Tether FUD

by Ben Lilly

We Learn How Much To Authorize in Advance

Tether is what many label as a systemic risk in crypto. That's because of its ubiquitous presence in the markets.

Go to virtually any centralized exchange and you'll see bitcoin paired up with USDT. It's in part why a quick glance at USDT volume and you'll see it's about 50% more than bitcoin.

This makes it the most liquid and used cryptocurrency. And it's why we all care so much about it.

The FUD (fear, uncertainty, doubt) over the potential collapse of Tether is a topic that surfaces several times in a year.

Frankly, I think the FUD is understandable.

Tether is an entity operating much like a bank, but in a transparent ecosystem like crypto. Which means it can't fully disclose its holdings, treasury, and interworking. This is in stark contrast to the rest of the space, making Tether generate a lot of uncertainty over its operations.

While I don't believe Tether operates with the sharpest of edges, I don't think it'll be disrupting the markets anytime soon.

Today, let's look at Tether a bit before the next wave of FUD surfaces tomorrow in relation to a January 15th date.

On January 15, 2021 an almost two year old legal act of gathering information by the New York Attorney General is coming to an end. It's called the 354 order.

It's just a legal requirement to produce information. That's it.

Bitfinex and Tether will be operating as normal on January 16th.

A lot of the FUD originates from an April 30th statement from Tether where they said, 74% of USDT is backed by cash and cash equivalents.

Now, to understand this a bit more let's first understand some more about the life cycle of USDT, the token. It's broken down into four parts. It's first authorized (minted), then issued into circulation, redeemed and finally destroyed. Here's each with more detail:

- Authorized - Token creation and available for the market. These are not counted towards market cap. Think of this like inventory.

- Issued - Authorized tokens that are in circulation, fully backed by reserves, and sold to public. When tokens are issued, the 'inventory' and 'authorized' tokens are shrink.

- Redeemed - Issued tokens are depleted from circulating supply. Customers get fiat in return. Back to inventory and awaiting future purchases.

- Destroyed - Eliminating authorized USDT from Treasury.

OK, so going back to the 74% figure... Not all the tokens referred to in that statement were in circulation. What Tether did mention was all the USDT issued were fully backed.

Here's where there's a little bit of FUD in my opinion...

The backing of USDT is cash and cash equivalents. This includes a $550 million Bitfinex loan (2.5% of Tether's reserves) and bitcoin.

If you listen to Peter McCormack recent podcast (here) you'll note the legal representative and the CTO Paolo Ardoino seem to have no clue where the bitcoin on their balance sheet came from. It's like it just magically appeared from some random acquisition.

My guess is bitcoin was cheap and they bought some. It's a gray area. Sure, they could buy bitcoin up with USDT, bitcoin goes up and their cash/cash equivelents rise, and then they can buy more with printed USDT.

But that's not something that'd last for long. They have too many partners for something like that not to be uncovered.

Again, I think at one point in time they hung out in the gray area in terms of operating, but I think they've since grown up. They are too big now and everybody understands Tether is a systemic risk. We all want them to succeed.

So when you hear about the New York Attorney General and Tether in the news, don't pay too much attention to it. It's just a dog and pony show at this point so Tether get's their practices inline.

One thing I did find really interesting from the interview is when Paolo Ardoino explained why they issue USDT before a customer send funds.

His response was, "We learn how much to authorize in advance."

There's your tell.

Market Update

The Grayscale Effect is proving to be reliable here. Big buyers are not to be seen right now.

Sure, Grayscale opened up investments again and we saw a little bit of bitcoin get added to the Grayscale coffers, but this BTC was likely already purchased ahead of time.

