Grayscale is the Market

by Ben Lilly

Grayscale's (GBTC) Pump Effect Means 2021 Will Start Slow

(I got a lot of feedback on the Grayscale analysis from last week, so I decided to re-write it and break it down even more. As you'll see, it's a compelling argument. As always, you can reach me at ben.lilly@jarvis-labs.xyz or on telegram at @Ben_Lilly if you have any questions. And if you want to share this article with your friends, here our Twitter: https://twitter.com/Jarvis_Labs_LLC.)

It started with a solitary alert.

The spot market was finally driving the market, not the derivative market. It was the first time we'd seen this in almost three years.

Alerts continued to pour in. After several months it was clear Bitcoin was not just heating up, the market was an inferno.

Soon the reality of the macro shift began to settle in and we'd come to terms that the bull market was not something to question, it was a given.

The long-awaited bull market is here... But something seemed odd.

The cacophony of alerts showed an organized effort. But not an effort reminiscent of a coordinated whale pump we'd come all too familiar with in terms of tracking. The traits of this effort hadn't been seen before. Like a new species leaving their footprints on the blockchain for the first time.

It didn't take long for the news to come out. Grayscale had $300 million of inflow in a single day back. That was October.

In response, we knew it was time to get the hands dirty and begin digging into the spot buying data and Grayscale.

The tools at our disposal were 8-k reports, quarterly reports, a cell phone, and Jarvis.

Now for those who don't know, Jarvis is our artificial intelligence machine that tracks real-time blockchain data across several networks. We use it to help manage an army of algorithms that minimize risk, pinpoint timing, and take advantage of volatility via spot, futures, perpetual futures, and options. The best part is Jarvis trades for us and acts as our steady compounding machine.

And when it came to Grayscale, we wanted to see what told Jarvis the spot market was heating up several weeks before the price began to really take off.

This meant we needed to find out how Grayscale operates. What we found is the biggest driving force in crypto and it'll lead to a slowdown starting December 29, 2020.

The in's and out's of Grayscale

To sum it up, Grayscale is an entity of the Digital Currency Group that has cornered the market, accumulating a total of 536k BTC to date.

Their unique structure is what makes it possible. It’s essentially structured to hoard Bitcoin. BTC and USD (which is then used to purchase BTC) flow in and nothing comes out.

The way Grayscale achieves this one-way flow is in the way they distribute shares. Accredited investors or 'wealthy individuals' can sign up for Private Placements to receive shares.

These accredited investors can then give BTC or USD to Grayscale. In exchange, Grayscale gives them an equal value of shares. If each share equals 0.001 BTC (In reality it’s 0.00095085) then for every BTC handed over to Grayscale, the accredited investor receives 1000 GBTC shares (minus a small fee).

The catch is the private investor must wait 12 to 6 months before selling the shares on the market. That's where the non-accredited retail investor comes in. Aka the not so wealthy buyer.

It might seem fair, the exchange of shares for BTC, but in reality, it's anything but fair. That’s because GBTC almost always trades at a premium. non-accredited or retail investors looking for a pure-play into BTC within the stock market are paying anything but fair value.

Here's what I mean... Recently GBTC closed at $28.25. Bitcoin according to the BraveNewCoin Liquid Index closed at $22,830. According to the Grayscale website each GBTC share equals 0.00095085 BTC. Meaning fair value for GBTC is $21.71.

The current price represents a 30% premium just because the buyer isn’t wealthy. And that’s a 30% premium going straight to the accredited investor who handed over their BTC.

This strategy is how Grayscale created a Trust where Bitcoins essentially flow one way, into the trust. What accredited investor who owns Bitcoin is not interested in growing their balance in terms of Bitcoin? It doesn't matter if the price is $5,000 or $20,000. The value in terms of BTC grows as long as there is a premium.

It's an almost risk-free 30% return in six months. In a year, 69% if each 6 month period is a 30% return.

The 30% return is pretty impressive, and natural economic pressures should bring this premium down to 0%.

Yet, for some reason, we just haven't seen that happen yet. Let's find out why.

The Effect

The easiest way I found to explain the Grayscale effect is by breaking down various periods of high inflows into the fund and looking at Bitcoin's spot market price action shortly after the dates shares are unlocked. I then compared this with the change in GBTC premium slightly before and after this date.

