Did We Buy The Dip?

by Ben Lilly

Are We Buying The Dip Yet?

On-chain flows are now showing a mix of red and green.

Yesterday we posted about these transactions in our telegram during trading hours on December 9th. Majority were flashing red and this resulted in also a rejection in price near 18,600 resistance levels.

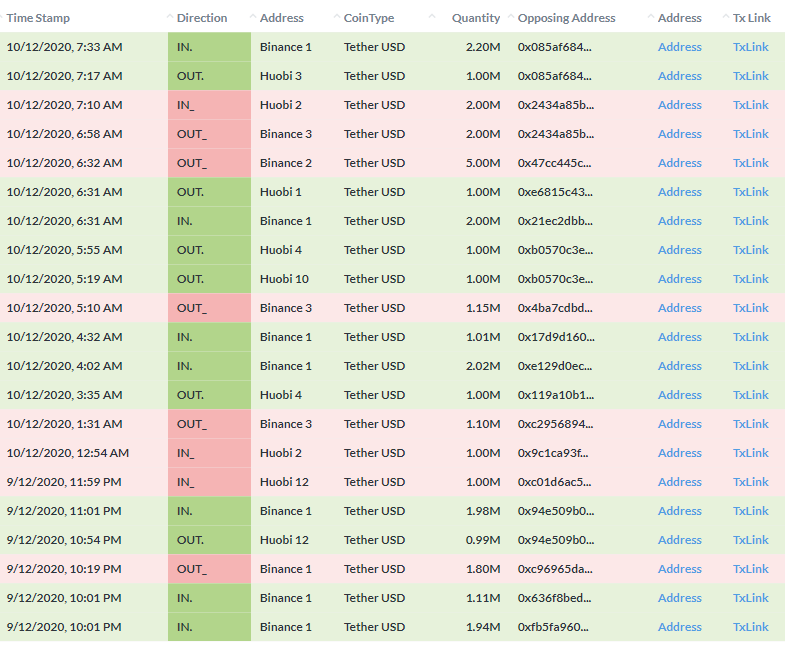

Today's snapshot on the transactions are here :

The entire day was full of transactions that Jarvis flagged as having a high correlation with bearish price action.

We're not comfortable saying what way the market is going in the near term... But the long-term view is still very much bullish. The key now is to figure out when to scale into a long position.

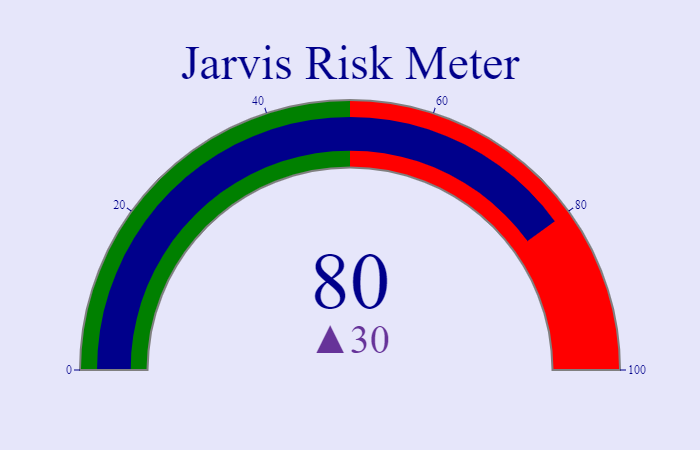

Based on a few Jarvis indicators risk levels remain elevated for Bitcoin:

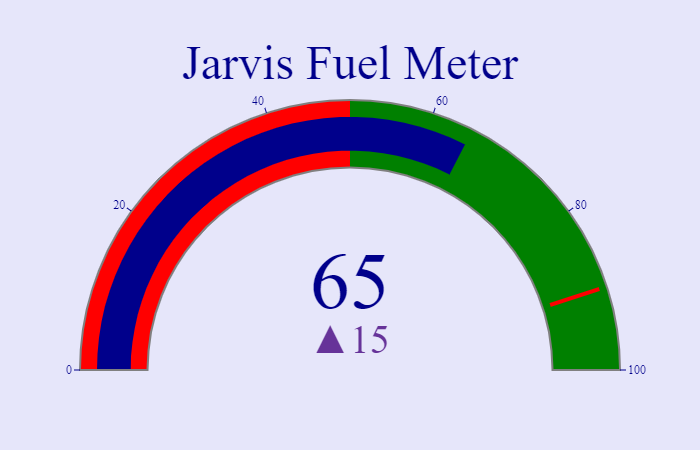

And the amount of fuel to push the market higher is nothing to get anxious over:

So what does this mean for you? Take those two hands of yours and just sit on them. Better yet, take a day and go enjoy some time away from charts.

Looking ahead...

We're watching funding rates within the leveraged markets. When they begin to pile up in one direction it'll create an opportunity for price action. Of particular interest is when shorts start paying traders holding a long position.

When traders start to crowd into shorts it'll be a recipe for some higher prices.

Alright, that's enough out of me for today.

Your Pulse on Crypto,

B. Lilly

Jarvis is Your Path to Financial Freedom

Jarvis is our artificial intelligence machine used to turn the market into a second stream of income for you... while you sleep. All you need to do is link Jarvis up to your trading account and it goes to work. Set it and forget it.

If you are interested in a subscription reach out to us on Telegram by contacting @benjamin_bc

or

For non-Telegram users go to our website: www.jarvis-labs.xyz and use the chat box in the bottom right hand corner.

And if you're still not convinced Jarvis is as great as we tell you, follow our account live by clicking here.