Tell them it'll drop 50%

by Ben Lilly

The Moment You Buy BTC It Will Crash

Be sure to read the important Market Update below

The moment you decide to finally buy your first batch of bitcoin, the market will drop 20%.

Does that sound like your greatest fear? Or maybe a close friend you know? The fear that the moment you'd been agonizing where bitcoin is flying higher and your or your friend is tired of missing out... but it turns out to not be just poor timing, but laugh in your face awful?

It's a fear each of us grapple with.

My advice to you or your friend is to confront it. Assume that first purchase will be at the absolute worst moment. And no matter what you do, it'll be right when you or your friend hits "buy".

Now ask yourself... If you know that's a given, how will you act differently?

That's what I tell my friends sitting on the sidelines. Friends who I haven't spoke to in a year are calling me up to discuss crypto.

The question I always get revolves around me speculating whether the market will dip or not in the next few days.

In truth, I'm not the greatest discretionary trader. In my own opinion I'm a much better researcher. (Benjamin is very good at discretionary trading.) Which means I know my time is best spent finding patterns, cycles, indicators, wallets, and other data that relate to price. Then figure out a way to automate it. This way when the pattern or indicator hits, the trade happens no matter where I am.

So when it comes to my friends or family, I learned it's easiest to tell them the minute they hit the buy button, whether it's today or tomorrow, it will drop 50%.

And once they let out their nervous laugh on my semi-serious joke, I try not to offer too much guidance. Instead, I try to make sure their mind is right before they begin to dip their toes in.

I've only recently begun this method. So far it's working. And in the long-term I think it'll work out better. Here's why...

I understand I won't turn everyone I meet into crypto a geek. It turns out virtually nobody is curious about how inflation rates and lock up rates might impact the security or velocity of an asset on a certain protocol from day one.

Nor will they be excited about a new DeFi project launching or how the infrastructure is caving in from the current stress its experiencing on Ethereum.

None of this matter to them. I've come to terms with this. But maybe one day they might ask what the difference between two smart asset networks like Polkadot and Cosmos...

And at that point I become the bridge to the crypto rabbit hole. It's when I get to witness their first peek into this mythical world.

However, to get this point means not letting fear get the best of them. And its why I encourage you when talking crypto to your friends and family to confront their fear head on. Otherwise, they'll hold a grudge on crypto and never get past that first step if the market does in fact chop their portfolio by 20% or more the next day.

If you can help newcomers feel a little less fearful, you can act as that same bridge for them. In doing so we can grow the space together.

Ok, enough of the hoorah, go get em talk... I know why you're really here. You're here for some market talk.

