$1.78 Million per BTC

This should help you keep your eye on the prize

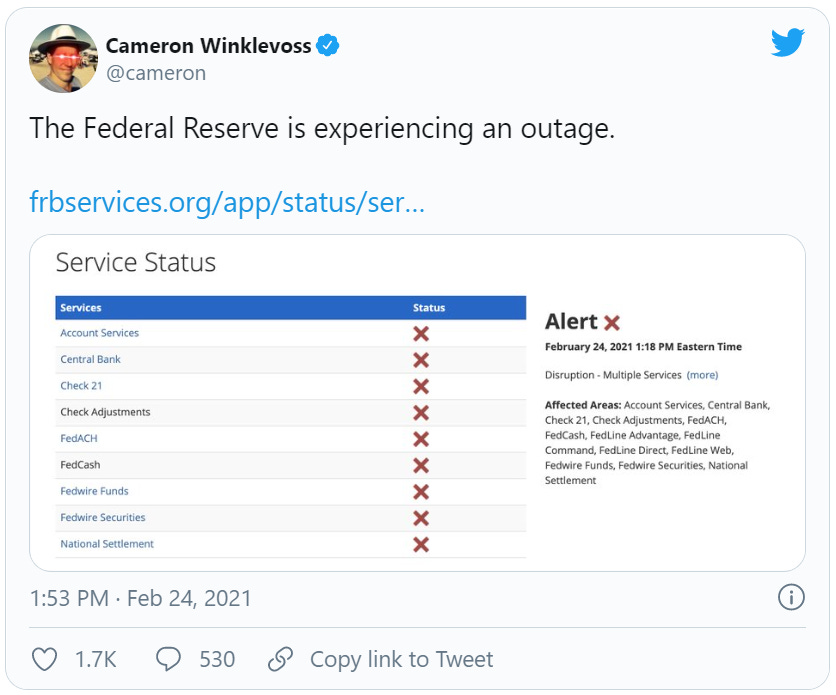

The J-Pow network came to a halt yesterday.

It wasn’t just Fedwire, FedCash, Central Bank, or any of the other services that act as the backbone for the Federal Reserve financial network, it was the entire suite of services.

$3.3 trillion in average daily transactions that U.S. banks use for large transfers between one another among other uses was frozen for several hours.

It’s the system bitcoin and other cryptocurrencies look to disrupt. Yet, the news seemed to get buried in the news cycle. Fox news, the Atlanta Journal Constitution, and the New York Post were the only outlets that seemed to pick up on it… As well as Cameron Winklevoss.

Why was this such a non-event? Not sure, nor do I care to speculate on such things unless it has to do with crypto, and frankly, it’s in part why I personally opted for crypto in the first place.

Regardless, this is the settlement network that supports a $20.8 trillion economy.

If we were to view the two stats we’ve mentioned as a ratio then maybe we can look at the size bitcoin wants to become. After all, bitcoin is tracking towards becoming the largest settlement layer for crypto like the U.S. is to the world.

And with the U.S. sitting at a GDP of $20.8 trillion and the Federal Reserve’s archaic payment system moving $3.3 transaction value per day, we arrive at a ratio of 6.3 (20.8 divided by 3.3).

Gold on the other hand has a market size of approximately $10 trillion and daily average trading volume of $145.5 billion. This gives it a ratio of 68.7.

Main difference in gold is that it’s a store of value, which means it tends to move hands less than dollars.