That's because rational investors will continue to buy-in to the Trust as long as this premium exists near the lock-up. If it does, they are likely to rinse and repeat, adding more funds into the Trust. Otherwise, opportunity costs would likely push investors towards spot markets.

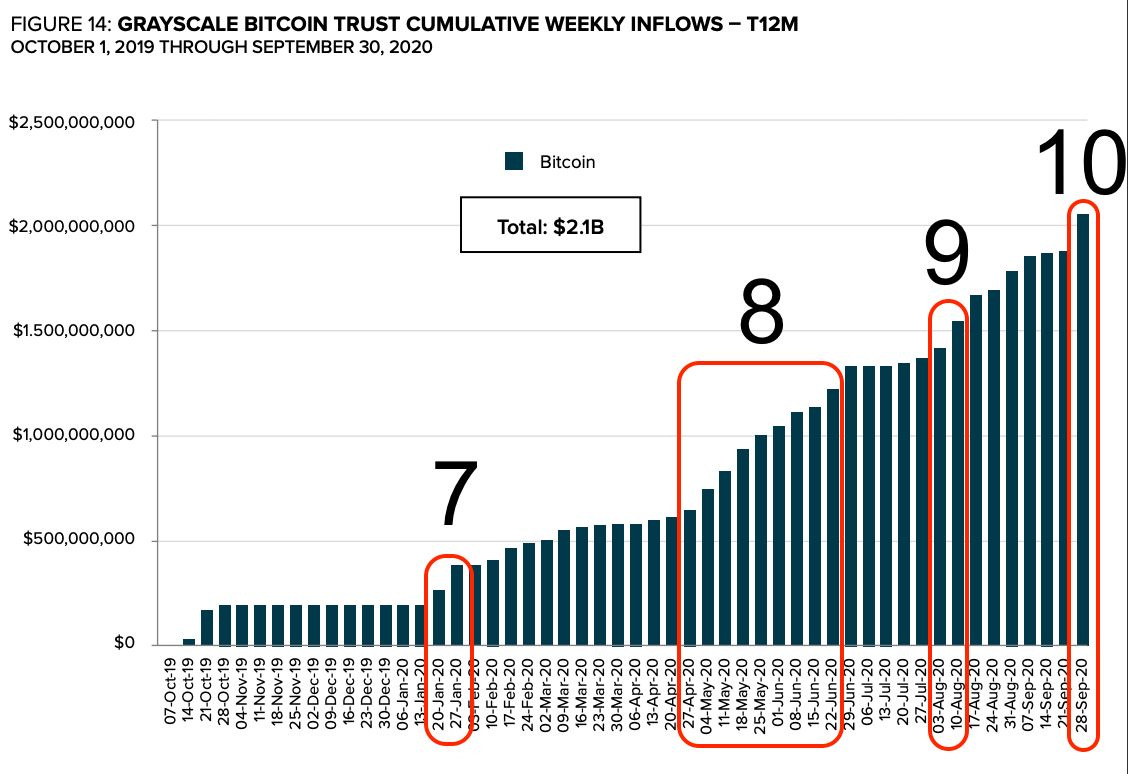

To understand this better I broke high inflow periods into 10 tranches. I'll be running through each one. If you start to get bored halfway through, just jump to the next section where I draw some conclusions. I'll admit, it gets a bit redundant here, but I do this for thoroughness.

So first up is tranche 1 and 2.