I don't want to disappoint... Market Update

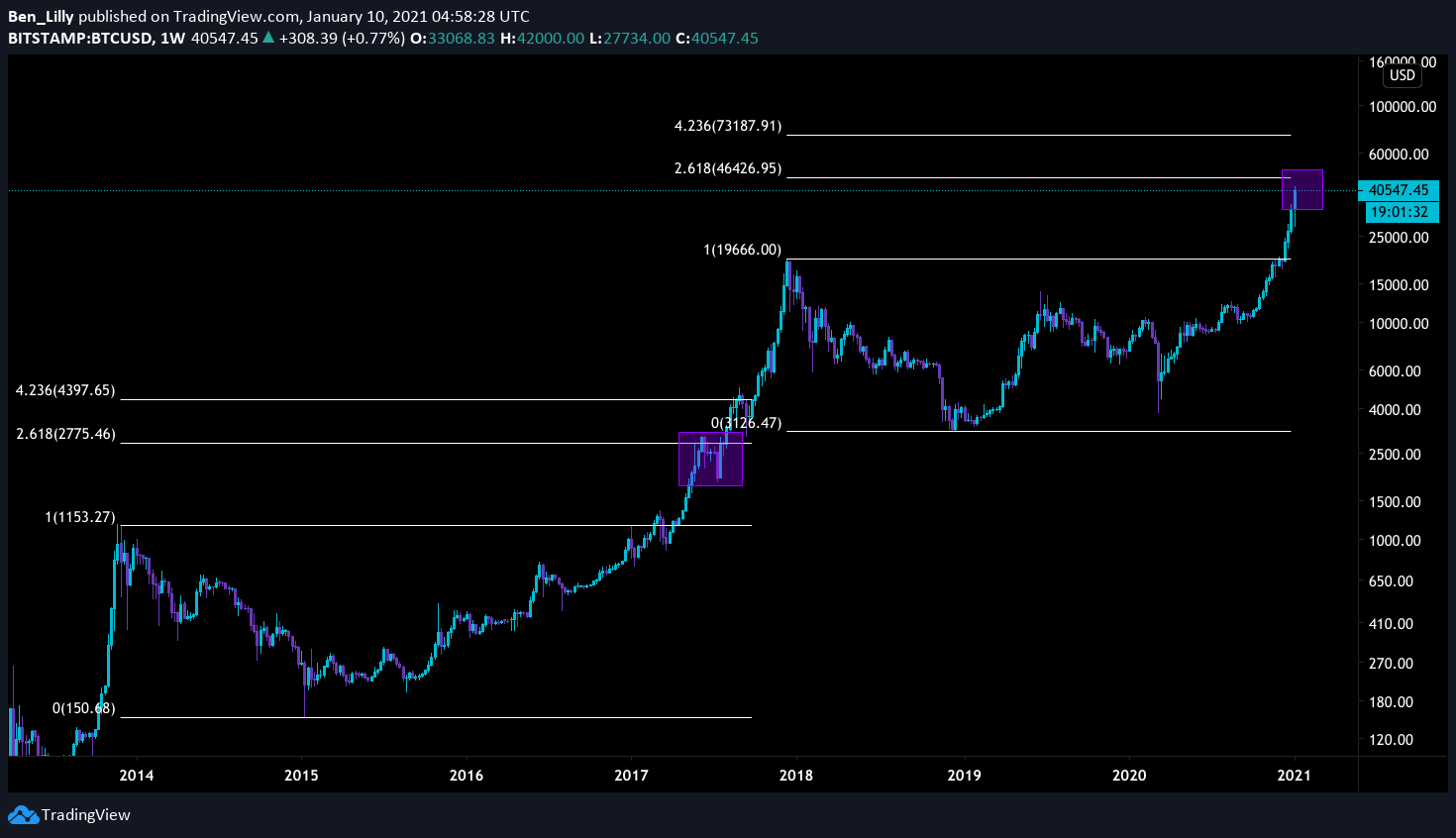

Charles Edwards, the creator of Hashribbons pointed out an interesting price level just a few days ago. It was the $45k area.

That's the price where the 2.618 fibonacci extension lands when measuring the peak to trough of bull cycles.

You can see it in the chart below.

Last major cycle when price reached the same fib level, price retraced around 30%. Ouch.

Now, I'm not a big time believer in fibs, my thoughts on this are two fold. First, crypto is in no man's land when it comes to price discovery. None of us really know how much a network like Ethereum is going to be worth in four or five years from now. There's just no comparable. This isn't a car manufacturer with cash flow and earnings. It's a completely new animal. So to find price targets one of the few tools at our disposal is fib extensions.

And second, if a lot of traders start to believe in it, chances are it'll be a self fulfilling effect. Which is why you must be familiar with the most popular forms of technical analysis in crypto in order to succeed.