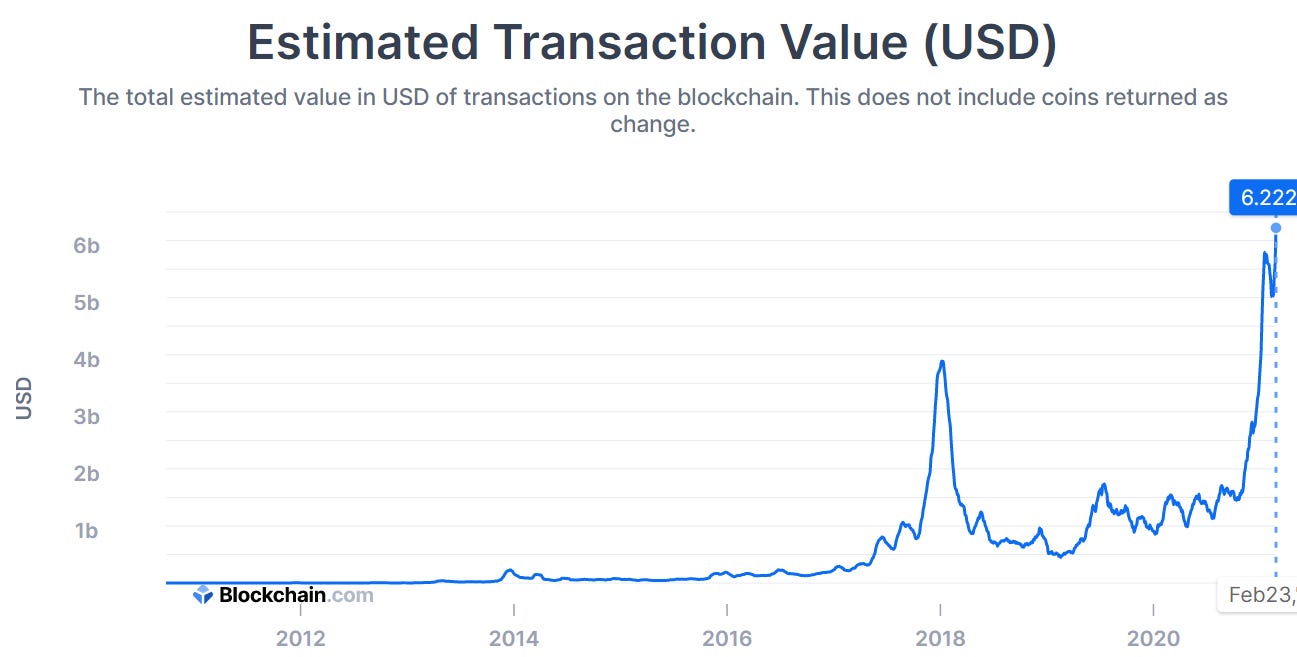

Looking at bitcoin its market cap is $937 billion as I type and its 30-day average transaction value is currently sitting at about $6.2 billion or a ratio of 151.

Fundamental analysts will look at that number and immediately state bitcoin is incredibly overvalued. Perhaps they have a point. Maybe the true value of bitcoin is closer to the FED example which places bitcoin’s market cap at $40 billion. Or maybe it’s near gold and its market cap is $426 billion, less than half of what it is right now.

To that I adamantly disagree.

There’s a reason tech stocks command insane valuations in the market. Companies like Amazon and Netflix are able to do more with less. They are both an upgrade over their legacy competitors such as brick and mortar and Blockbuster.

It’s not just because they are new. It’s because these business are more efficient in terms of providing the end users with what they need faster and also by using less workers.

Bitcoin is set to disrupt the legacy financial system in the same way. It’s a tech play against a dilapidated financial system. Which is why I think the transaction volume of the FED’s payment system is a better comparison than gold. But because bitcoin is a store of value much like gold, it can retain a higher ratio than what the FED has in addition to its technology being far superior… it’s time to settlement is on the magnitude of minute to hours versus the FED, which is days.

What this means is if bitcoin can continue witnessing an increase in transaction volume towards a $1 trillion level, and have a ratio between gold and the FED at 37.5, that’s a $37.5 trillion market cap for bitcoin… Or $1.78 million per bitcoin.

Crazy? Absolutely. Do I believe this to be bitcoin’s potential. Sure. Will other networks come in and take some of this value? Yes. Do I believe this to be bitcoin’s ultimate price? No.

But I’m not ready to necessarily rule it out completely.

Which means maybe this is a better indication of where crypto as a whole is going. And if we start bringing in other GDPs of the world, then the $1.5 trillion crypto market cap begins to look like a pesky gnat on the back of a global financial system sloth.

After reading this news about the FED the case for crypto is clear.

Legacy systems are crumbling and showing their weakness in broad daylight. Meanwhile the currency that’s used in its plumbing is becoming less valuable by the day thanks to inflation dilemmas that are putting the FED between a rock and hard place.

They are damned if they do something about it, damned if they don’t. Right now, they choose the latter.

So don’t let a small hiccup in the bitcoin market to cause you to lose sight of where this ride is going. We’re in a cycle and the top is not in.

As people begin to lose interest in crypto in the coming days and Crypto Twitter charts being posted start to look bearish, it’s time to look at opening positions.

The play I’m doing in my personal account is Hegic call options. I’m pro-DeFi development so I experiment with the tools. It’s getting more efficient. Also, the team over at Hegic is open to feedback and improvements, meaning they look to create a good protocol.

Regarding the ‘when’ I’ll try to put the trade on… once the charts start to show some momentum to the upside AND the current structure shows clarity (ie - wedge, triangle, double bottom).

In the meantime take some time to dive into some tech yourself. This space is full of the smartest people in the world building the tools of tomorrow. Get lost in it and have some fun while the bears make some noise.

Your pulse on crypto,

B