They left

by Ben Lilly

It's an Emotional Trip

I'll never forget the first experience.

The days running up to it were spent daydreaming of my family's 40-acre farm.

Nestled at the end of a dirt road lined with mature oaks I pictured a rustic home with touches of modern throughout. And nights in that home would be spent on the porch making fairy tales about the star studded sky. I told myself this is what my family will soon be doing .

But then Monday came around. As I glanced at my phone my innards were transformed to lead as they dropped to the floor.

Any dreams got crumpled like the Hulk taking a seat in a lawn chair. The pit in my stomach that remained in the days that followed is a feeling I can remember to this day. This feeling is something I'm reminded of whenever the market has a day like yesterday.

I wanted to share that with you because some of you shared the pain you felt.

And listening to these stories quickly reminded me that crypto markets are not like anything else. They take a lot of emotional energy.

Now, this emotional swing that rises and falls with the markets is why Jarvis exists. Whether the market is ripping higher or taking a plunge, it's always considered as an opportunity. That's because with more volatility brings with it more chances for a successful trade.

Here's what I mean...

Yesterday felt like a fresh money making season was born. Funding rates are beginning to reset, RSI's are coming back into normal ranges, market movers are showing themselves on-chain and supports / resistances are here again. These are the things we like to see as the risk level gets tamped down a bit. This helps us trade with higher accuracy.

Now, before getting into our market update, I wanted to mention why crypto can be so extreme, emotional and painful at times.

The stock market is full of stocks that will and do drop 20% in a single day. For a trader with twenty or so different stocks in their portfolio, this might represent a minor blip on the radar. And while the stock took a hit, the index itself might remain flat. Diversification is real. It works in stocks.

Forex markets on the other hand differs in that they always have winners and losers. If one currency wins, another loses. Commodity currencies could be strong one day while emerging markets are getting crushed. Days where they all go down don't really exist. Even back in March when almost every currency got curb stomped, the USD went parabolic.

In stocks and forex, when the market is a sea of red there are still islands of solace. Not so much with crypto.

If BTC takes a plunge your entire basket of tokens will get shredded. Which means diversifying into BTC, ETH, large cap, small cap, DeFi and/or payment tokens will be like a tent in a hurricane. Not to mention traditional hedging tools are still maturing.

This inability to diversify takes many investors by surprise. And with hedging tools so young, few are able to buy a simple put for their portfolio. It's in part why we stick to large cap and more liquid tokens, and not the small cap home runs. We want reliable tokens with high liquidity.

Others want the shitcoins. It's why we're not a solution for everybody.