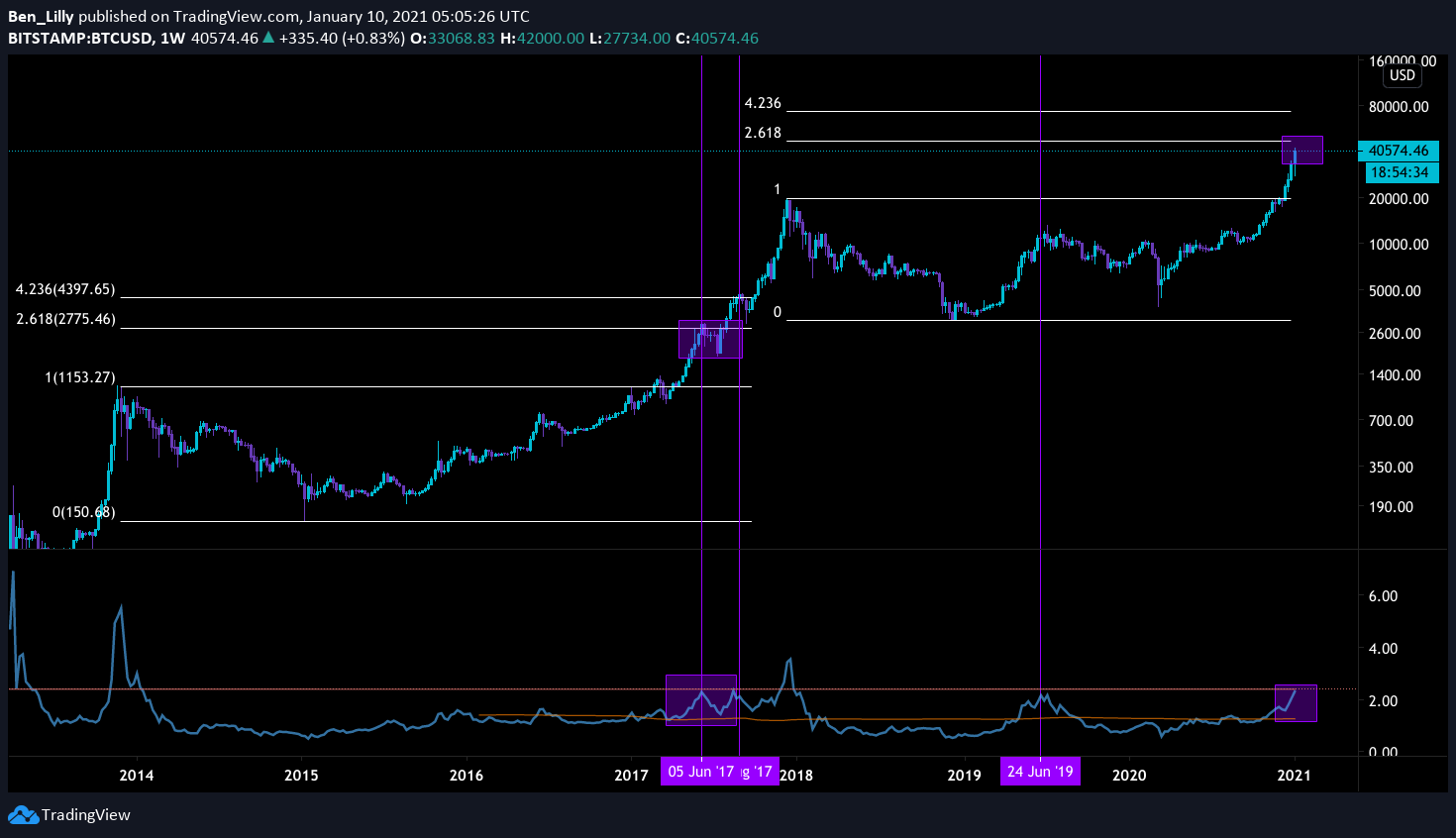

The technicals are not the only reason to pay attention. There's a metric called the Mayer Multiple.

The Mayer Multiple is a way to look at the price of bitcoin in relation to past price. Specifically, it's 200 average. Bitcoin last closed around $40,300 and the 200 day moving average is $14,709. Divide the two and you get 2.74, that's the Mayer Multiple.

The rule of thumb is buy below 2.4 and sell above. Here's the Mayer Multiple over time to give you an idea.

I highlighted some areas of interest. The orange horizontal line in the M.M. indicator on the bottom half is the 2.4 figure. I highlighted historical taps of that line. Price doesn't like it very much...

Here's a zoomed in chart focusing on the last few years.

