Your Enemy

by Ben Lilly

Day By Day

No need to rush in.

Over the last week we've been talking about funding rates and how they are a warning sign in crypto markets. For us it's a way to gauge when a trade is getting crowded.

A helpful way to view funding rates is through some logic.

If bitcoin is ripping higher and the funding rate climbs to 0.4%, that's 26x the 0.015% average. And over the course of say three days this amount gets expensive for your position.

If you have a $100,000 position (using $10,000 of capital), a sizeable chunk of interest will have to be paid out.

And as this chunk grows traders begin to close positions. That's the cool down effect, which can take time.

Just look out at the growth of open positions as of late. It's grown from $7.2 billion to $11.5 billion as of January 12th.

If no big buyer steps up in the next few days, chances are we'll see open interest keep dropping with funding rates so elevated.

Now, one thing to keep in mind... When bitcoin began its parabolic run in mid-October, the spot market drove prices higher. Not derivatives. In fact, funding rates were actually negative for the first leg. We chalk this up to traders growing accustomed to sub $20,000 prices since December 2017.

During this first leg it the long trade never got too crowded. This allowed the move higher to have such long legs.

It wasn't until the past seven days did funding rates start to look whacky. These rates are what caused risk levels to start flashing for us.

In light of all this funding rate talk, it's important to remember to take all of this day by day. I know it's easy to get excited and jump into a dip.

Crypto twitter doesn't help with their constant drum beating of buying the dip and staying poor. Try to ignore it.

Things can change quick and try not to get too attached to anything.

A new buyer can come in tomorrow and change the entire dynamic we're detailing here. It's why we also try to refrain from forming a price action narrative. Because if we get too married to what we think might happen, then we will be fighting ourselves when we change our minds.

It's how you can become your own worst enemy.

Take it day by day...

On-chain flows

exchange flows

Ebb and flow...

Tides move in

Buyers step in

Tides flow out

Things get dark...

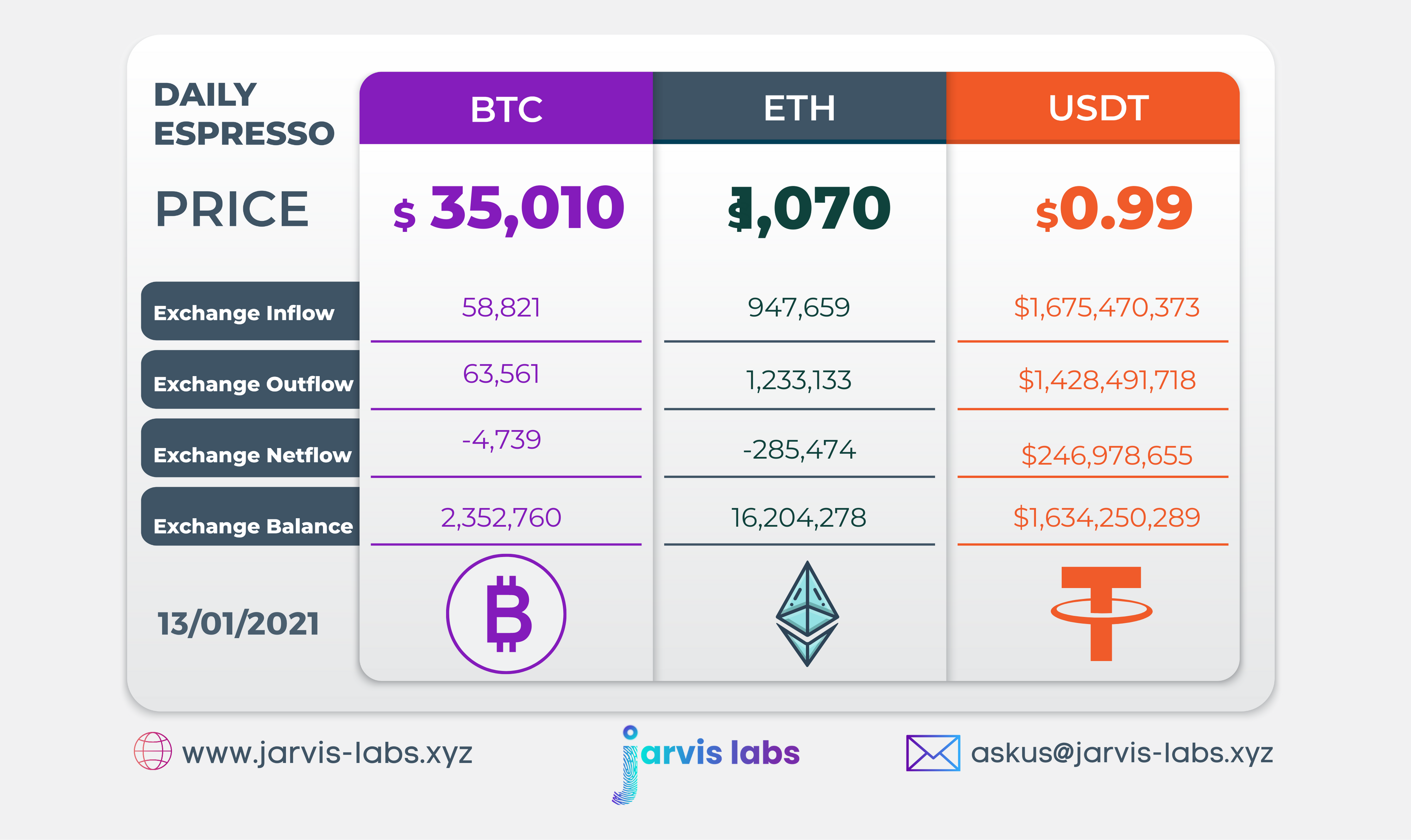

We haven't seen buyers step in as of 3:45 UTC on January 13th. We saw on-chain and exchange flows indicating profit taking, not position building. The $250 million USDT still sits dormant.

Funding rates still rise fast whenever price seems to start heading higher. Traders are FOMO'ing into any price action right now. Eventually they'll grow tired. Luckily for us, computers don't.

Your pulse on crypto,

B. Lilly

Let Jarvis Trade For You

Click the button below to learn more about how Jarvis turns the market into a second stream of income for you... while you sleep.

Any questions you may have please don't hesitate to reach out to us at askus@jarvis-labs.xyz or on our website via the chat button in the bottom right-hand corner: www.jarvis-labs.xyz

Did you know you could earn up to 1,000 USD paid out in BTC when you refer Jarvis to each friend?

If you would like to know further about our affiliate program check the link here: https://telegra.ph/Heres-how-to-earn-income-from-Jarvis-without-a-subscription-you-can-start-today-12-07