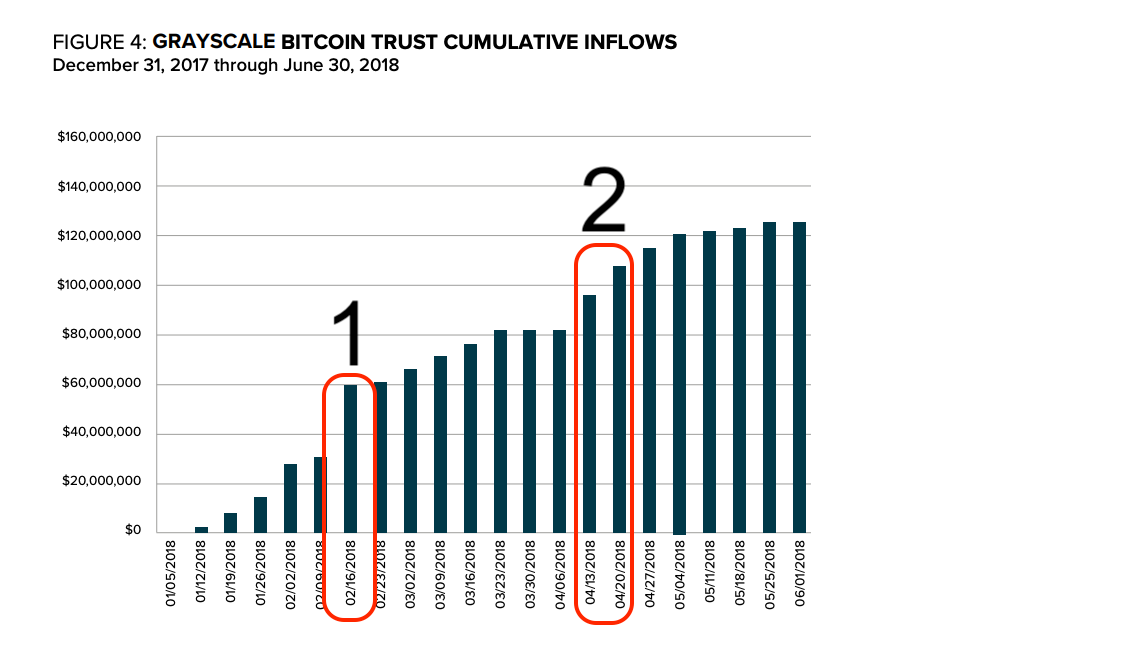

The chart below shows two periods where the fund witnessed a large jump of inflows. Tranche 2 appears to happen after a brief period where no inflows were happening. Consider these 'flat' periods as moments when Grayscale did not accept new investors (similar to right now).

These two tranches were set to unlock twelve months later around February 16, 2019, and April 13, 2019. Yes, twelve months. The six-month lock-up didn't come around until January of 2020.

Now two weeks before each unlocking period the average net asset value was 18.8% and 23.9%. These figures represent the premium GBTC is trading at in terms of the total amount of BTC held by the trust. If there were $100 million in assets in the trust, it means shares are trading as if the trust is worth $118.8 million or $123.9 million.

When the premium is 0% GBTC buyers are getting fair value for the assets held by the trust.

Now where things get interesting is after each unlocking event. As you'll see, BTC has noticeable moves every single time. Here's the price shortly after the first two tranches.

During these pumps, the premium swelled to 26.1% on April 3rd and 39.85% on May 10th.

Now, after two instances it can be considered a fluke. And it can also be considered a great coincidence that the first major unlocking occurred as Bitcoin bottomed out from its December 2017 high. (Note: That wasn't the first unlocking, just the most significant to that point)

So to find out if this was a fluke, let's keep going.