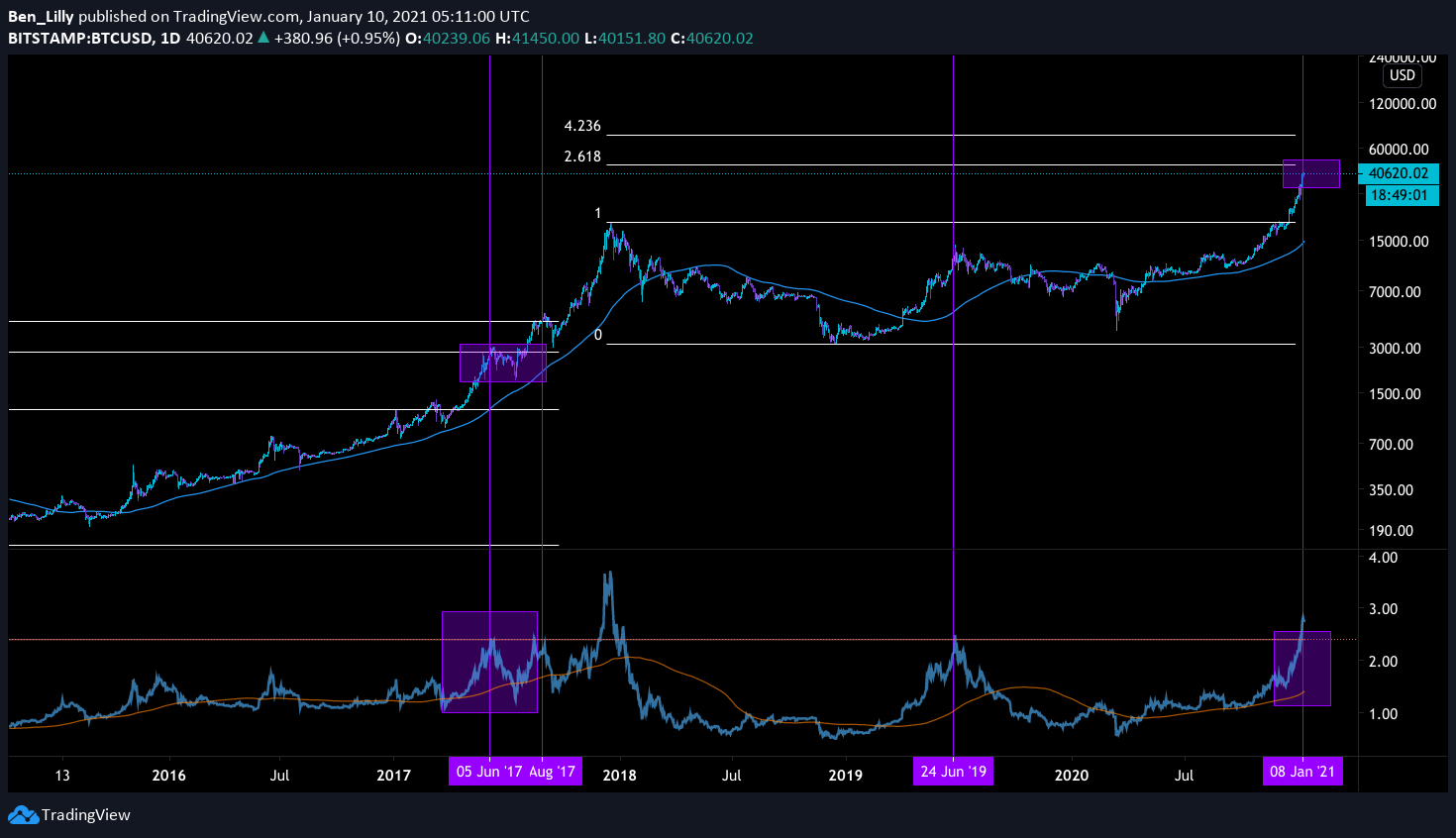

Seems a pull back could be coming this week. Now, in terms of market structure, there are bullish and bearish pieces.

