Bitconnect on-chain

by Ben Lilly

Bitconnect On-chain

Carlos Matos of New York, USA lured other investors in with his glowing smile and magnanimous personality.

But it wasn't just Carlos.

It was single moms, folks who couldn’t afford retirement and middle-class laborers who would all preach of a better life. These stories would drop the guard of listeners before they got peppered with investing pitches.

But the testimonials were too hard to ignore. Their stories all included experiences of how their investments grew and reversed their luck. The savior was a lending platform called Bitconnect. Its secret was in lending, trading, and what was described as volatility software.

Investors were earning 1% daily compounded interest. The project was so popular it broke the top 20 cryptocurrency tokens by market cap.

Then it all came crashing down. Carlos Matos like the rest of Bitconnect investors saw their money evaporate.

Bitconnect was a multilevel marketing structure that relied upon the next set of investors to hand over the funds. It's how they kept impossibly high payouts going. Clever marketing and a bit of distraction were enough to keep wary eyes from asking too many questions.

Its collapse became the most talked-about crypto ponzi scam in early 2018.

We hope to never see anything like it again. But the fact of the matter is these things sprout up like weeds. And in euphoric times like right now in crypto, I wouldn't be surprised to hear about one next week.

Luckily, there is one development becoming more mainstream by the day. It's Decentralized Finance (DeFi) and its ability to keep transactions fully on-chain make projects like Bitconnect nearly impossible to exist.

In fact, if Bitconnect was fully on-chain today, I'd wager it would never have made it more than a month.

I'll show you why...

Never Trust, Always Verify

On-chain projects are becoming commonplace. You may have heard of Uniswap, Macha, 1inch, Yearn finance, Synthetix, Hegic, Maker, and dozens of others.

These are financial tools letting users you to lend, borrow, trade, swap, purchase call/put options, and many other things. It's as if the legacy financial tools are sprouting up as applications transacting fully on-chain.

This means collateral, fees, interest, smart contract funds and more are always visible and verifiable. That includes the history of all transactions, trades, interest payments, providers, and borrow addresses are all there too. It exists on the Ethereum blockchain.

That's why you never need to trust anyone in crypto if the transaction, project, or whatever is 100% on-chain. Simply verify the blockchain for what's actually happening under the hood.

It's an easy way to weed out the bad actors. If Bitconnect was on-chain, Carlos Matos would not have become an internet meme just as crypto witnessed its blowoff top. New investors could view how the funds were being generated if investors were truly getting 1% daily compounded payouts, how their lending and trading was doing, how many investors were receiving payouts, and a lot more information.

It'd take one researcher five minutes to realize something isn't lining up with Bitconnect. That's why on-chain is so powerful.

And it's why we are big believers in what DeFi is and where it's going. It's why we are joining the DeFi crowd and launching an on-chain fund on Enzyme Protocol (formerly Melon Protocol).

It's a platform allowing fund managers to set up shop and allow anyone to take a magnifying glass to their performance.

We love it.

For us, we can finally show what Jarvis can do. And if anybody wishes to learn more we can point them to a smart contract address to show its performance. Further questioning means digging into the blockchain. It's a win-win in our minds.

So while we are fast approaching Enzyme's version 2 launch, it means we are also fast approaching our launch. We hope you join us in starting this next venture.

In the meantime...

Market Update

Did you see the whiplash investors got shortly after bitcoin poked its head above $40,000?

It didn't take long for bitcoin to dip below $37,000. For Jarvis traders, we got knocked out of our risk-free bitcoin trade for no loss after finding an entry in the first dip.