Market Update

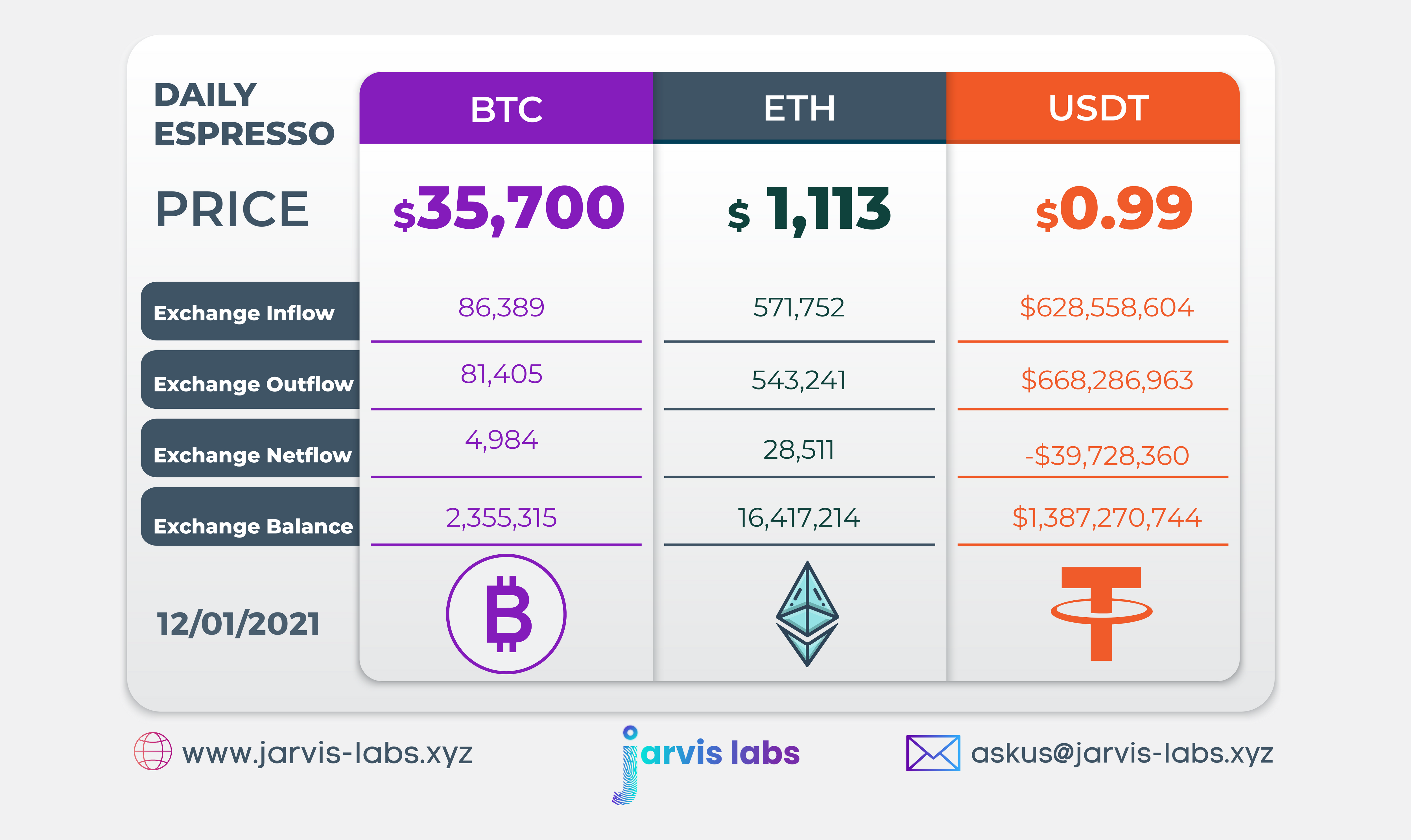

Bitcoin is currently printing its fourth red candle in a row on the daily charts as I write at 3:00 UTC.

The last time we saw that was late September/early October. Coincidentally, this was just a couple weeks before the onslaught of Grayscale unlockings unfolded, which finally came to an end as 2020 came to an end.

The unlockings impact the market by driving price higher for a couple weeks after they take place. The lack of this effect taking place in the market was seen yesterday. We haven't seen any wallets tied to the Grayscale Effect make any moves since the middle of last week.

What this tells us is the main buyer has stepped to the side as we expected when we wrote The Grayscale Effect about a month ago.

The part I find incredible is that this Effect and drop pairs up so well with other technicals and fundamentals - which we hit on a few days ago .

These things being funding rates, risk levels, lack of USDT being doled out, Mayer Multiple being high, fibonacci extensions, and more.

