Be Ready for a Dec. 29 Selloff

by Ben Lilly

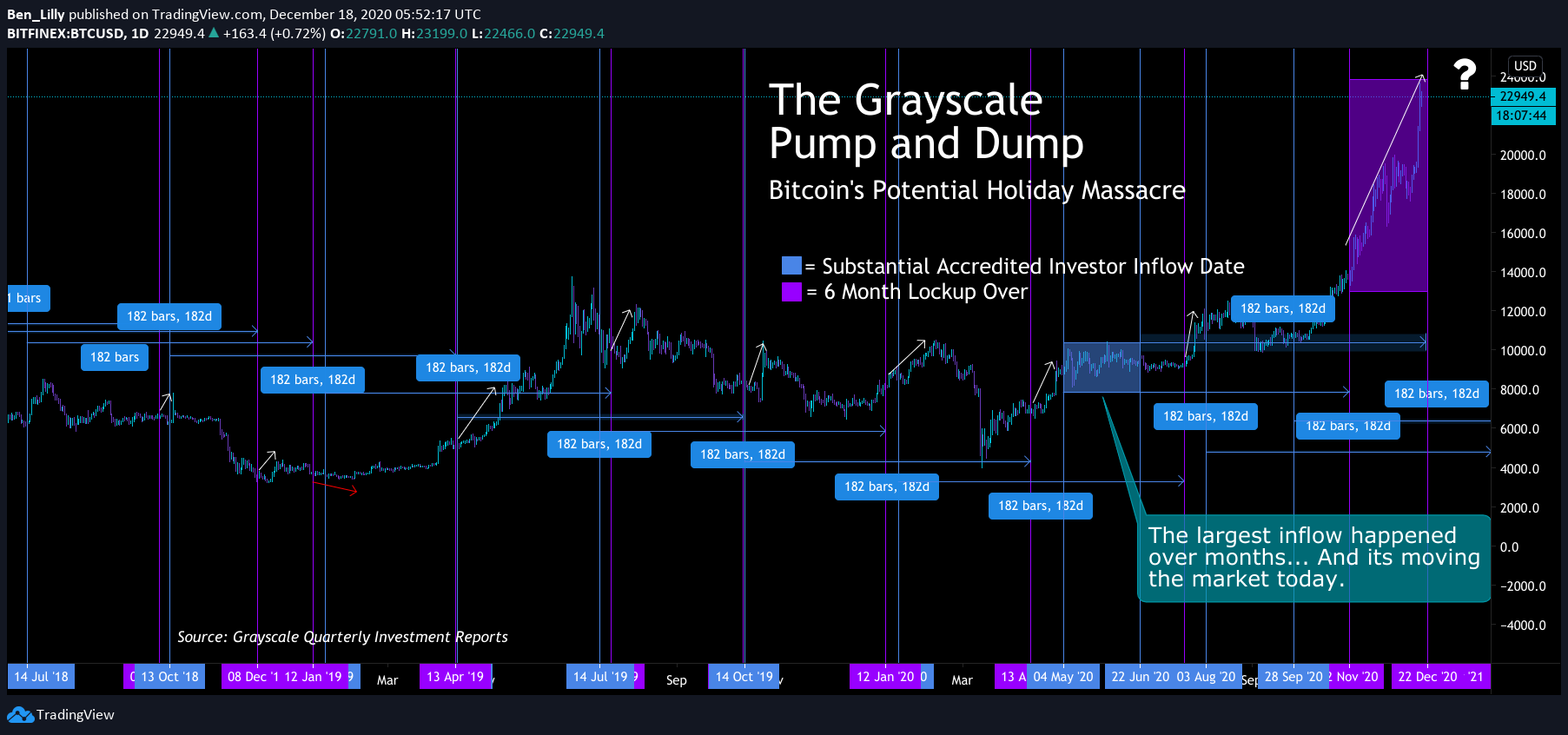

A Bitcoin Holiday Massacre

It's a Grayscale pump. Yup, we're willing to disclose it now.

All you need to do is dig through their 8-k reports and quarterly reports, then pair it up with price action. It takes a little work to match it all up, which is why you don't see anybody talking about it.

