Espresso 2.0: January's Grayscale Effect

by Ben Lilly

The Calm is Coming

The Holidays are nearly over and so are GBTC unlockings.

With the drop in unlockings the Grayscale Effect looks to be a non-factor over the coming weeks.

Recall, Grayscale Bitcoin Trust (GBTC) accepts investments from accredited investors. These investors receive newly minted shares that can be traded in the stock market six months later.

Once these shares can be traded in the market, we call it an unlocking event. Shortly after these unlockings occur we noticed price rises. That's the quick take on what the Grayscale Effect is.

Today, I want to show you where we are on the unlocking schedule and what it means for January. But first...

I want to welcome our new subscribers! Our Grayscale report from last week generated a lot of interest. Many of you took the time to reach out, ask questions and provided some feedback. I want to thank you for taking the time to do so.

Others went ahead and took the leap to subscribe to our automated trading software, Jarvis. To those folks, congratulations! We look forward to helping build your holdings. If any of you signed up for a lifetime membership, we have a private Telegram channel you can join. Reach out to @Benjamin_bc for more information on that.

OK, so many of you are new, so a quick breakdown on what we cover in Espresso before jumping into our insight of the day.

Our almost daily newsletter tends to look at the structure of the market. What does the on-chain exchange flows look like, how much tether are locked and loaded in wallets that are correlated with bullish price action, is the derivative market getting out of whack, what regulatory or systemic like risks are there, what did the most recent USDT mint mean, and more. This makes Espresso more like a jolt of caffeine to get your trading day started.

In terms of what Espresso is not... We don't go over buy signals, sell signals, profit taking prices, and the like. We're not a trade group. We are a team with a background in economics, finance, data science and computer engineering that built Jarvis our artificial intelligence machine to trade for us. Our time is spent digging into what moves price, modeling it, and then feeding it into Jarvis. We find this to be the most successful way of using our time and being successful traders.

As we do our research we come across what we believe to be interesting stories about the market. When this happens we like to share it. That's what the Grayscale Effect report was. To us it's interesting. We don't view it as giving away alpha since we have our own detailed models that cross reference everything we track. And frankly, there's about to be so much capital flowing into crypto there's enough alpha for everybody to enjoy.

In fact, in a few weeks we'll have another story on Chainlink. It was going to be completed for this week but so many of you want to know more on Grayscale. So we wanted to satiate those desires first. So let's get to it...

