors again. And once opened I merely sent the BTC over?

Does that influence the market today? Sort of.

While there was no purchasing of 1,000 BTC on the market today or the last few days, the mere act of sending it to Grayscale and them recording it on their antiquated ledger might be enough to influence the market.

Now couple this up with incredible FOMO in the market as seen in how quickly funding rates rise and you soon realize self fulfilling prophesies can exist, and it's why on-chain data is crucial to find the signal amidst the noise. Without it you're flying blind.

The media is your noise, turn it off. It's extremely rare to find the 'why' from a source who's mission is to be the first to cover a story.

Another thing to consider in terms of how the market is operating is best understood from a tweet by Three Arrows Capital co-founder Kyle Davies.

He said, "If speculation is to eat the world, let me be in the business of financing speculators." This was tweeted yesterday just as FOMO was starting to surface in the derivative markets.

What he's saying is to lend money to the speculators... the traders. Is it a coincidence? I personally think no. I think he was literally talking about lending capital to traders in the derivative markets.

As you know, we tend to watch funding rates a lot. It tells us when a trade is getting crowded and essentially too expensive to keep open. Which means once it gets too out of whack, we can expect price to take a turn the other way.

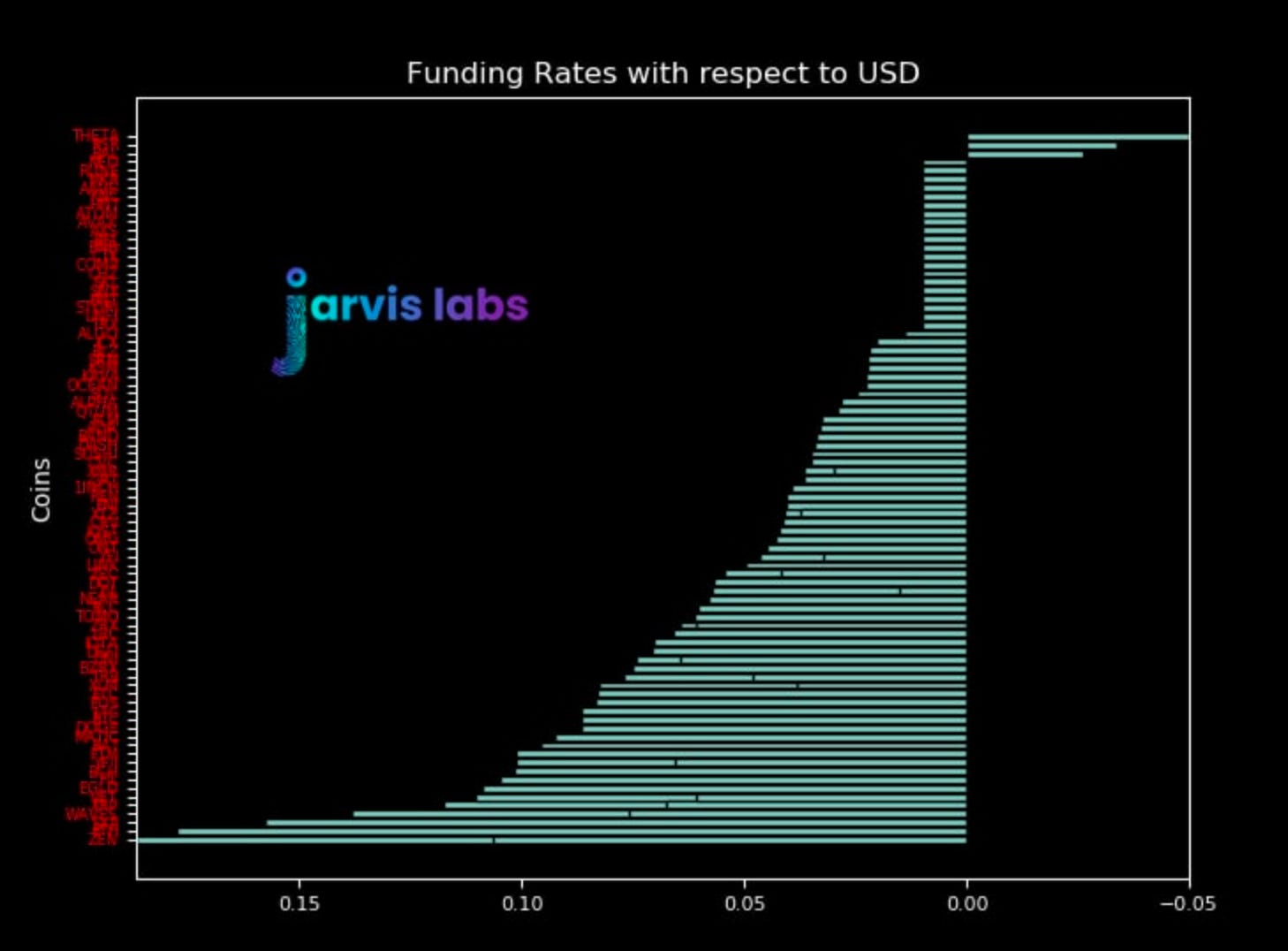

Now, to see what I mean, let's first pull up funding rates when BTC was at $38k on January 11th:

A lot of meat on the left side, which means the derivative market was piling into longs. As you know, price slide down and flirted with $30k. Here's what those rates looked like then:

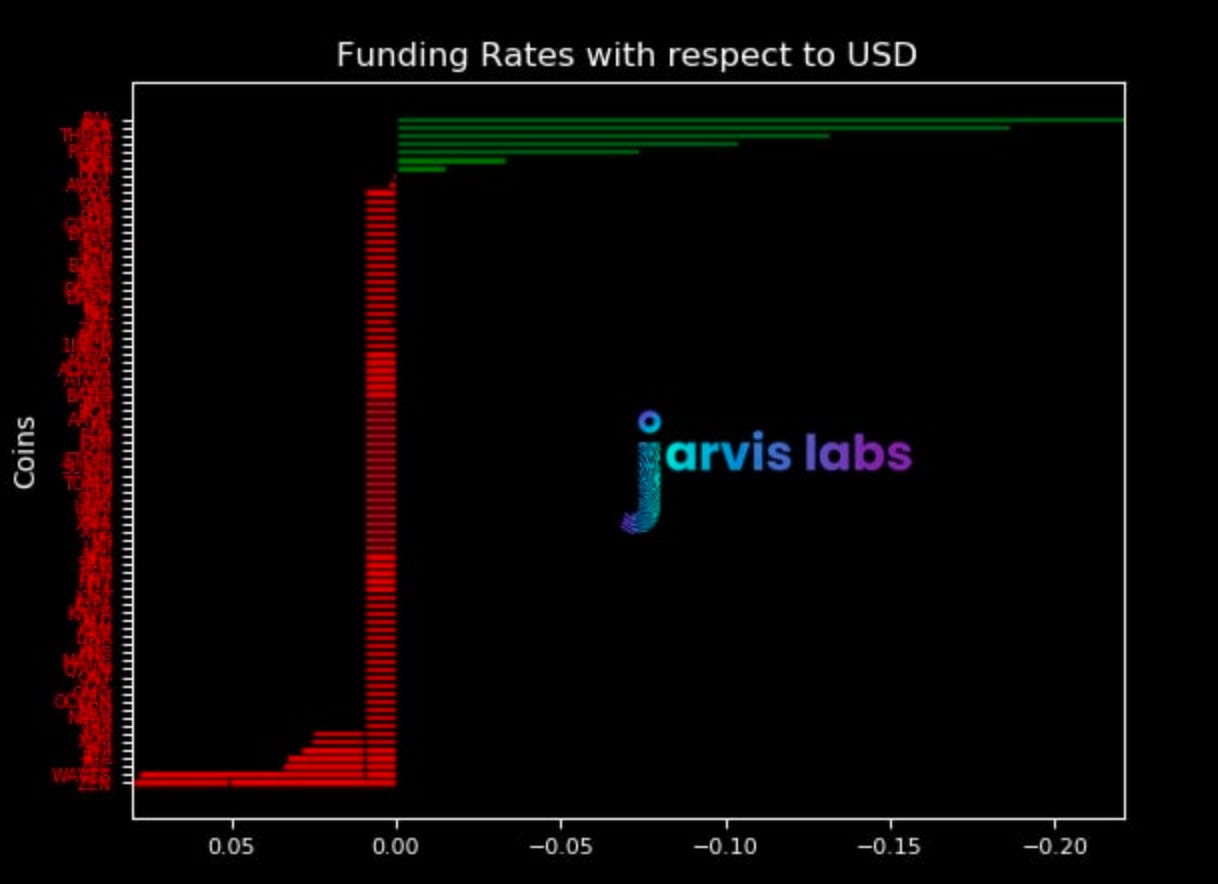

It was a great market cleanse. It was so great that the meat was showing up to fund the traders going long, a rarity in a bull market.

This was enough for the market to start its consolidation and begin trading within a range.