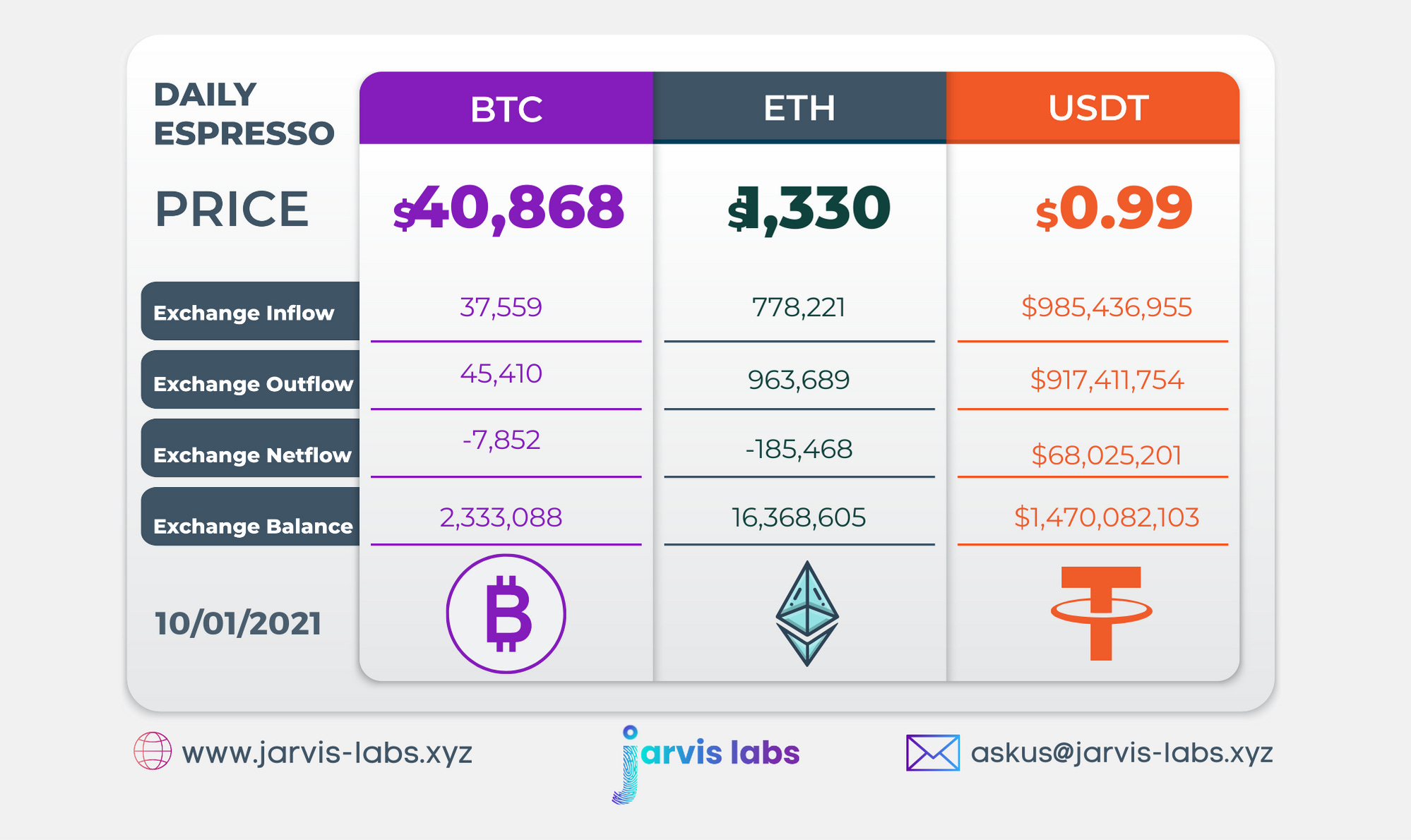

Bullish is USDT. Tether's treasury was running low on Friday and printed $300 million more worth of USDT. With the coffers flush with cash, we saw the market respond as $50 million of it was used in such a way that translates to altcoin activity. There's $250 million still left. Surprisingly, it hasn't been used yet. But that could change at any moment. If it gets deployed, we're going higher. Plain and simple.

The bearish pieces fill up more of the bag... We already mentioned the fib level and Mayer Multiple. The other pieces are $250 million worth of USDT is sitting there to potentially buy up a dip. We don't know for sure why the money hasn't moved, but we've seen dip buying capital like this ready to act.

Funding rates are also insane still with ETH at 0.32% and BTC at 0.2%. That's anything but sustainable.

Then there's the macro picture.