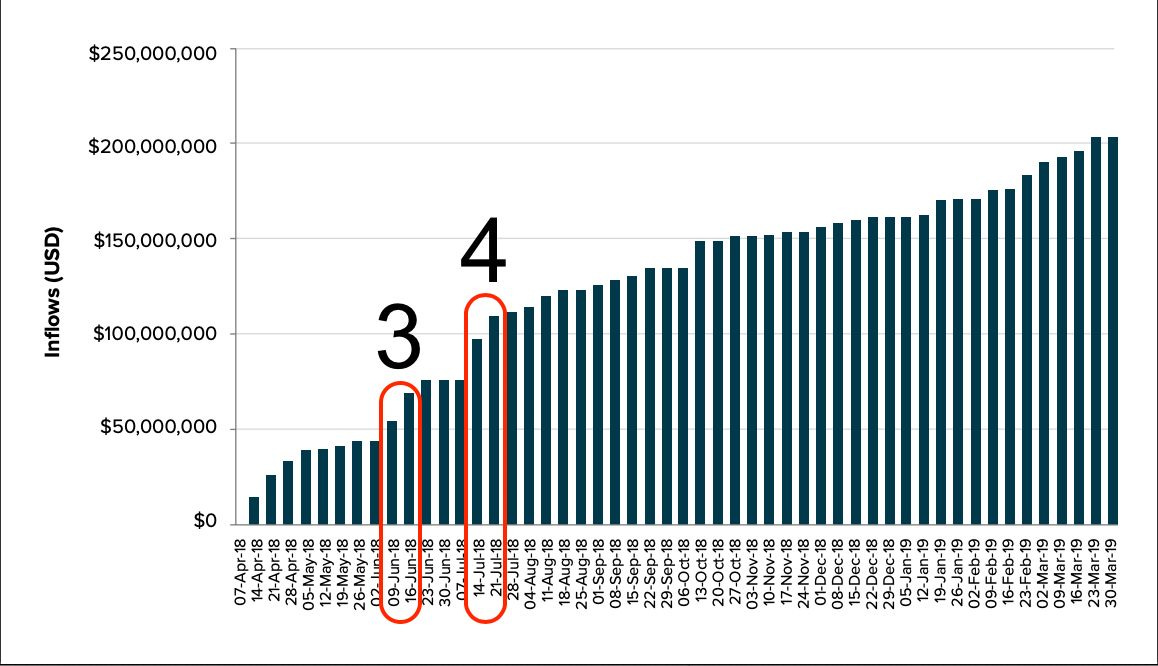

Moving on to tranche 3 and 4.

Tranche 3 unlocked on June 9 and June 16, 2019. Remember, the 6-month lock-up didn't change until 2020. The week prior to tranche 3's unlocking, the premium on GBTC shares averaged 26.4%.

At the end of the June 17th trading week, the premium hit 41.9%. And for five consecutive trading days starting on June 20th, the premium's average was 38.4%.

Tranche 4, the premium's average was 31% for the week prior. Selling the second week of the unlocking resulted in an average premium of 38.1%. Two weeks makes sense here because this tranche had two weeks of significant upticks in inflows. Meaning you can interpret it as one week after the period of unlocks.

Here is the spot market during that period.

A quick note on why I'm showing the spot market here. If price were to be manipulated, it'll likely show up here. That's because premiums for GBTC tend to be influenced by the underlying asset, BTC. Therefore as prices rise, premiums can rise. And as for price drops or consolidates, premiums shrink.

The other thought for why the spot is arbitrage.

If shareholders are selling GBTC at a premium and buy a spot at the same time, they fulfill two purposes. They buy back their BTC on the spot market and drive up premiums. It's a win-win as the price has no effect on the return in terms of BTC.

Again, bitcoin can be $5,000 or $50,0000 and the return in terms of BTC does not change. The focus is on the premium. Move the premium, increase your stack.

Now back to the doldrums of the tranches...