And frankly, the motivation to go that far was more from our ai trading machine Jarvis. It was basically telling us to look at something without saying it.

So here's what we found...

The market price we see today is a direct result of the massive inflow seen into Grayscale from six months ago.

But here’s the thing…

That effect from the massive inflow ends near the end of the year. Combine that with low levels of liquidity due to the very nature of the holiday season and profit-taking before the year closes out… The stage is set for a Bitcoin Holiday Massacre.

Now to understand why inflows and the time period of six months matter, let's pull back the curtain on Grayscale a bit.

Grayscale is an entity of the Digital Currency Group that has cornered the market, accumulating a total of 536k BTC to date.

Their unique structure is what makes it possible. It’s essentially one way. BTC and USD flow in and nothing comes out.

Here are their holdings over time:

The way they achieve this one-way flow is in the way they dole out shares. Accredited investors or 'wealthy individuals' can sign up for Private Placements to receive shares.

These accredited investors can then give BTC or USD to Grayscale. In exchange, Grayscale gives them an equal value of shares. If each share equals 0.001 BTC (In reality it’s 0.00095085) then for every BTC handed over to Grayscale, the accredited investor receives 1000 GBTC shares.

The catch is the private investor must wait six months before selling the shares on the market… to the non-accredited retail investor. The not so wealthy investor.

It might seem fair, the exchange of shares for BTC, but in reality, it's anything but fair. That’s because GBTC almost always trades at a premium. Retail non accredited investors looking for a pure-play into BTC within the stock market are paying anything but fair value.

For example. Yesterday GBTC closed at $28.25. Bitcoin according to the BraveNewCoin Liquid Index closed at $22,830. At 0.00095085 BTC per share, fair value for GBTC is $21.71. That’s a 30% premium just because the buyer isn’t wealthy. And that’s a 30% premium going straight to the accredited investor who handed over their BTC.

It gets worse…

Periodically Grayscale closes its offering for some time before allowing more investors to buy new shares. Once these new offerings start, the six-month countdown begins.

Once the countdown is over we see over the last two years solid evidence that the market suddenly jolts higher almost every single time. That’s right… the spot market gets driven higher shortly after the newly minted shares can hit the market.

Don’t believe me? Well, before I show you the chart with 51 different lines and arrows (yes, I counted... but am a bit sleepy so could be off by a few) let me first add-in that six months prior to bitcoin jumping past $14,000 the largest inflow happened at Grayscale. And it happened over months, not a week.

Now that the six months are up as of November 2nd the market has been rallying hard. Not to mention Wall Street fund managers are suddenly changing their tune.

Here's the thing. The large inflow of capital into Grayscale paused the week of June 29th. Meaning for most of July there were no inflows according to the most recent quarterly report. Six months from then is December 29th.

The holiday season might experience the first major correction of this bull market. Professional traders will be on break, market makers will be less active and Wall Street not in the office... It's a recipe for lower volumes and lower levels of liquidity. Combine this will natural profit-taking measures that can happen before the New Year and no new shares getting dole out, we're setting up for an environment poised for a correction.

This lines up with what we said earlier this week regarding on-chain metrics needing a 'reset'. This could be that reset.

Hope you enjoy the analysis... Your pulse on crypto,

B. Lilly

It's best to focus on the white lines... It might also be easier to view the chart on tradingview...

Here's the link:

https://www.tradingview.com/chart/BTCUSD/xvLdVH8n-Grayscale-s-Holiday-Massacre-of-BTC

Key

Blue vertical lines represent inflows resuming

Purple lines represent when the 6-month lock-up is over from the date inflows resumed

The white line is the pump after the lock-up is over

The two boxes represent the largest inflow time period and unlocking period

Horizontal arrows help connect each blue line to the corresponding purple line

Let Jarvis Trade For You

Click the button below to learn more on how Jarvis can start turning the market into a second stream of income for you... while you sleep.

Any questions you may have please don't hesitate to reach out to us at askus@jarvis-labs.xyz or on our website via the chat button in the bottom right hand corner: www.jarvis-labs.xyz