We Take Breaks Too

by Ben Lilly

Full Cargo Pockets

In light of our recent Grayscale article we've received quite a bit of feedback and attention. Some of the feedback was great (thanks Crypto Briefing), while others made me want to find the nearest soapbox.

Luckily for everybody I can't find a soapbox. There won’t be any foolish preaching. But instead I'll briefly mention a few things regarding the feedback.

Now, the main piece of feedback we received relates to this question... Why give away one of the biggest buying indicators in the market? Well, I'd like to address this in three ways.

First, we (you and us) are in this together. With the amount of money entering the space each day there is plenty of room for all of us to make money. It’s what we want to do at Jarvis Labs. To help turn the market into a second stream of income for you.

So for anybody subscribed to Espresso, that's the purpose in these daily e-mails. It's free alpha. Stop by whenever you want. Stay as long as you'd like. Unsubscribe as you please. Ask questions as often as necessary. And if you don't understand what a metric is, an abbreviation that I use, or why I keep referring to this Jarvis guy, please reach out.

Second, I have more alpha stuffed in the pockets of my over-sized cargo pants (ps - I don't wear cargo pants... it's just a visual here).

I'm referring to the Grayscale letter again. When we decided to let readers know about Grayscale, it was from a risk management perspective. The buying effect was about to wane. The upside was limited. And the biggest unlocking to date was about done.

We didn't mention anything in terms of how to trade the Grayscale effect, the exact date to look for, how much capital is getting ready to go in... along with a few other tidbits. To us, that's the real alpha. That's because this type of alpha is something we can program into Jarvis and let it go to work for us.

In fact, we've come across a few new pieces of information during our dig that have since created several new models. We plan to incorporate them into Jarvis to take advantage of the Grayscale effect even more.

Third, what we see most often in this market is poor risk management. And in reality that's the most alpha you can get, and the most alpha you’ll get in this daily e-mail.

There are plenty of bulls in crypto. In fact, we are one of them. We believe 2021 will be incredible in terms of upside.

However, proper risk management in crypto is scarce. And its how most traders and investors end up losing money. In my opinion, part of the reason this happens is whenever somebody discusses a possible bearish event its met with scorn and hatred. Why?! Consider this... If something you come across is uncomfortable, then your exposure to such an event might be too much. If that’s the case, find a way to hedge against it. If you’re unsure, let us know.

Every investor and trader should evaluate risk in the market daily. That way you know if the juice is worth the squeeze. For us, Jarvis evaluates this with everyone new data point. And does so ten times better than we can.

A focus on market risk is what you'll see from us. Remember, we are incredibly bullish. But when we analyze we're focused on risk. The Grayscale effect was waning and the risk was rising.

if you need a bullish piece to reconfirm your beliefs, a quick google search will satiate that need.

Now, enough of that.

State of the Markets

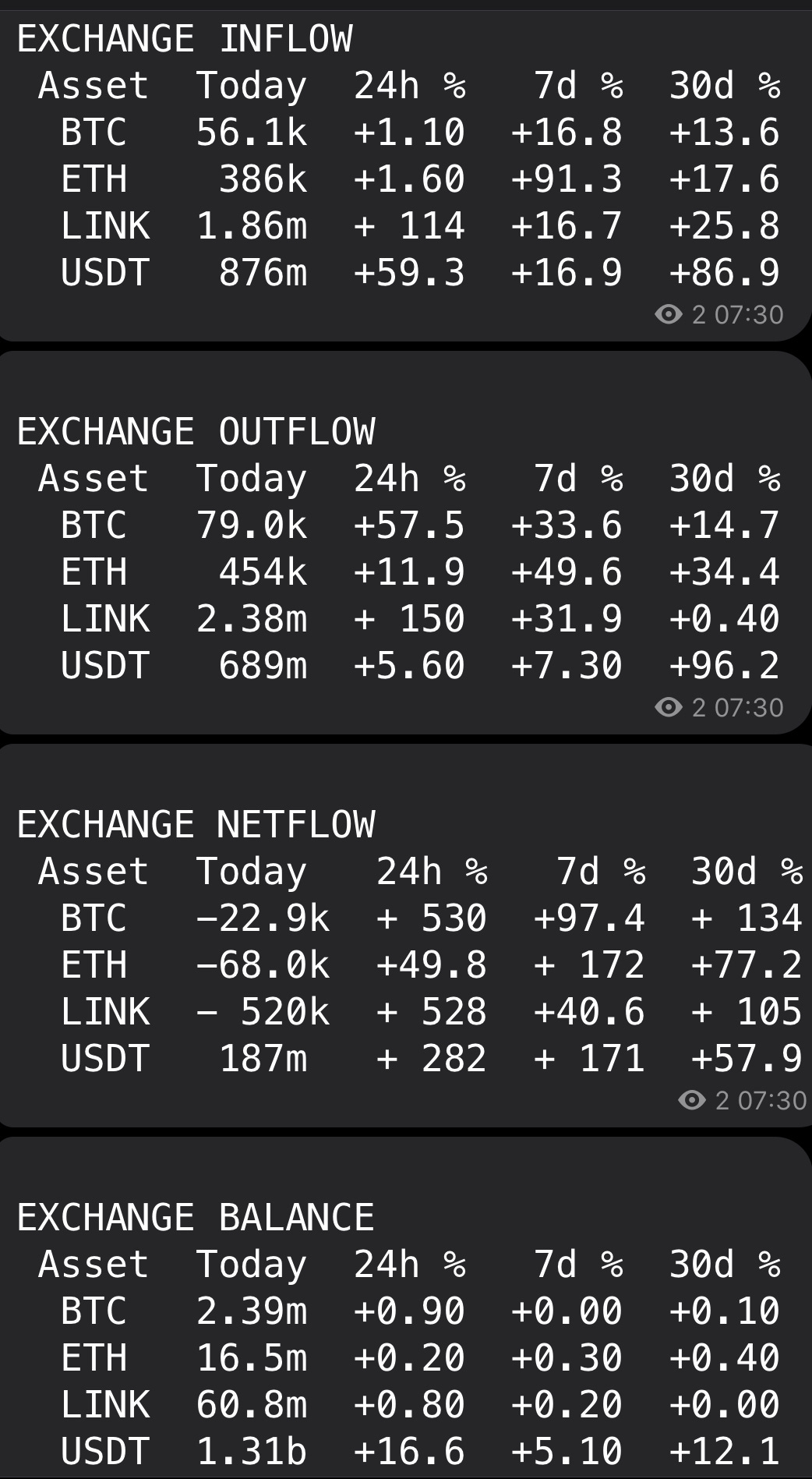

Regarding the markets... The market is in the same shape as we wrote yesterday. Inflows are still a bit bearish, fuel meter is neutral, and low holiday volume is here. Protect yourself to the downside.

We won't be sending anything on Christmas nor the weekend. We are wiped out and wish to spend time with our family. We'll be back soon. We’re already working on another piece. This time we line the crosshairs on Zeus Capital. Get ready LINK Marines, you might like this one.

Also, expect a sale soon. Some guy that does sales believes its a good time to run one with the holidays. Something to do with a flash sale? We’ll be finding out together.

Ok, the cookies are done and I need to help with icing them. Merry Christmas and Happy Holidays! We’ll be back soon.

Your juice squeezing consultant,

B. Lilly

Let Jarvis Trade For You

Click the button below to learn more on how Jarvis turns the market into a second stream of income for you... while you sleep.

Any questions you may have please don't hesitate to reach out to us at askus@jarvis-labs.xyz or on our website via the chat button in the bottom right hand corner: www.jarvis-labs.xyz