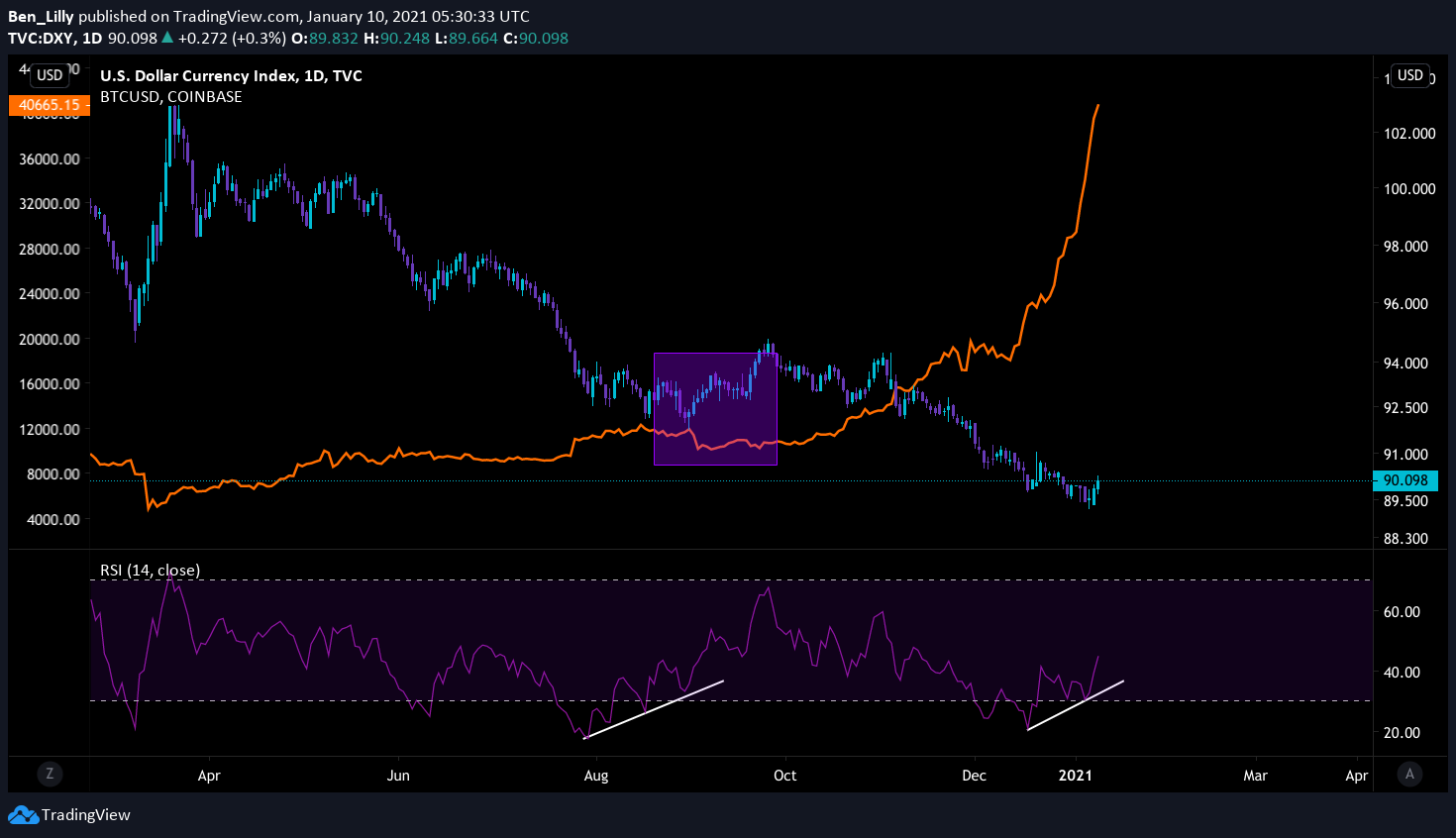

The USD has gotten beaten down like an inflatable tube that you're trying to store away in the same box it originally came in. It's hated by every investor everywhere. And while the long-term outlook for it is terrible when you pair it up with the fundamentals, it doesn't mean it'll go straight down. There will be some bounces. If there were going to be a bounce, the charts line up with it on Monday's open...

One of the biggest theses on bitcoin is a hedge against the dollar. Meaning if the DXY (US dollar index) decides to go on a bit of run for a few days, we might see something similar to what we saw in Q3 2020. At the time DXY was getting crushed. The price had dropped so low it was getting overextended, meaning it needed to cool down. The white trend line was showing a potential mini run could happen. When it eventually did, bitcoin (orange line) took a hit.

Today we are seeing a similar setup. Now pair this up with what we were saying about the Grayscale effect beginning to cool down and the bearish bag is filling up with a lot of arguments for a near term pull back.

Exercise caution, buy a put or two, and don't trade without a safety net.

There will be another time to catch the bullish rally, this week might not be the most ideal time.

Your pulse on crypto,

B Lilly

Let Jarvis Trade For You

Until further notice monthly subscriptions are no longer available until further notice. Each month we set aside a certain amount, but in order to prioritize alpha, we can't budge on this. However, we still have annual and lifetime slots available.

We apologize for the inconvenience.

In an effort to free up slots we are offering a limited-time opportunity for monthly subscribers to upgrade to annual or lifetime. If you’re interested we’ll pass along a 20% discount, that’s a $500 savings or two months free. Or on a lifetime that’s $2,000 off, almost a year for free!

Contact @benjamin_bc on Telegram if you have any questions.

Remember, for lifetime subscribers you get any and all Jarvis products such as option bots, hedging bots, multi-account access, and more.

-Jarvis Labs Team

p.s. - Click the button below to learn more about Jarvis subscriptions. Or go to www.jarvis-labs.xyz and use the chat icon in the bottom right corner.