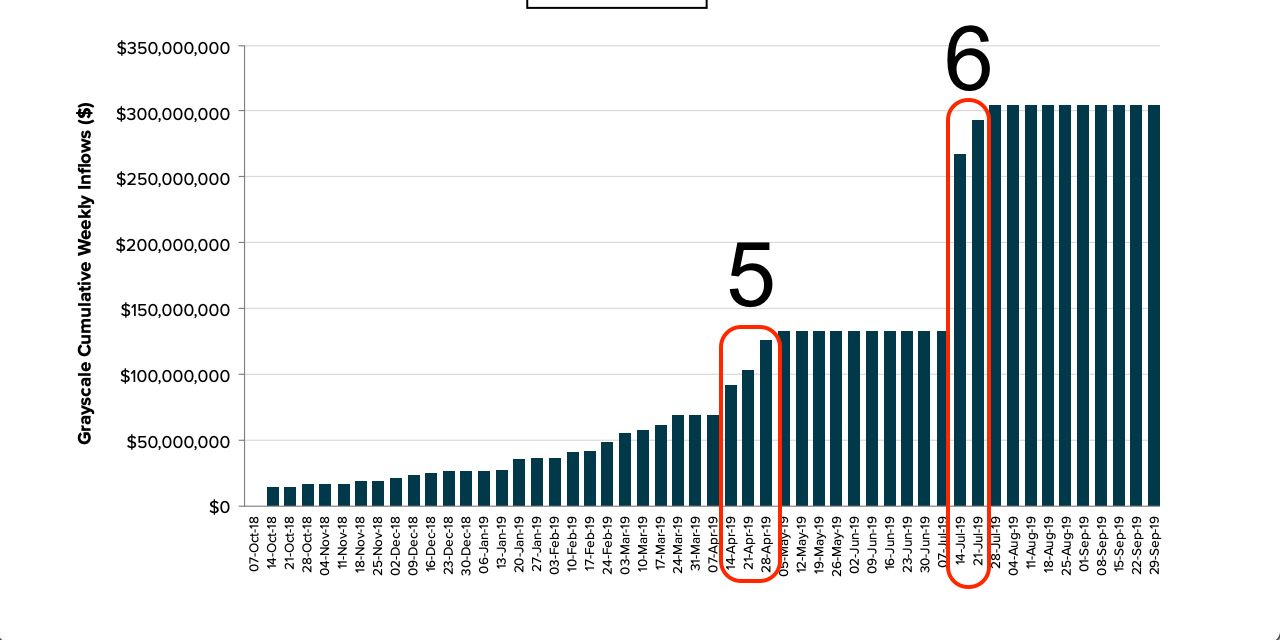

Tranche 5 and 6 These two are unique in that the unlocking happened as the Trust moved from a 12-month lockup to only a 6-month lockup.

The rule changed happened on January 21, 2020, and takes 90 days to go into effect. I was uncertain whether this applies to shares already under the unlocking timer or it only applies to new offerings. As I'll show you in a moment, my intuition says it didn't apply to shares already pending.

Here is tranche 5 and 6. As you can see tranche 6 more than doubled the Trust's inflows.

For tranche 5 the 12 month period ends on April 14 - 28, 2020. The rule change if applied to this tranche would be April 20. So not much impact here.

The average premium before the unlocking period began was 11.9%. The premium average just after was 21.4% with a high of 30.7% on May 7th. This sizable jump surrounding the unlocking means the fluke and coincidence argument starts to lose water.

Then there's Tranche 6, a monster. Here's the chart so you know what I mean.

As for the premiums on tranche 6, the week prior to the unlocking on July 14th the average was 11.7%.

This one got thrown off a bit with an outlier. The day before the unlocking the premium was 7.8%. The week after the July 21st unlocking was 18.25%. And the week after that it was 23.6%. Meaning there were plenty of opportunities to capture the premium.

Tranches 7 through 10 are next. The rule change occurred on January 21st, so the rest of the tranches are 6-month lockups.

Tranche seven ends up falling on July 20th and July 27th. This overlaps with tranche six in terms of the premium. No need to cover this again.