Here's Where We Are

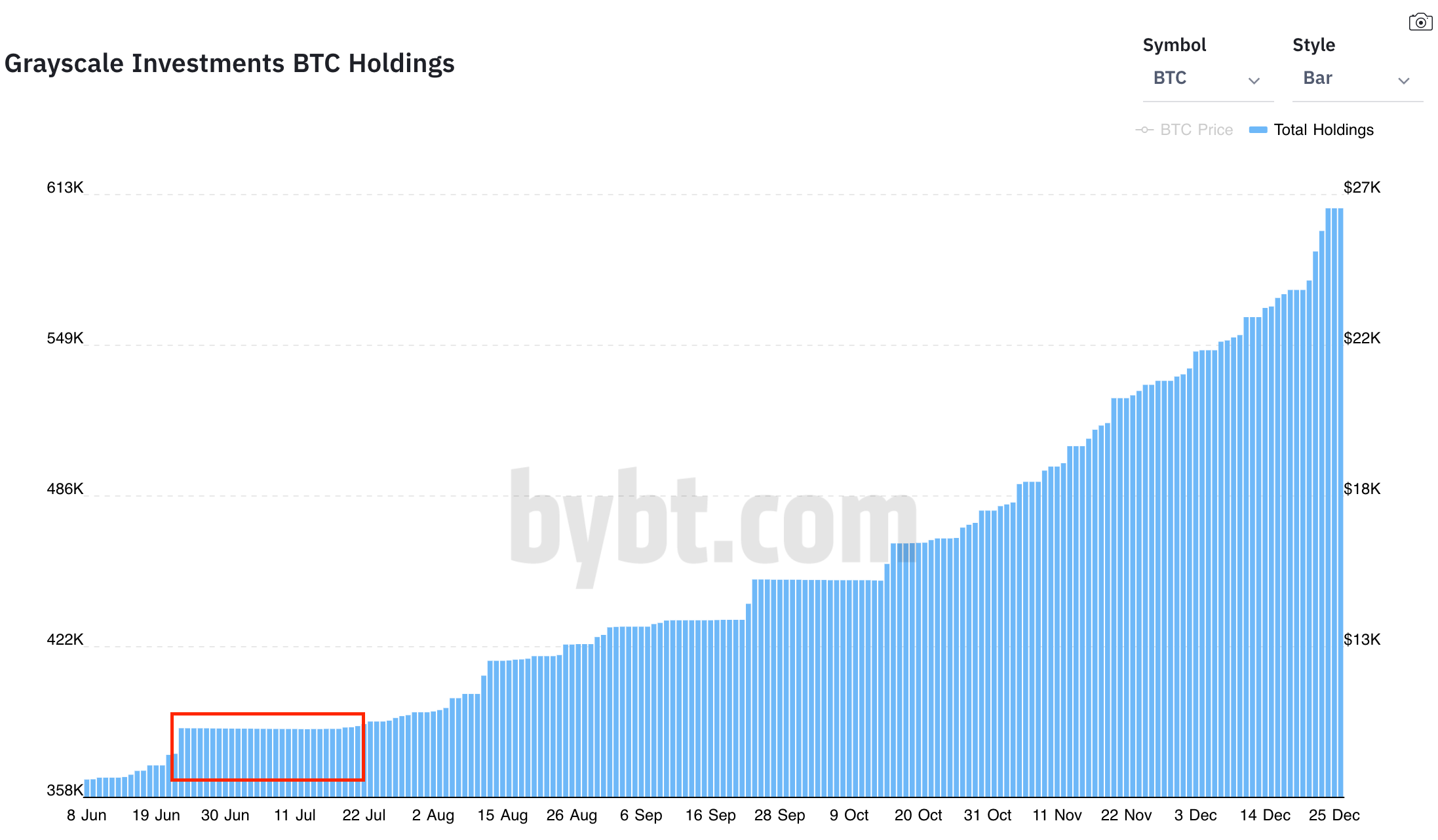

The chart below is from bybt.com (shout out to M B on this). It's a daily bar graph of BTC holdings over time - as opposed to the weekly charts I used previously.

The red box is the period we're about to enter.

June 23, 2020 was when new holdings into Grayscale went flat, and six months later brings us to December 23, 2020. That's the date we are focused on because price tends to rise shortly after an unlocking. With no unlockings for about five weeks after December 23rd, the Grayscale Effect won't be driving BTC prices.

After the Grayscale Effect on price runs its course on the current unlockings, we are anticipating the premium on GBTC will shrink.

Note, this most likely won't be December 29th on the dot. I know that's what we said last week, but the effect on price can last a week or two after the last unlocking.

The next significant uptick on new inflows into GBTC is August 5th, 2020. Six months later brings us to February 5th. Which means the month of January might be a good time for Ethereum and altcoins to play catch up. That's assuming BTC consolidates instead of dropping.

I know everybody seems to be eagerly awaiting a drop on BTC. To be honest, I don't know if it'll come or not.

What I do know is the Grayscale Effect on BTC prices seems to be on the sidelines over the next five weeks or so. That information by itself is powerful.

The Chart Below

OK, again, I know we have a lot of new subscribers joining us. If you know what the table is below, go ahead and skip this section.

The chart below details exchange flows over the last 24 hours for BTC, ETH, and USDT.

When more inflows happen than outflows, the netflow is positive. Postiive netflows tend to be bearish on price when we see it for BTC and ETH. That's because more holdings entering exchanges tends to correlate with more selling pressure. When netflows are negative for BTC and ETH, it means there is less selling pressure.

Regarding USDT, the opposite is true. The way to think about this is when USDT is entering exchanges, there is more 'fuel' to push price higher. Tether tends to enter exchanges and then buy assets. When USDT leaves, it means traders appear to be pocketing their profits.

Below are the exchange flows over the last 24 hours.

Your pulse on crypto,

B. Lilly

Let Jarvis Trade For You

Did you like the Grayscale Effect report? If so, Jarvis can trade that effect and dozens of others we've uncovered in the market.

That's because Jarvis uses real-time data across several blockchains to track over 800 market mover wallets to front run them and update on-chain metrics as transactions happen. This helps turn the market into a second stream of income for you... while you sleep.

Any questions you may have please don't hesitate to reach out to us at askus@jarvis-labs.xyz or on our website via the chat button in the bottom right hand corner: www.jarvis-labs.xyz