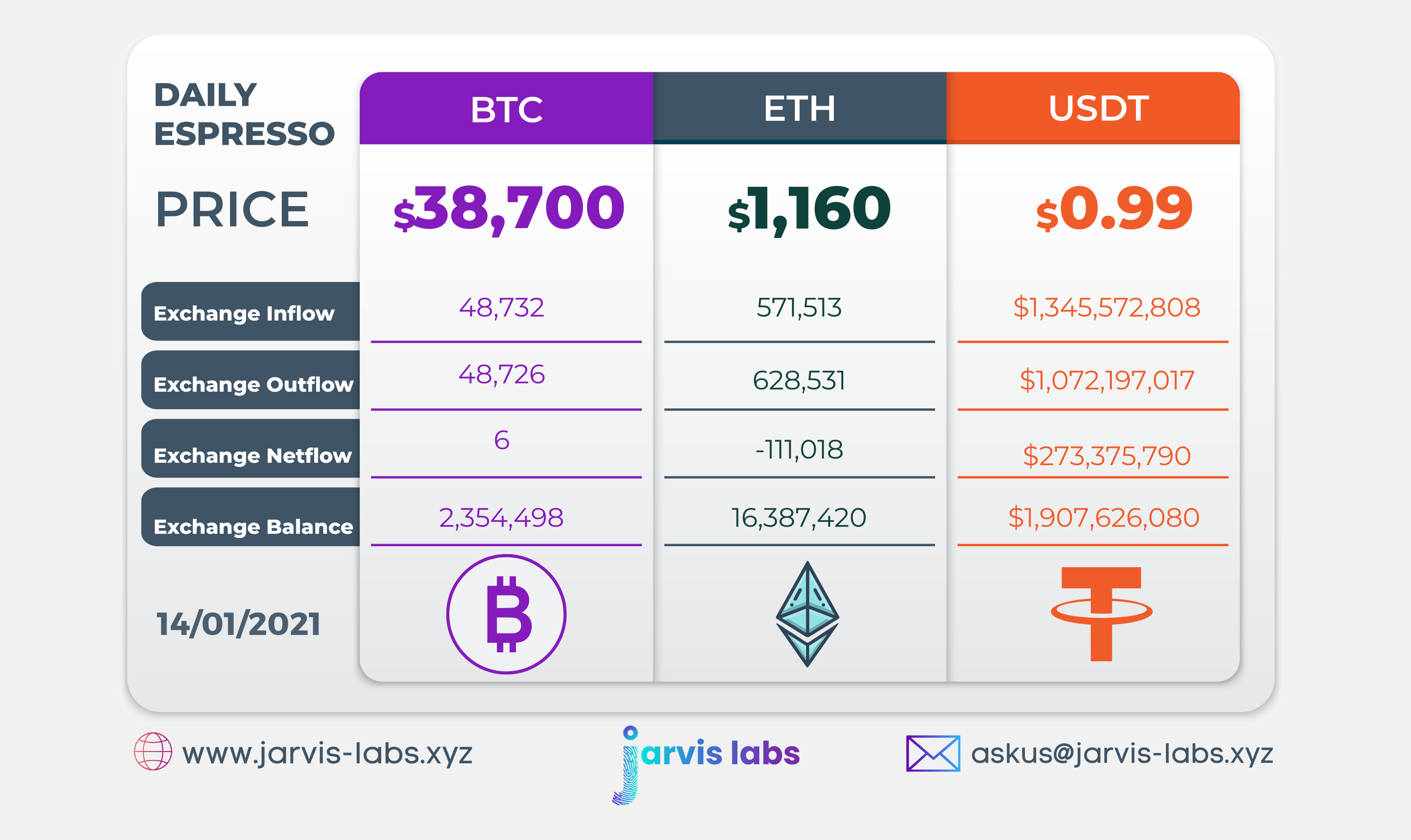

Jarvis AI caught some bids yesterday and put stops in profit, it's more of a minor swing type of play. The USDT we keep talking about appears to still have indecision surrounding it. This tells me either it'll be used to buy a dip or the potential buyer is second guessing themselves.

One interesting note is the funding rates. Every time price starts to gain momentum the funding rate gets insane. This can't continue if price is to go on a run.

Funding rates have started to rise again.

YFI was north of 0.1%. That's a bit higher than the standard 0.015%.

What this all means is consolidation is still in the cards. DXY isn't showing much strength or weakness for the time being as of 21:00 UTC.

Patience for the time being is key. There's some potential for activity bookending the weekend, but that's about it.

It's a good time to clean a closet or weed the garden depending on where you live.

Your pulse on crypto,

B Lilly

Jarvis AI

For clarification to our readers, Jarvis Labs is an Independent Software Vendor. We are not a fund. Our business is providing on-chain alerts, actionable data and algorithmic trading software solutions.

Any inquiries into what Jarvis AI can do for you, please reach out to us by going to www.jarvis-labs.xyz and hit the chat button in the bottom right hand corner. Or send us an email at askus@jarvis-labs.xyz