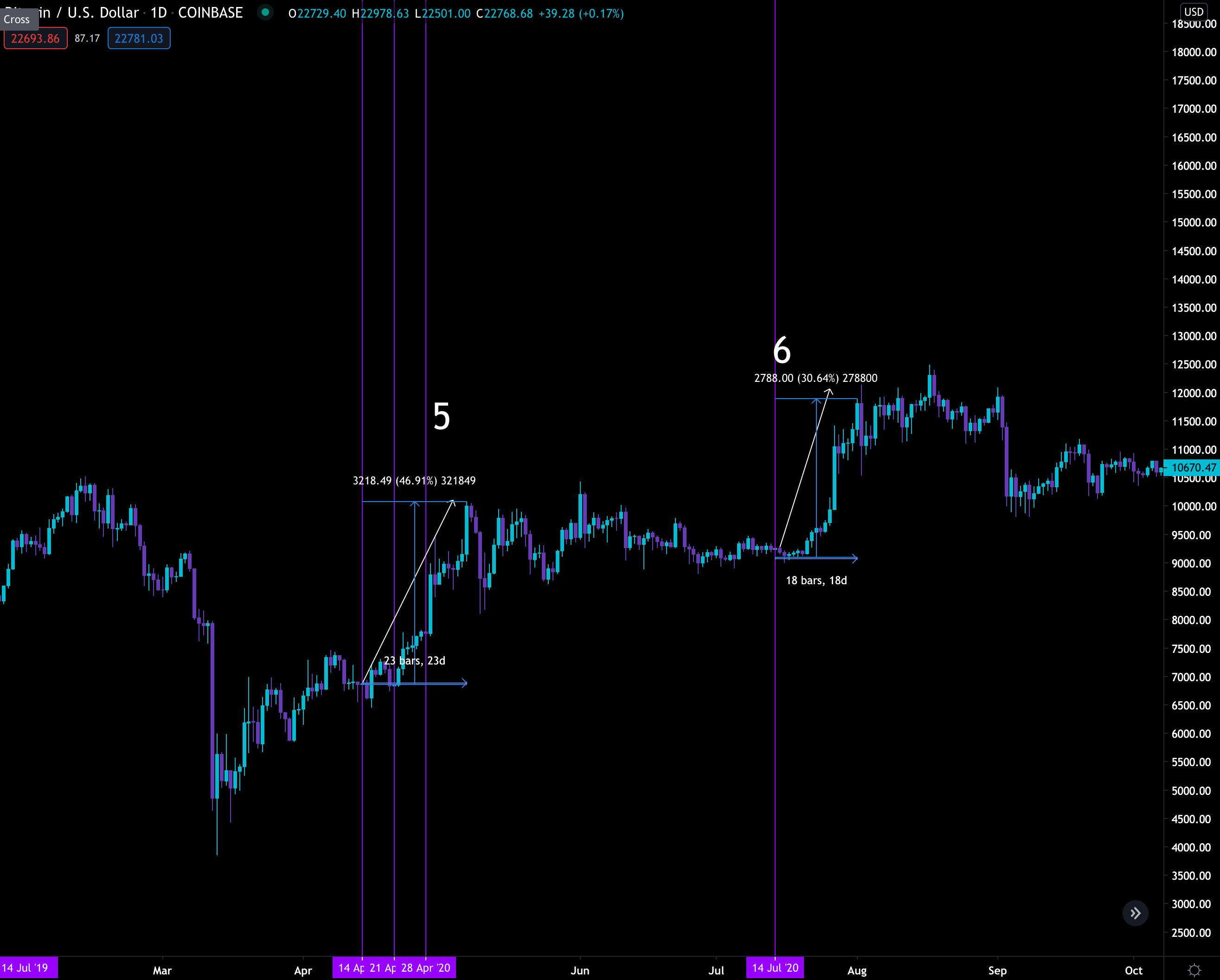

Tranche eight was an absolute moon shot. It was a sustained period of inflows from April 27, 2020, through June 29, 2020.

The various unlocking events started on October 27, 2020, and runs for 9 weeks to December 29th.

In terms of what the premium was before, I chose to look at the first half of October. That's a period well enough before the gauntlet of unlocking events. The average for the first half is 11.2%.

The average from the start of November 2nd to December 18th is 22.5%. Six days of which hovered above 30%. Another winning tranche. And each week during this series of unlocks is like a cash register of Bitcoin for accredited investors.

There really wasn't much opportunity for an accredited investor to get it wrong.

The price action supports this moon shot period.

These unlocking events coincide with significant price moves higher.

What's important to know is once these higher price moves and premiums are realized after an unlocking, the price goes on to consolidate. This lets the premium shrink again before its next unlocking event.

Combining this information with Jarvis and its data on spot purchases driving the market higher, it's clear Grayscale is driving the market. There is nothing more important for you to focus on. Even 3 Arrows Capital is getting in on the game.

They bought 21 million shares back in June of this year per the SEC EDGAR filing system.

So What Does it Mean?

The next major unlocking is set to happen around February 3, 2021. Meaning the time period from December 29th to the next unlocking will be void of unlockings.

This void enables premiums to shrink again just like the nine times before. And it'll keep shrinking until the next unlocking.

Because of this, I expect the price to either consolidate or sag.

Now, I say sag because the duration of the last unlocking is unprecedented. It unfolded for over 9 weeks.

The market is overextended after this huge rally. Combine this with what is typical over the holidays - lower trading volume and lower levels of liquidity. Then a scenario where momentum builds to the downside becomes very real.

It's the holiday season, many traders and trading desks are enjoying time with family and not coming into the office.

And as this holiday season effect happens as a gap in unlocking events begins, there is a real opportunity for lower prices or consolidation over a two month period.

This means Bitcoin might not be a great trade for the first two months of 2021. If we don't get any dramatic moves lower, expect ETH and altcoins to have an opportunity to play catch up.

To determine if ETH is under the Grayscale spell and can see some Grayscale Effect Pumps over the coming two months I'll be looking into ETHE, the Ethereum Grayscale Trust.

I understand there's a lot to digest here. Please drop me a line if that's the case.

Your pulse on crypto,

Ben Lilly

P.S. You can also have a read aboutt what I mentioned in Crypto Briefing's latest article on why Grayscale halted institutional buying (https://cryptobriefing.com/grayscale-halts-institutional-bitcoin-ethereum/)

Let us Trade For You

Click the button below to learn more about how Jarvis turns the market into a second stream of income for you... while you sleep.

Any questions you may have please don't hesitate to reach out to us at askus@jarvis-labs.xyz or on our website via the chat button in the bottom right-hand corner: www.jarvis-labs.xyz