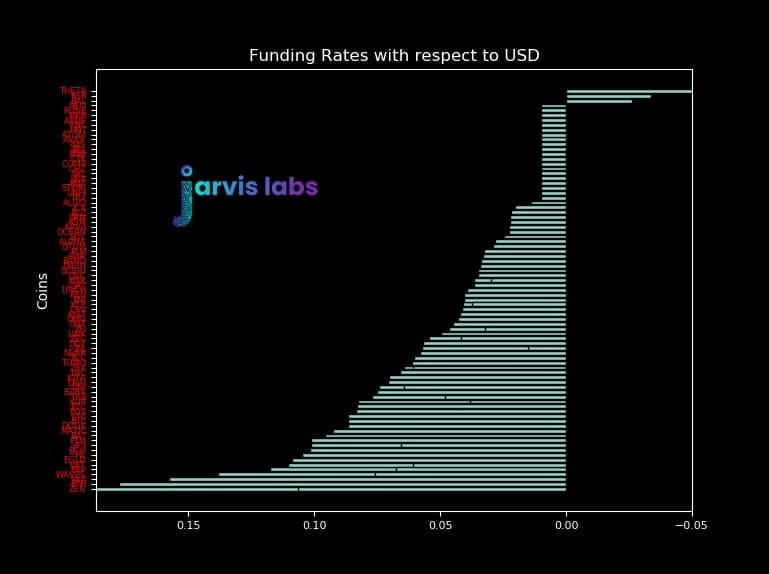

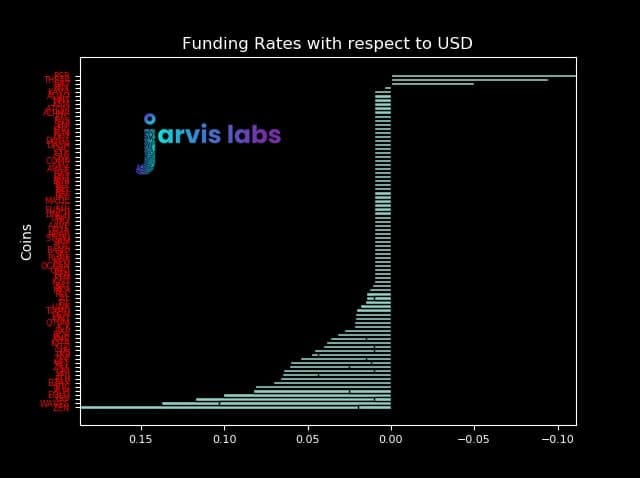

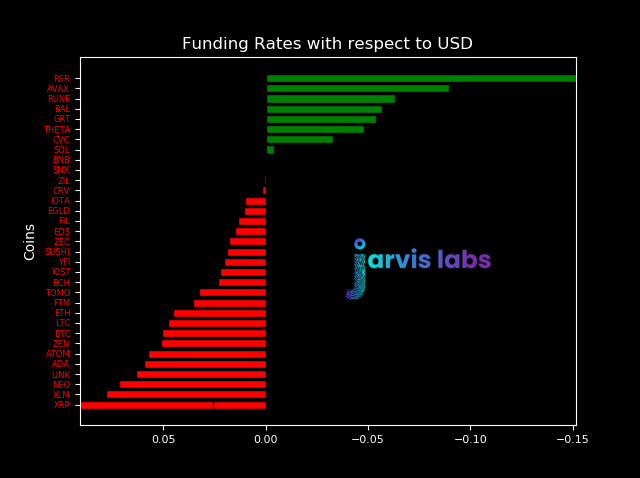

As far as funding rates go, here is a before and after. The further left the bar graph goes, the more out of whack the funding rate is. As you can see long positions were paying a heavy price for their position to stay open. We expect this extreme to come back quickly, but without the same intensity.

Funding rates on Binance Futures before the drop

Funding rates on Binance Futures after the drop

Funding rates on Binance Futures now. (Note: Coins with 0.01% neutral funding are not listed in the below chart)

This type of 'reset' helps tone down the risk meter which is now at 80. While we are still at high risk zone, at least we're not contemplating if our index is capped at 100 or not.

DXY (US Dollar index) is still showing us it still has life, and not showing any hints at lower lows in the immediate future.

The $250 million USDT is still sitting on the sidelines, and so was Jarvis. We expect it'll dip its toes back into the market here soon (orders in the book).

Talk more tomorrow...

Your pulse on crypto,

B Lilly

Let Jarvis Trade For You

Until further notice monthly subscriptions are no longer available until further notice. Each month we set aside a certain amount, but in order to prioritize alpha, we can't budge on this. However, we still have annual and lifetime slots available.

We apologize for the inconvenience.

In an effort to free up slots we are offering a limited-time opportunity for monthly subscribers to upgrade to annual or lifetime. If you’re interested we’ll pass along a 20% discount, that’s a $500 savings or two months free. Or on a lifetime that’s $2,000 off, almost a year for free!

Contact @benjamin_bc on Telegram if you have any questions.

Remember, for lifetime subscribers you get any and all Jarvis products such as option bots, hedging bots, multi-account access, and more.

-Jarvis Labs Team

p.s. - Click the button below to learn more about Jarvis subscriptions. Or go to www.jarvis-labs.xyz and use the chat icon in the bottom right corner.