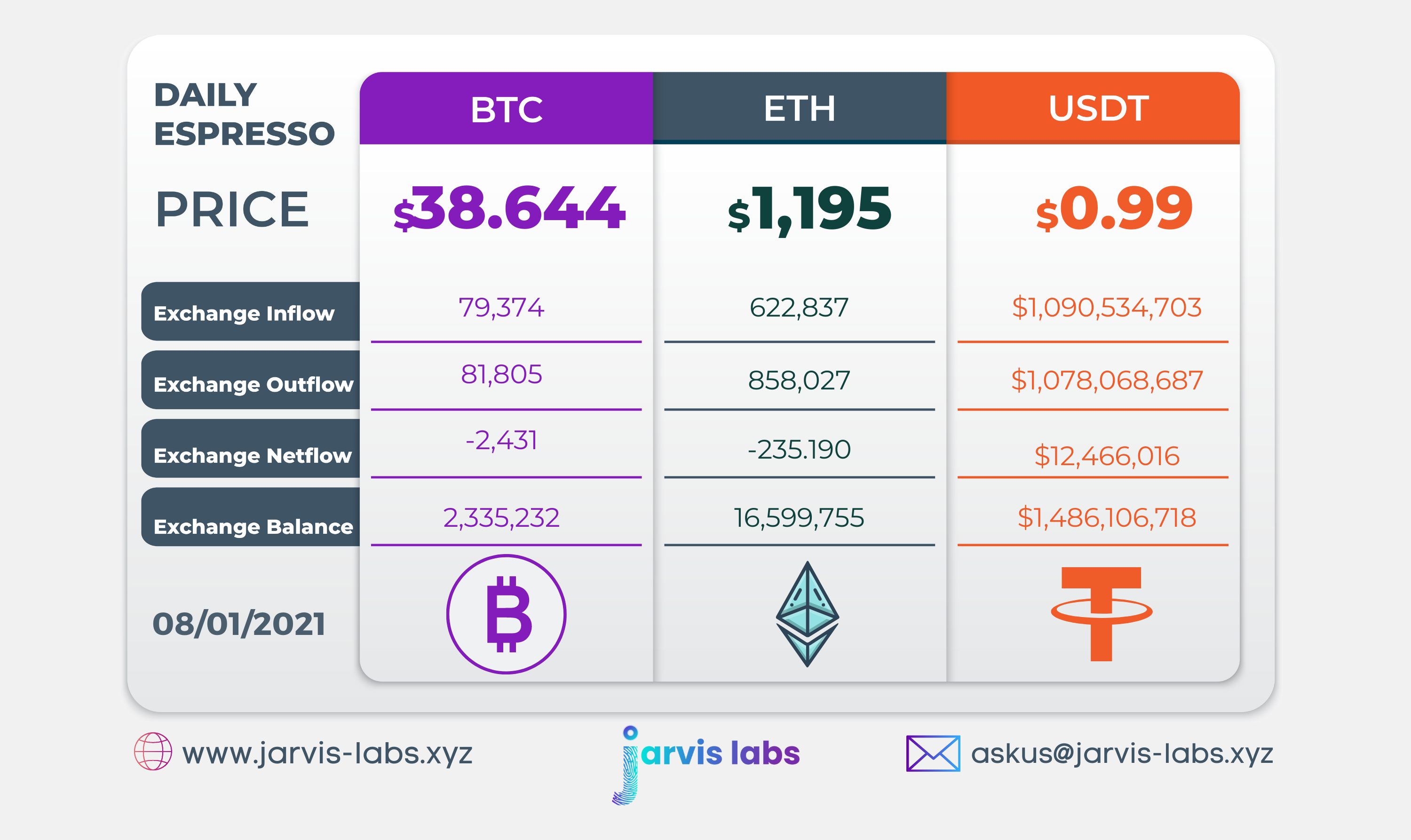

Yesterday saw a lot of stablecoin volume pop up on-chain especially before the rise to $40,000.

Bitcoin and Ethereum continue to leave exchanges, which only continues to clean out the coffers of these exchanges.

The funding rate on Binance is a hair below 0.1% after the series of stop-loss hunts. This is a bit more manageable and more in line with expectations as this bull market rages on.

Fuel meter is sitting at 70, while Risk meter is at 91. This indicates buyers are still coming in while disregarding the risk in the market. In euphoric markets, this is nothing surprising.

That's it for now. If we see more stablecoin flows tomorrow we expect $40,000 to be another checkpoint that's tested, conquered, and left behind.

Your pulse on crypto,

B. Lilly

p.s. - Special thanks to Michael for the idea of Bitconnect. If you ever have anything you'd like us to cover, drop me a line at askus@jarvis-labs.xyz or ben.lilly@jarvis-labs.xyz

Jarvis Update

Until further notice monthly subscriptions are no longer available until further notice. Each month we set aside a certain amount, but in order to prioritize alpha, we can't budge on this. However, we still have annual and lifetime slots available.

We apologize for the inconvenience.

In an effort to free up slots we are offering a limited-time opportunity for monthly subscribers to upgrade to annual or lifetime. If you’re interested we’ll pass along a 20% discount, that’s a $500 savings or two months free. Or on a lifetime that’s $2,000 off, almost a year for free!

Contact @benjamin_bc on Telegram if you have any questions.

Remember, for lifetime subscribers you get any and all Jarvis products such as option bots, hedging bots, multi-account access, and more.

-Jarvis Labs Team

p.s. - Click the button below to learn more about Jarvis subscriptions. Or go to www.jarvis-labs.xyz and use the chat icon in the bottom right corner.