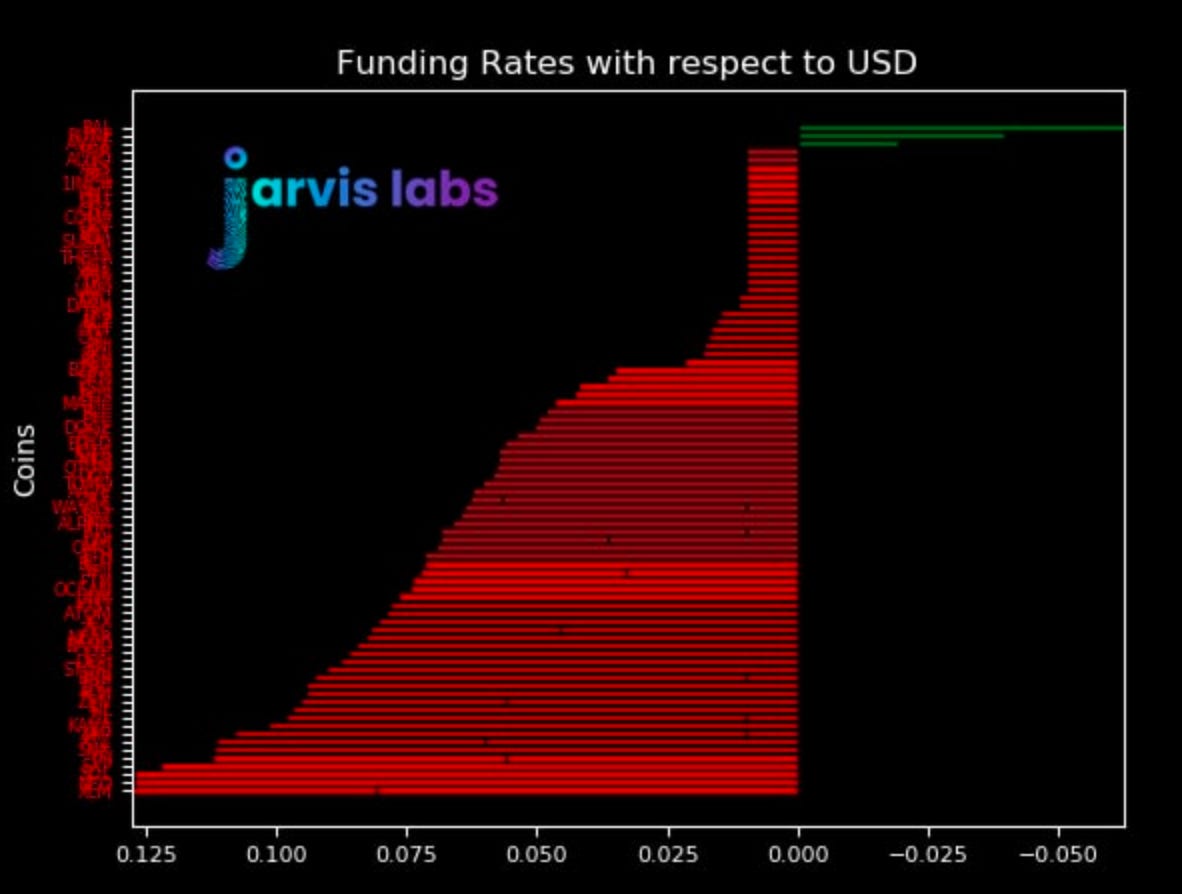

And as price approached $38k yesterday, the traders were already piling in on the long side again. Here's what that chart looked like yesterday:

Just like a turkey leg at Walt Disney World.

Now, as I write this at 3:00 UTC, pice is hanging out around $39k. A lot of alts on Binance Futures have a funding rate north of 0.1%, IOTA is at 0.15% (?!), and BTC at 0.063%.

What this tells me is the market is currently being driven by the derivatives market, not the spot market. For BTC to get turbo boosters and jettison north of $42k we need spot buying to pick up. And since we didn't see any on-chain movements in relation to Grayscale, that doesn't look great right now.

In fact, we had some bearish on-chain activity come through as BTC topped out (cool new alert system we're building for a hedge fund). It was a wallet moving $104 million in what we consider a bearish transaction.

If that wasn't enough, we can check out DXY (US dollar index) which is still consolidating. It's current pattern is certainly not weak and shows potential for a move higher. For now it's still consolidating.

If DXY does end up making a break to the upside as BTC runs in to weakness like we're seeing, expect BTC to fail its breakout to the upside. This is sort of similar to the setup we discussed in the Espresso we sent out Sunday.

Let's see how it plays out, remain flexible. Like we said a couple days ago, there is some activity we are expecting either Friday or Monday to play out that can slap any bear upside the head thanks to Grayscale.

As for now, that's all I got. Until next time.

Your pulse on crypto,

B

Jarvis AI

We are Jarvis Labs, a research, actionable data provider and independent software vendor. Our business is to provide on-chain alerts, research, algorithms and autonomous artificial intelligence trading solutions such as Jarvis AI.

If you are interested in what Jarvis Labs or Jarvis AI can do for you or your fund, reach out to askus@jarvis-labs.xyz. You can also use the chat box in the bottom right hand corner of our website: www.jarvis-labs.xyz. Or find us on Telegram @benjamin_bc or @ben_lilly.

Grow your portfolio while you sleep.